Fillable Lady Bird Deed Document

The Lady Bird Deed, also known as an enhanced life estate deed, is a legal document that allows property owners to transfer their ownership upon death while retaining full control of the property during their lifetime. This unique form of deed enables individuals to manage their property without the complexities of probate, making it a favored choice for estate planning. If you're considering using this valuable tool, fill out the form by clicking the button below.

The Lady Bird Deed form plays a significant role in estate planning, particularly in the context of property transfer upon death. This type of deed, also known as an enhanced life estate deed, allows individuals to retain control of their property while designating a beneficiary who will automatically receive the property upon the individual's passing. Unlike traditional transfers, a Lady Bird Deed allows the property owner to maintain the right to live in, sell, or otherwise manage the property without needing consent from the beneficiary. It provides a straightforward method to avoid probate, ensuring a seamless transfer of property while potentially providing tax advantages. Additionally, the deed can be created in a way that accommodates multiple beneficiaries, affording flexibility in estate distribution. This tool not only simplifies the transfer process but also helps in addressing concerns related to Medicaid eligibility and ensuring that the property remains within the family. By considering a Lady Bird Deed, property owners can effectively plan for their future while safeguarding their interests and their loved ones’ inheritance.

Lady Bird Deed Preview

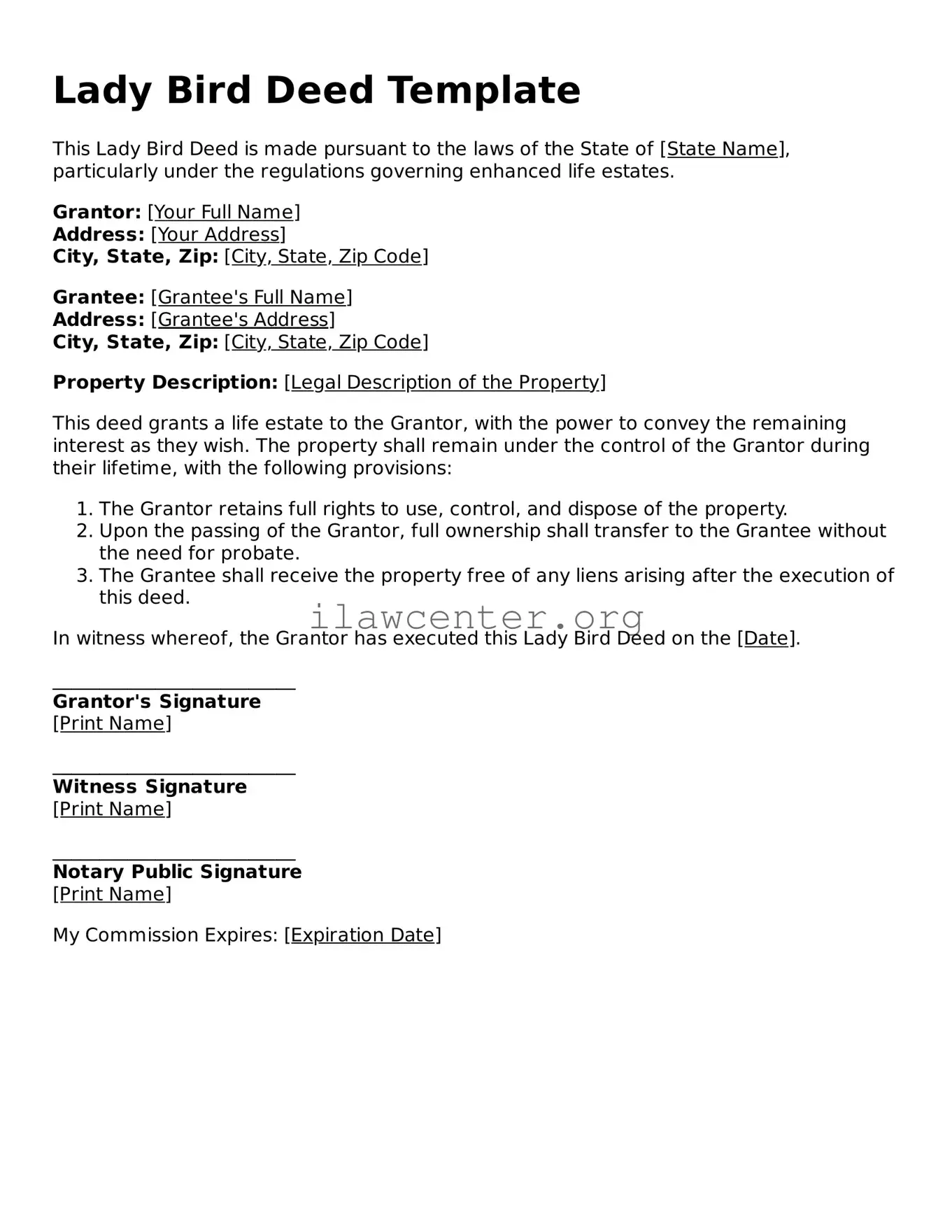

Lady Bird Deed Template

This Lady Bird Deed is made pursuant to the laws of the State of [State Name], particularly under the regulations governing enhanced life estates.

Grantor: [Your Full Name]

Address: [Your Address]

City, State, Zip: [City, State, Zip Code]

Grantee: [Grantee's Full Name]

Address: [Grantee's Address]

City, State, Zip: [City, State, Zip Code]

Property Description: [Legal Description of the Property]

This deed grants a life estate to the Grantor, with the power to convey the remaining interest as they wish. The property shall remain under the control of the Grantor during their lifetime, with the following provisions:

- The Grantor retains full rights to use, control, and dispose of the property.

- Upon the passing of the Grantor, full ownership shall transfer to the Grantee without the need for probate.

- The Grantee shall receive the property free of any liens arising after the execution of this deed.

In witness whereof, the Grantor has executed this Lady Bird Deed on the [Date].

__________________________

Grantor's Signature

[Print Name]

__________________________

Witness Signature

[Print Name]

__________________________

Notary Public Signature

[Print Name]

My Commission Expires: [Expiration Date]

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of enhanced life estate deed that allows property owners to retain control over their property during their lifetime while facilitating a smooth transfer of ownership upon their death. |

