Instructions on Utilizing Independent Contractor Pay Stub

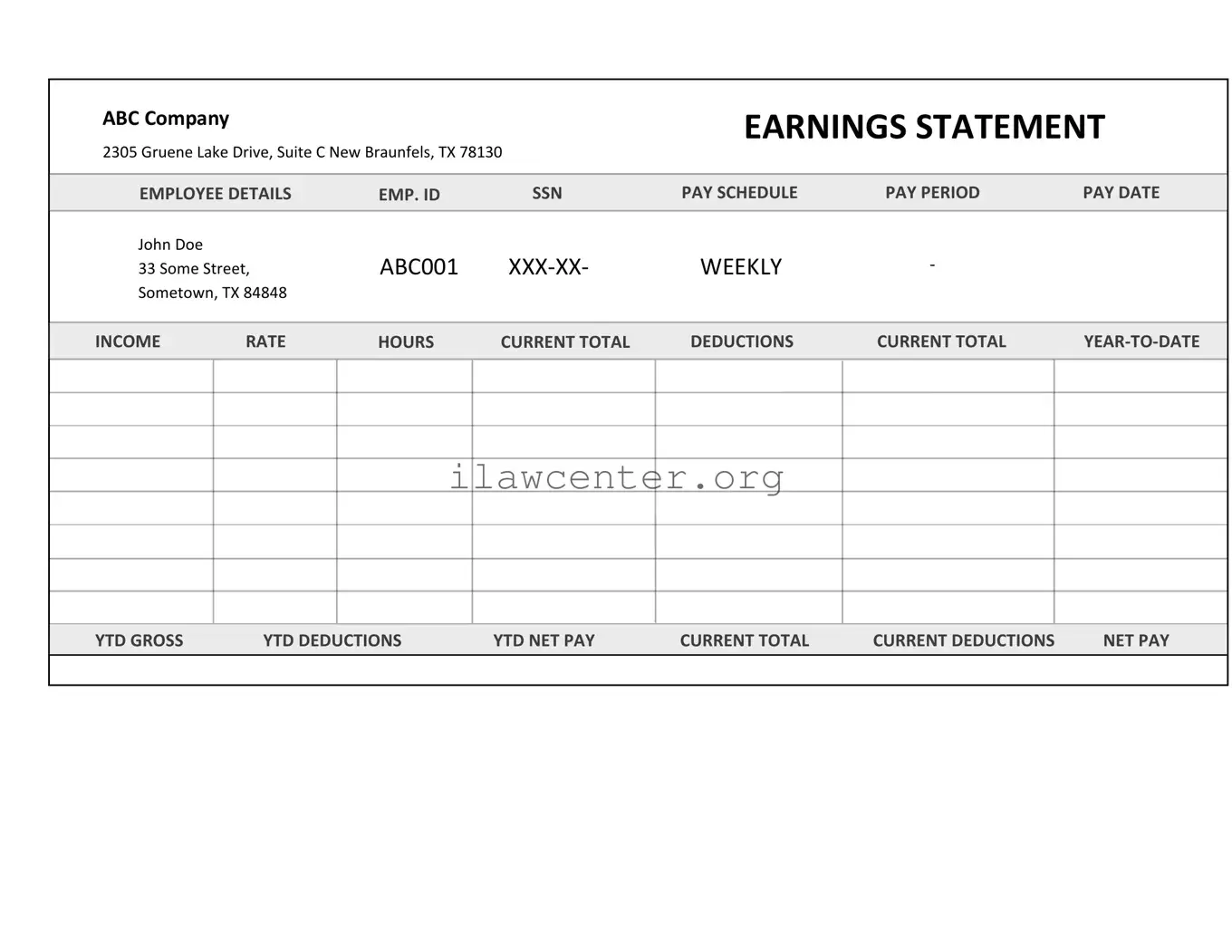

When preparing to fill out the Independent Contractor Pay Stub form, it's important to have all necessary information ready. Organizing your details beforehand will streamline the process. This form typically requires information related to the payments made to independent contractors, including personal information and financial details. Follow these clear steps to complete the form accurately.

- Gather your information: Collect the contractor's name, address, Social Security number, and any other identification details.

- Identify payment details: Determine the payment period for which you are reporting and the total amount paid to the contractor.

- Fill in contractor information: Enter the contractor's name and address in the designated fields on the form.

- Input payment period: Clearly indicate the start and end dates of the payment period within the specified sections.

- List payment amount: Record the total payment amount for the period, ensuring accuracy in the figures.

- Add additional details: If applicable, include any deductions or bonuses that may be relevant to the compensation during that period.

- Review for errors: Before submitting, double-check all entries for spelling mistakes, numerical errors, or omissions.

- Submit the form: Follow the specific instructions for submitting the form, whether electronically or via mail.