What is a Transfer-on-Death Deed in Idaho?

A Transfer-on-Death Deed, often referred to as a TOD deed, is a legal document that allows an individual to transfer real estate property to a beneficiary upon the individual's death. This form bypasses the probate process, allowing for a more straightforward transfer of property to heirs without delays or additional costs typically associated with probate court proceedings.

Who can create a Transfer-on-Death Deed in Idaho?

In Idaho, any individual who is at least 18 years old and is legally capable of conveying property can create a TOD deed. This means that property owners can designate one or more beneficiaries to inherit their property after they pass away. It's important to note that the ownership of the property remains with the individual until their death; the beneficiaries hold no rights until that time.

What information is needed to complete a Transfer-on-Death Deed?

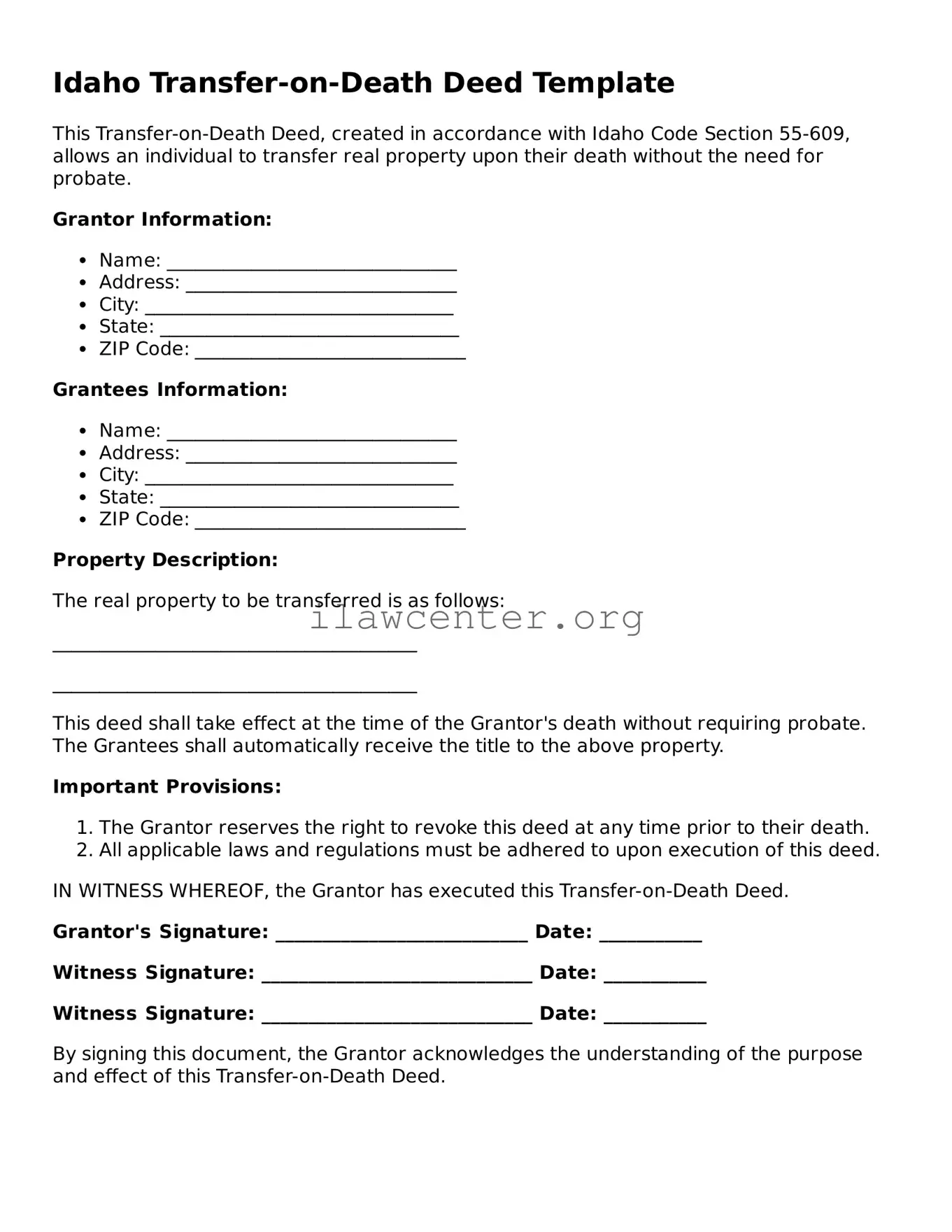

To complete a Transfer-on-Death Deed in Idaho, you will need several pieces of information. This includes the full legal description of the property, the names and addresses of the owner(s), and the names and addresses of the designated beneficiaries. Additionally, the deed must be signed and notarized to ensure its validity and to comply with Idaho's legal requirements.

Does a Transfer-on-Death Deed affect my property during my lifetime?

No, a Transfer-on-Death Deed does not affect your property rights while you are alive. As the property owner, you retain full control over the property. You can sell, mortgage, or modify the property without any interference from the beneficiaries. The deed only takes effect upon your death, at which point the property automatically transfers to the named beneficiaries.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time during your life. To do this, you must create a new deed that explicitly revokes the previous one or amend the existing deed to reflect the changes you wish to make. It’s vital to ensure that any modifications are properly executed and recorded to avoid any confusion for your beneficiaries later on.

Are there any tax implications associated with a Transfer-on-Death Deed?

Once the property is transferred through a Transfer-on-Death Deed, the beneficiaries typically receive it without immediate tax implications. However, they may be liable for capital gains taxes if they later sell the property. Furthermore, the value of the property may count toward the decedent's estate for tax purposes. Consulting with a financial advisor or tax professional can provide clarity regarding individual situations.

Where do I file a Transfer-on-Death Deed in Idaho?

A Transfer-on-Death Deed must be filed with the county recorder’s office in the county where the property is located. Filing before the property owner's death is crucial to ensure that the deed is effective. Once filed, it becomes part of the public record, providing official notice of the beneficiaries' rights to the property after the owner's death.