| Governing Law | In the United States, the laws governing Lady Bird Deeds vary by state, with Texas being one of the most recognized states to use this type of deed. |

| Benefits | This deed allows property owners to avoid probate, which can save time and legal fees for their heirs. |

| Control | The property owner retains full control over the property, allowing them to sell, lease, or mortgage it without needing consent from the beneficiaries. |

| Termination | The property owner can revoke or change the Lady Bird Deed at any time during their lifetime, providing flexibility. |

| Tax Implications | Property transferred via a Lady Bird Deed is eligible for a step-up in basis, which can reduce capital gains taxes for the heirs. |

| Eligibility | Not all states recognize Lady Bird Deeds, so it's essential to consult local laws to determine eligibility and validity. |

Instructions on Utilizing Lady Bird Deed

Once you have gathered all the necessary information, you can begin filling out the Lady Bird Deed form. This document requires specific details about property ownership and the intended beneficiaries. Careful attention to each step will ensure accurate completion.

- Property Information: Begin by entering the full legal description of the property. This includes the address and parcel number, if available.

- Grantor Details: Fill in your full name and any aliases. Include your current address to ensure clear identification.

- Beneficiary Information: Enter the name(s) of the beneficiary or beneficiaries who will inherit the property. Include their relationship to you, if applicable.

- Transfer Conditions: Specify any particular conditions under which the property will transfer to the beneficiaries. This might include continued rights to use or occupy the property during your lifetime.

- Signatures: Sign and date the document at the designated area. Should a witness be required, ensure they sign as well.

- Notary Public: Arrange for a notary public to review and notarize the document. Ensure you bring identification to the session.

- Record the Deed: After notarization, file the deed with the county recorder’s office where the property is located. This step ensures that the deed is legally recognized.

Important Facts about Lady Bird Deed

What is a Lady Bird Deed?

A Lady Bird Deed is a special type of property transfer document. It allows a property owner to transfer their property to a beneficiary while retaining control over the property during their lifetime. This deed is particularly common in estate planning as it can help avoid probate and minimize estate taxes upon the owner's passing.

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed. First, it allows the owner to keep the right to manage, use, and even sell the property while they are still alive. Second, upon the owner's death, the property automatically passes to the named beneficiary without going through probate, which can be a lengthy and expensive process. Lastly, it can help limit tax implications for the beneficiary, as they typically receive the property at its current market value.

Who can be named as a beneficiary in a Lady Bird Deed?

