Instructions on Utilizing Idaho Last Will and Testament

Once you have gathered the necessary information, you can begin filling out the Idaho Last Will and Testament form. Properly completing this form is essential to ensure that your wishes are honored regarding the distribution of your assets after your passing.

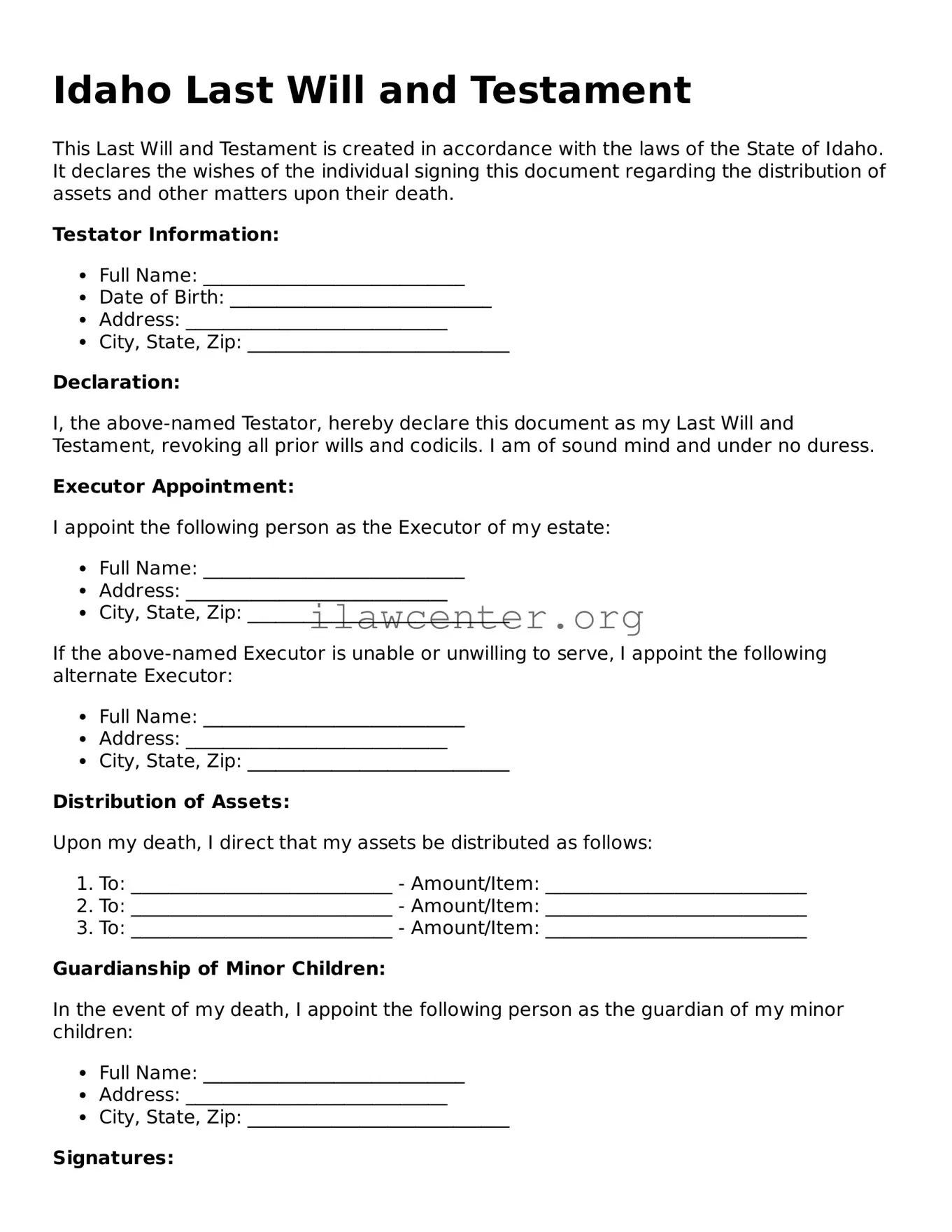

- Obtain the Form: You can find the Idaho Last Will and Testament form online or through local legal resources.

- Title the Document: Begin with the title "Last Will and Testament" at the top of the page.

- Personal Information: Fill in your full name, address, and any other required personal details.

- Executor Information: Name the person who will execute your will. Provide their full name and relationship to you.

- Beneficiaries: List the names of the individuals or organizations that will inherit your property, specifying the assets they will receive.

- Guardianship (if applicable): If you have minor children, designate a guardian and provide their information.

- Sign the Will: After completing the form, sign it in the presence of at least two witnesses who will also sign the document.

- Store the Will Safely: Keep the signed will in a secure location and inform your executor of its whereabouts.

Once the form is filled out and signed, consider discussing your wishes with your executor or beneficiaries. This will help clarify your intentions and reduce confusion in the future.