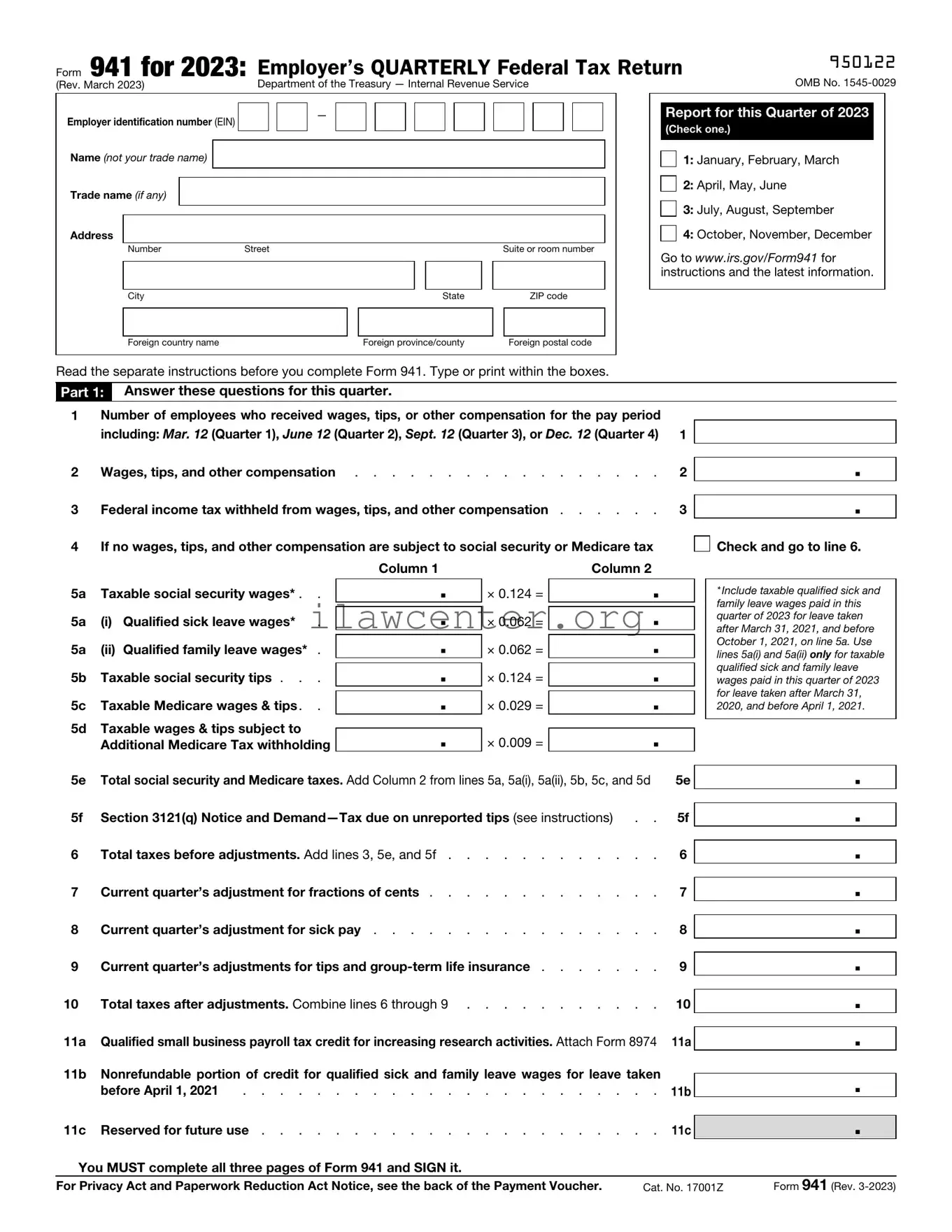

Instructions on Utilizing IRS 941

Once you're prepared to fill out the IRS Form 941, it’s important to have all necessary information at hand. This form is generally used by employers to report employment taxes. Ensure that you have your business name, address, Federal Employer Identification Number (FEIN), and details about employee wages and tax withheld. Follow these steps carefully to complete the form.

- Begin by entering the basic information in the top section. Fill in your business name, address, and FEIN.

- Specify the quarter for which you are filing. There are four quarters to choose from, depending on the time frame of your reporting.

- Look at the next section where you report the number of employees who received wages during the quarter. Enter that number accurately.

- Calculate the total wages paid to those employees. This will require you to sum up all wages, tips, and other compensation.

- Determine and report the total Federal income tax withheld from employee wages. Use your payroll records for this calculation.

- Next, calculate the total Social Security and Medicare taxes owed. Follow the set percentages for employee and employer contributions.