You can name any individual or entity as a beneficiary in a Lady Bird Deed. Common choices include family members, friends, or a trust. It's essential to ensure that the named beneficiary is someone who will effectively manage the property after your passing. Discussing your decision with your loved ones can also help to clarify expectations and prevent potential disputes.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or modified at any time while the property owner is alive. This flexibility allows the owner to adjust their estate plan based on changing circumstances, such as the addition of new beneficiaries or different property management intentions. To make changes, a new deed must be created, and the old one should be formally revoked.

Is legal assistance necessary to create a Lady Bird Deed?

While it is possible to create a Lady Bird Deed without legal help, consulting with an attorney familiar with estate planning is advisable. A legal professional can ensure that the document meets all state requirements, accurately reflects your intentions, and helps you understand any potential ramifications. This guidance can save you and your beneficiaries time and stress in the future.

Common mistakes

Filling out a Lady Bird Deed can seem straightforward, but many people make common mistakes that can cause problems later on. One frequent error is failing to include all necessary information. This may include the names of all parties involved or a complete legal description of the property. Without this information, the deed may not be valid.

Another mistake is not signing the deed correctly. All parties must sign in the presence of a notary public. Skipping this step can lead to complications when trying to use the deed in the future. It is also crucial to ensure that the notary's acknowledgment is present, as this adds an extra layer of validity to the document.

People often neglect to review local laws and requirements. Each state has different regulations regarding Lady Bird Deeds. Not understanding these rules can lead to errors that invalidate the deed. Therefore, doing some research or consulting a local attorney can save time and headaches later.

Some individuals incorrectly assume that a will can replace a deed. While both estate planning tools serve a purpose, they are not interchangeable. A Lady Bird Deed allows for a smooth transfer of property while avoiding probate, unlike a will which must go through that process.

Additionally, it is common for individuals to forget to inform their heirs about the deed. If beneficiaries are unaware of how the property will pass, conflicts can arise after one's passing. It is important to communicate these decisions with loved ones to minimize confusion and disputes.

Another error involves the way property is titled. People sometimes fail to clearly state how the ownership will be held. Including phrases like "joint tenants with rights of survivorship" can clarify the intent and protect against misunderstandings in the future.

When filling out the form, many overlook details about life estates. Understanding the implications of creating a life estate is critical, as it affects how property is used and inherited. People often assume that a life estate means full control, which is not always the case.

Many also underestimate the importance of accurately determining the value of the property. Incorrect valuations can lead to tax issues or disputes among heirs. A fair market assessment ensures clarity and aids in proper planning.

A common mistake is using outdated forms. Laws and forms can change, so it is vital to use the most current version. Using an old form might lead to legal issues or invalidate the deed altogether.

Lastly, failing to file the deed correctly can cause serious complications. After completion, the deed must be filed with the appropriate county office for it to be legally recognized. Not doing so may leave the property subject to probate and other legal processes.

Documents used along the form

The Lady Bird Deed is a helpful estate planning tool that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. As you navigate real estate transactions or estate planning, several other documents may complement the Lady Bird Deed. Each of these forms serves a specific purpose and enhances the overall management of your property and estate.

- Will: A will is a legal document that outlines how a person's assets will be distributed after their death. It specifies beneficiaries and may appoint guardians for minor children.

- Trust Agreement: This document establishes a trust, which can hold assets for beneficiaries. Unlike a will, a trust can take effect during a person's lifetime, and may help avoid probate.

- Power of Attorney: A power of attorney allows someone to make decisions on your behalf, especially in financial matters, should you be unable to do so due to illness or incapacity.

- Transfer on Death Deed: Similar to a Lady Bird Deed, this document allows property owners to designate beneficiaries to receive property automatically upon their death, bypassing probate.

- Life Estate Deed: This arrangement gives one person the right to use the property during their lifetime while passing full ownership to another party upon their death.

- Affidavit of heirship: Used to assert ownership of property by a decedent’s heirs, this document serves as a declaration to establish who has the legal claim to the property, especially when there is no will.

- Real Estate Purchase Agreement: This is a contract between the seller and buyer of property, detailing the terms of the sale, including price, conditions, and contingencies.

These documents, in conjunction with the Lady Bird Deed, form an essential part of effective estate and property planning. Each plays a significant role in ensuring that your wishes are carried out and that your loved ones are provided for after your passing.

