INSTRUCTIONS

How to complete Form T-138

DEFINITIONS

Fleet: One or more vehicles that all travel in the same jurisdictions.

Private Carrier: A person, firm or corporation that uses its own trucks to transport its own goods, products or equipment.

For Hire Carrier: Any motor carrier providing vehicles and drivers that are available to the general public to engage in the transportation of passengers or property for compensation.

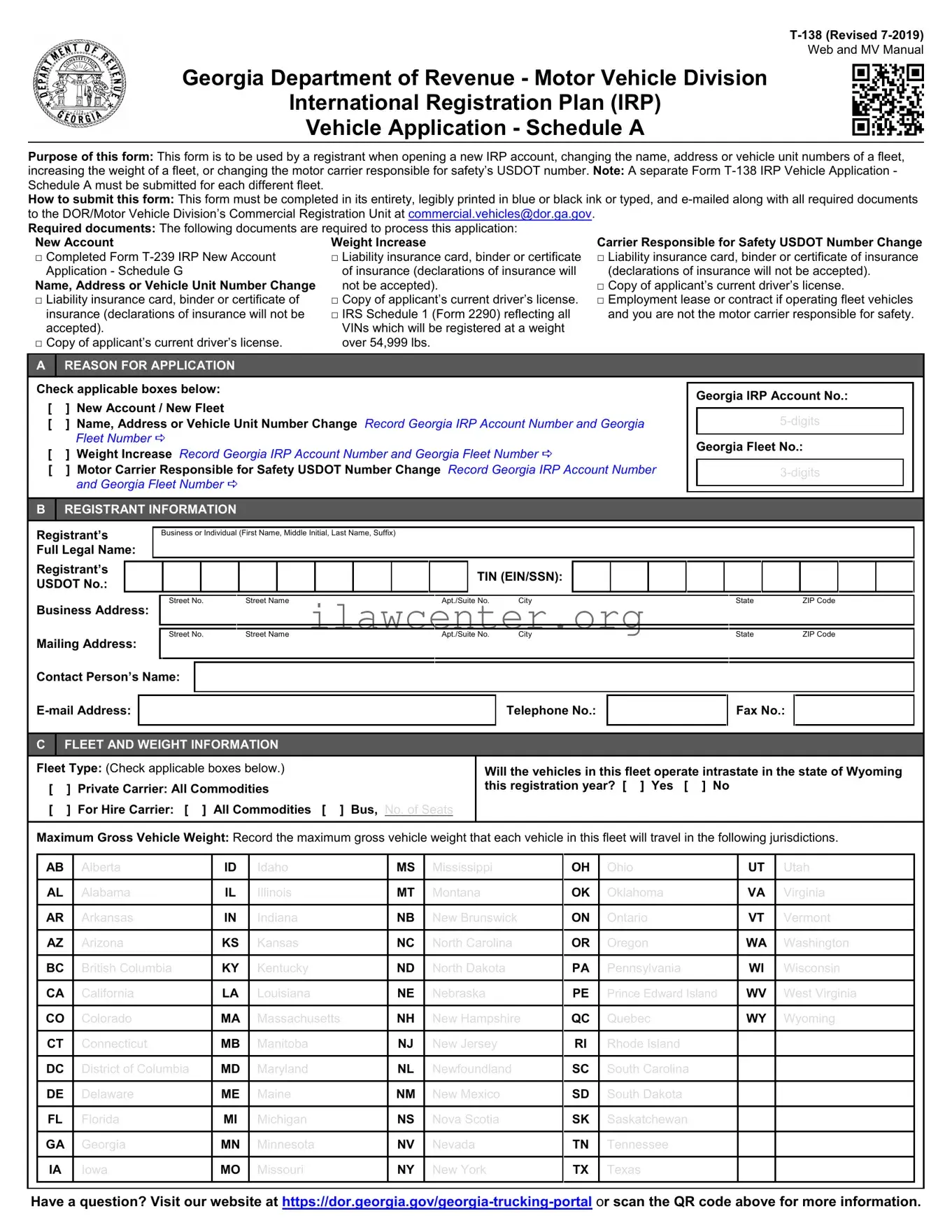

COMPLETING THIS FORM

This form must be completed in its entirety, legibly printed in blue or black ink or typed.

Section A: Check the applicable boxes that describe the registrant’s reason for application. If this application is for a new account or new fleet, attach a completed Form T-239 IRP New Account Application – Schedule G. If this application is for a name, address, or vehicle unit number change, weight increase, or motor carrier responsible for safety USDOT number change, record the registrant’s 5-digit Georgia IRP account number and a 3-digit Georgia fleet number.

Section B: Provide the full legal name, USDOT number (if operating with own authority), Taxpayer Identification Number (TIN), business address, mailing address, contact person’s name, e-mail address, telephone number and fax number of the registrant applying for a new IRP account or reporting a change.

Section C: Check the applicable boxes that describe your fleet type – Private Carrier: All Commodities or For Hire Carrier: All Commodities or Bus. When registering a bus, record the number of seats in the bus. Indicate if the vehicles in this fleet will operate intrastate in the State of Wyoming this registration year. Provide the maximum gross vehicle weight for each vehicle in the fleet in the jurisdiction boxes where these vehicles will travel this registration year.