- After that, add any adjustments for fractions of cents or sick pay, if applicable. These will be included in the total tax calculations.

- In the next section, calculate the total taxes after any adjustments and subtract any deposits you made during the quarter.

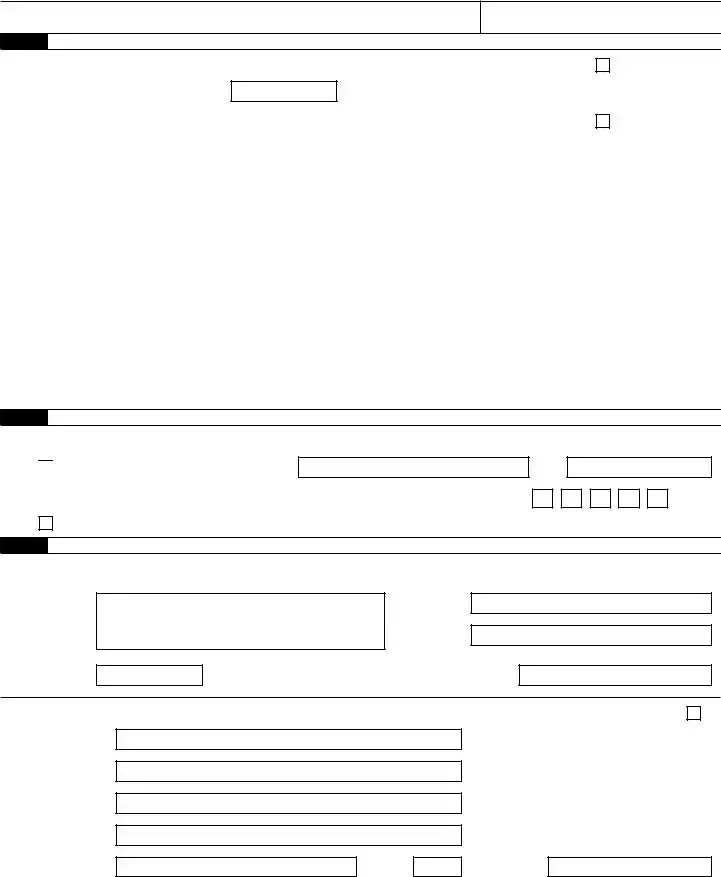

- Finalize the form by signing and dating it. Include your title and the date you filled it out to certify its accuracy.

With these steps, you should have completed your IRS Form 941. Once fully completed, ensure that you file it with the IRS by the deadline for that quarter. This is essential to avoid penalties.

Check and go to line 6.

Check and go to line 6.

.

. .

. .

. .

. .

.

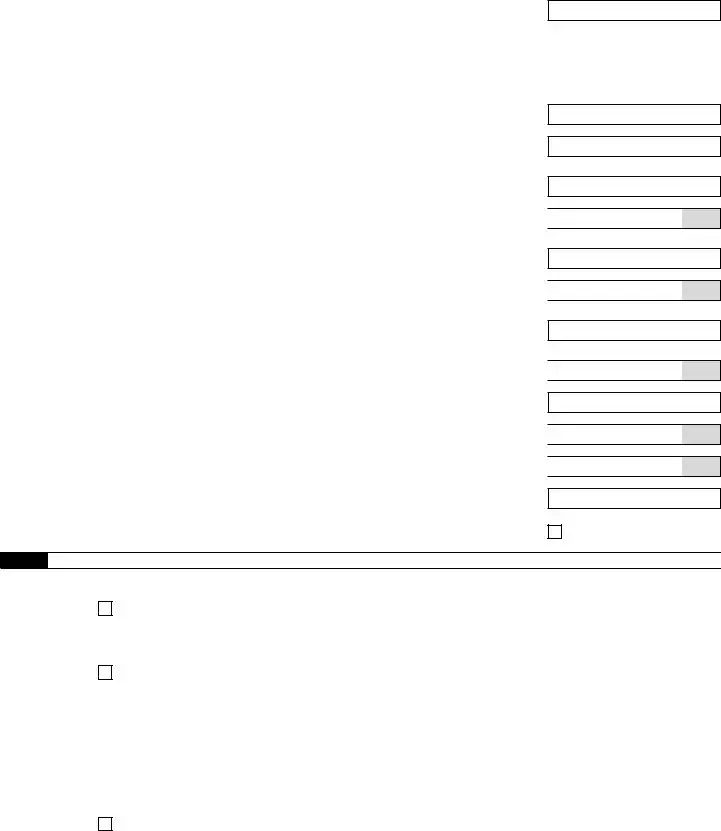

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number