Similar forms

The Lady Bird Deed is a unique estate planning tool that allows homeowners to transfer property, while still retaining control during their lifetime. It shares similarities with several other legal documents. Here are six documents that are akin to the Lady Bird Deed, along with their similarities:

- Transfer on Death Deed (TODD): Like the Lady Bird Deed, a Transfer on Death Deed allows property owners to designate beneficiaries who will inherit the property upon the owner's death. Both documents facilitate the transfer without going through probate.

- Life Estate Deed: A Life Estate Deed gives the homeowner the right to use and control the property during their lifetime, similar to how a Lady Bird Deed allows the owner to live on the property while designating future beneficiaries.

- Will: While a Will outlines how all assets, including property, are to be distributed upon death, a Lady Bird Deed specifically transfers ownership of real estate without the need for probate, much like the immediate effect seen in a Will’s testamentary provisions.

- Revocable Living Trust: This document allows property to be transferred into a trust, where the original owner can still use it while alive. Both the Lady Bird Deed and a Revocable Living Trust help avoid probate, ensuring a smoother transfer of assets after death.

- Joint Tenancy with Right of Survivorship: In this arrangement, individuals hold property together, and when one person passes away, ownership automatically transfers to the surviving owner. Similarly, a Lady Bird Deed designates beneficiaries who gain ownership without legal complications after the property owner's death.

- Power of Attorney for Real Estate: A Power of Attorney can authorize someone to manage property matters on behalf of the owner. While it doesn't transfer ownership, it grants someone the ability to act regarding real estate matters, as the Lady Bird Deed allows continued management and control by the owner during their lifetime.

Dos and Don'ts

When filling out a Lady Bird Deed form, it's essential to follow certain guidelines to ensure the document is valid and meets your needs. Here are some important dos and don’ts:

- Do clearly identify the property being transferred, including the legal description.

- Do ensure that all parties involved understand the terms of the deed.

- Do consult with a qualified attorney to review the form before submission.

- Do keep a copy of the signed deed for your records.

- Don't use vague language when describing the property.

- Don't forget to sign in the appropriate places; all required signatures are necessary.

- Don't skip the legal requirements for notarization and witnesses.

- Don't delay filing the deed with the county recorder's office after completion.

Misconceptions

The Lady Bird Deed is a powerful tool for estate planning, but there are several misconceptions surrounding it. Let’s clarify some of these misunderstandings to provide a clearer picture.

- Misconception 1: The Lady Bird Deed is only for the wealthy.

- Misconception 2: The Lady Bird Deed doesn't allow for changes.

- Misconception 3: It automatically transfers property to heirs.

- Misconception 4: Using a Lady Bird Deed avoids all estate taxes.

- Misconception 5: It can be used for any type of property.

- Misconception 6: It's a complex legal document that requires a lawyer.

This is not true. While it can be beneficial for those with significant assets, it is useful for anyone looking to avoid probate and manage their property effectively.

In reality, you can change or revoke a Lady Bird Deed anytime while you're still alive. This flexibility makes it a valuable estate planning tool.

Although a Lady Bird Deed allows for a smoother transfer, it only takes effect upon your death. Until then, you retain full control of the property.

A Lady Bird Deed does not exempt you from estate taxes. It simply provides a way to transfer property outside of probate, which can be beneficial for other reasons.

Though commonly used for real estate, a Lady Bird Deed may not be suitable for all property types, especially if there are existing liens or legal constraints.

While legal advice can be helpful, many find that a Lady Bird Deed can be prepared without extensive legal assistance. Understanding the terms and purpose can be enough for some individuals.

Key takeaways

The Lady Bird Deed, also known as an enhanced life estate deed, can be a valuable tool in estate planning. Here are some important points to consider while filling out and using this form:

- The deed allows homeowners to retain control over their property during their lifetime.

- It enables the transfer of property to beneficiaries automatically upon the homeowner's death, avoiding probate.

- Homeowners can change their mind about the transfer at any time before passing, offering flexibility.

- While this deed helps avoid probate, it does not protect the property from creditors or other claims.

- It's crucial to consult local laws, as the specifics of the Lady Bird Deed can vary by state.

- Filling out the form requires accurate information about the property and the designated beneficiaries.

- Ensure that the deed is properly signed and notarized to be legally binding.

Understanding these aspects can help in making informed decisions about estate planning and property management.

Fill out Common Types of Lady Bird Deed Templates

California Corrective Deed - A Corrective Deed can confirm the intent of the original deed.

Deed of Gift Property - Using a Gift Deed is an effective way to transfer property while possibly avoiding probate delays.