What is a quitclaim deed in Idaho?

A quitclaim deed is a legal document used to transfer ownership of real property from one person to another. In Idaho, this type of deed allows the property owner, known as the grantor, to relinquish any interest they may have in the property to the recipient, known as the grantee. Unlike other forms of property transfer, a quitclaim deed does not guarantee that the grantor holds clear title to the property, nor does it provide any warranties or assurances regarding the property’s condition or status. Essentially, it conveys whatever interest the grantor has, if any.

When should I use a quitclaim deed?

Quitclaim deeds are best suited for specific situations. They are commonly used among family members, such as when transferring property between parents and children, or during a divorce settlement. They can also be beneficial in clearing up title issues, such as when one person wants to remove their name from a property title. Additionally, if someone wants to gift property to another person, a quitclaim deed is a simple and effective way to accomplish this.

Are there any risks associated with using a quitclaim deed?

Yes, there are inherent risks in using a quitclaim deed. Because it does not come with any warranties, the grantee may end up assuming a property burdened by debts, easements, or liens. Moreover, if the grantor does not actually own the property or if there are conflicting claims from other parties, the grantee could face legal challenges in establishing ownership. Thus, it is essential for both parties to understand the implications of this type of deed before executing it.

Do I need to notarize a quitclaim deed in Idaho?

Yes, in Idaho, a quitclaim deed must be signed in the presence of a notary public to be considered legally valid. The notarization process helps to establish the authenticity of the signatures and ensures that the grantor is willingly transferring their interest in the property. Once notarized, the deed must be recorded with the county recorder’s office to provide public notice of the change in ownership.

How do I fill out an Idaho quitclaim deed form?

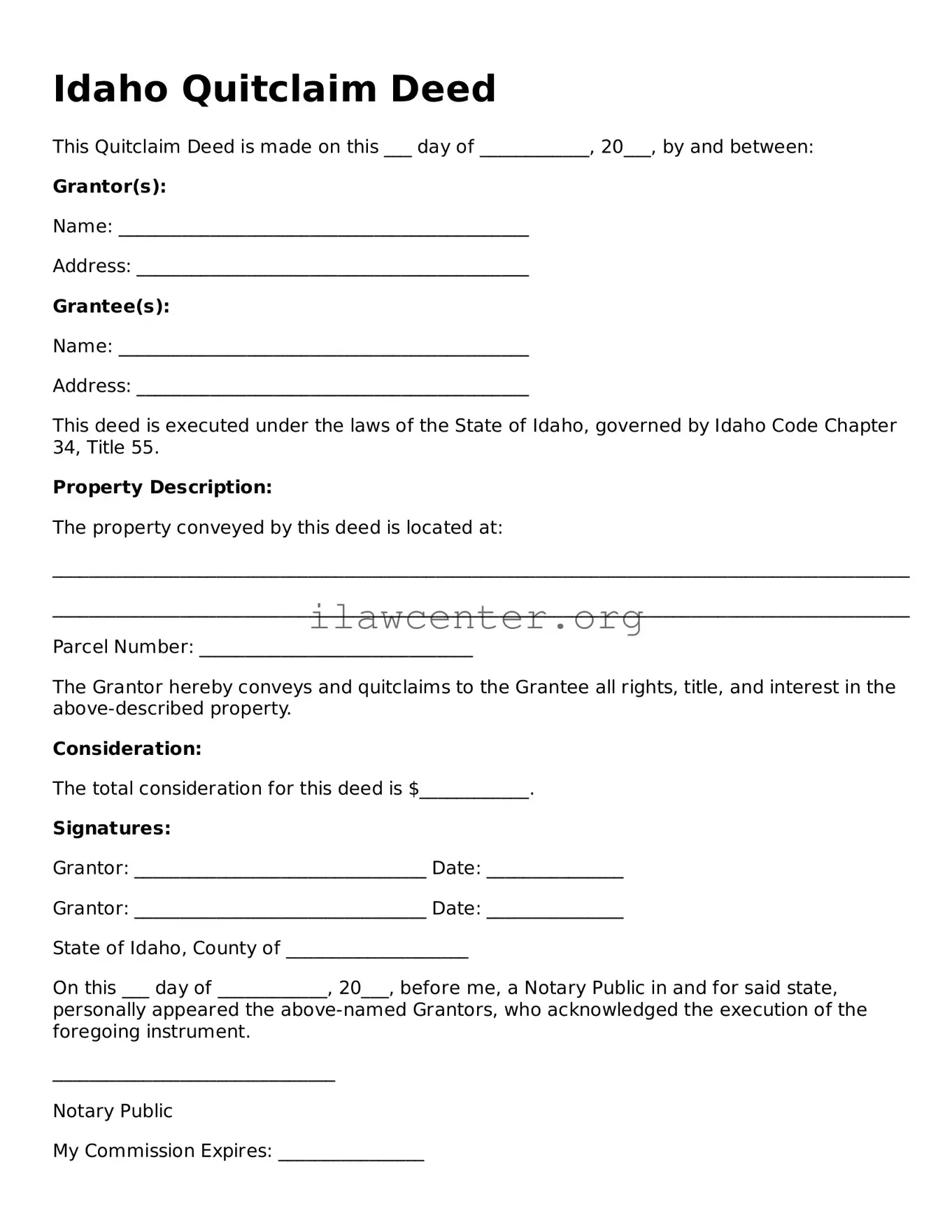

To fill out a quitclaim deed form in Idaho, you need to include several key pieces of information. Begin with the names and addresses of both the grantor and the grantee. Next, provide a description of the property being transferred, including the legal description found in previous property documents. Finally, include the date of transfer and ensure the deed is signed and dated by the grantor in front of a notary. It may be wise to refer to a sample form or consult a legal professional to ensure correct completion.

Is there a fee to record a quitclaim deed in Idaho?

Yes, there is typically a fee associated with recording a quitclaim deed in Idaho. The cost can vary depending on the county where the property is located. Generally, these fees cover the administrative costs of processing and recording the deed with the local government. It is advisable to check with the county recorder's office for specific fee amounts and to inquire about any additional requirements they may have.

Can a quitclaim deed be revoked?

Once a quitclaim deed has been executed and recorded, it cannot be revoked unilaterally by the grantor. The transfer of ownership is typically permanent unless the parties involved agree to invalidate the deed through a mutual agreement or another legal process. However, if there are errors in the deed or if fraud is involved, it may be possible to seek legal recourse to overturn the transfer.

Do I need an attorney to create a quitclaim deed in Idaho?

While it is not legally required to hire an attorney to create a quitclaim deed in Idaho, obtaining legal advice can be beneficial, especially in complex situations. An attorney can help ensure the deed is correctly drafted, that all necessary legal requirements are met, and that the rights and interests of both parties are protected. If there are potential legal issues or misunderstandings regarding the property, consulting a lawyer is advisable.

What happens after I file a quitclaim deed?

After filing a quitclaim deed, the county recorder's office will retain it as a public record. This serves as official notice of the transfer of ownership from the grantor to the grantee. The grantee should keep a copy of the recorded deed for their records. It is also recommended that the grantee check their property title to ensure that the transfer has been properly reflected and that there are no further disputes regarding ownership.