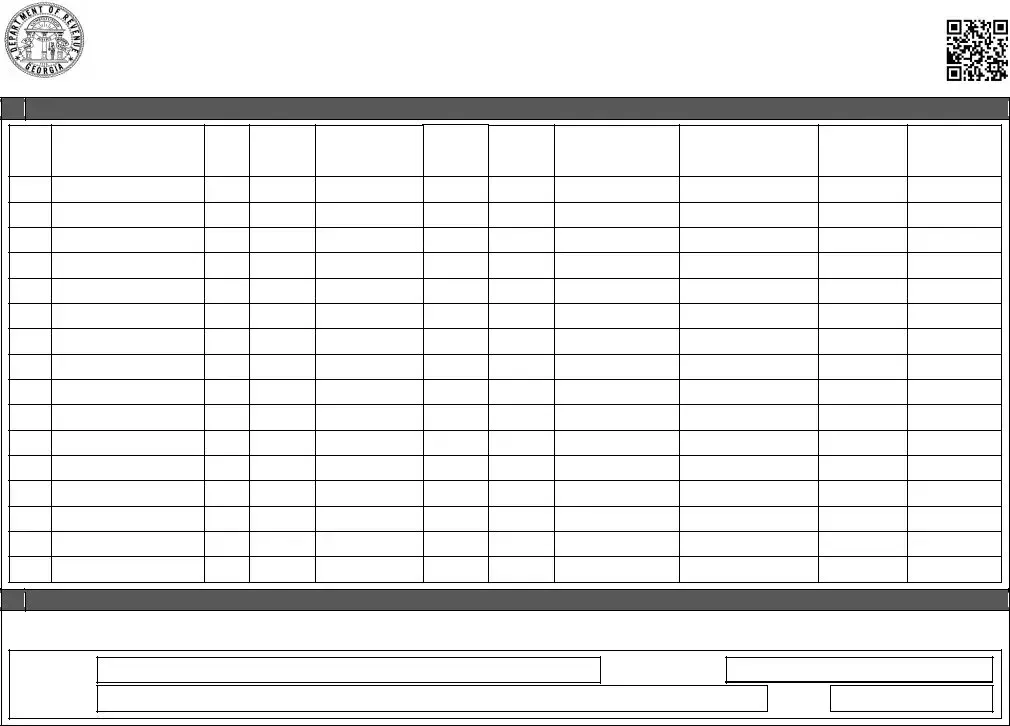

Section D: Record the following information for each vehicle in this fleet:

•Unit Number – This number is assigned by the registrant. Each vehicle requires a different unit number. Numbers cannot be reused in a license year.

•Vehicle Identification Number (VIN) – Must be recorded as it appears on the vehicle and vehicle’s title.

•Number of Axles or Seats – For trucks, include the steering axles. Do not include trailer axles. For buses, provide the number of seats.

•Empty Weight of Vehicle – Empty weight of the tractor or truck by itself.

•Combined Gross Weight of Vehicle – For vehicles in combination, record the combined weight of the tractor, trailer and the heaviest cargo that the vehicle can carry. This weight should be the same as you declared for the Federal Highway Use Tax. Please do not show a combined gross weight for trailers.

•Vehicle’s Purchase Price – The price the current owner paid for the vehicle minus any trade-in, sales or use tax and finance charges.

•Vehicle’s Factory List Price – Please do not use cents.

•Owner’s Name – Vehicle owners’ names must be recorded as they appear on the vehicle’s title. For vehicles under a lease, enter the leasing company’s name as it appears on the vehicle’s title.

•Georgia Title Number – Out-of-state title numbers are not accepted.

•Carrier’s Taxpayer Identification Number Vehicle Level – Federal Employee Identification Number.

•Carrier’s USDOT Number Vehicle Level – The motor carrier is required to update its Motor Carrier Identification Report (Form MCS-150) annually. A USDOT number can be applied for or a Motor Carrier Services Identification Report (Form MCS-150) updated from the Federal Motor Carrier Safety Administration’s website, http://safer.fmcsa.dot.gov/. From the website, click on “FMCSA Registration & Updates.” Motor carrier forms not updated within the last year will not be accepted.

Section E: Certify the information provided in this form is true, correct and complete to the best of your knowledge and belief.

REQUIRED DOCUMENTS

The following documents may be required to process this application:

1.A completed Form T-239 IRP New Account Application - Schedule G if opening a new account.

2.Liability insurance card, binder, or certificate of insurance (declarations of insurance will not be accepted).

3.Copy of applicant’s current driver’s license.

4.IRS Schedule 1 (Form 2290) reflecting all VINs which will be registered at a weight over 54,999 lbs.

•Each page of IRS Form 2290 containing registered vehicles must clearly show e-file watermark.

•IRS Form 2290 must reflect the correct year’s July 1st-June 30th period at top of form.

5.Employment lease or contract if operating fleet vehicles and you are not the motor carrier responsible for safety.

•Lease or contract must list USDOT of motor carrier responsible for safety.

•Lease or contract must list name and include signature of authorized representative of IRP account.

•Lease or contract must list name and include signature of authorized representative of carrier.

SUBMITTING THIS FORM

This completed form and all required documents must be submitted directly to the Commercial Registration Unit of the Department’s Motor Vehicle Division through e-mail to commercial.vehicles@dor.ga.gov.