Fillable Last Will and Testament Document

A Last Will and Testament is a legal document that outlines an individual's wishes regarding the distribution of their assets and the care of any minor children upon their passing. This essential document ensures that personal affairs are handled according to one's preferences. To get started on your Last Will and Testament, fill out the form by clicking the button below.

Creating a Last Will and Testament is an essential step in planning for the future. This legal document outlines your wishes regarding the distribution of your assets after your passing. It serves as a guide to ensure that your property, finances, and even guardianship of minor children are handled according to your specifications. A well-drafted will can prevent disputes among heirs and provide clarity in a time of grief. Important components of the form include the identification of beneficiaries, a detailed list of assets, and the appointment of an executor responsible for carrying out your wishes. Additionally, the will must meet certain legal requirements, such as being signed in the presence of witnesses, to be considered valid. Understanding these aspects can empower individuals to take control of their legacy and provide peace of mind to both themselves and their loved ones.

Last Will and Testament Preview

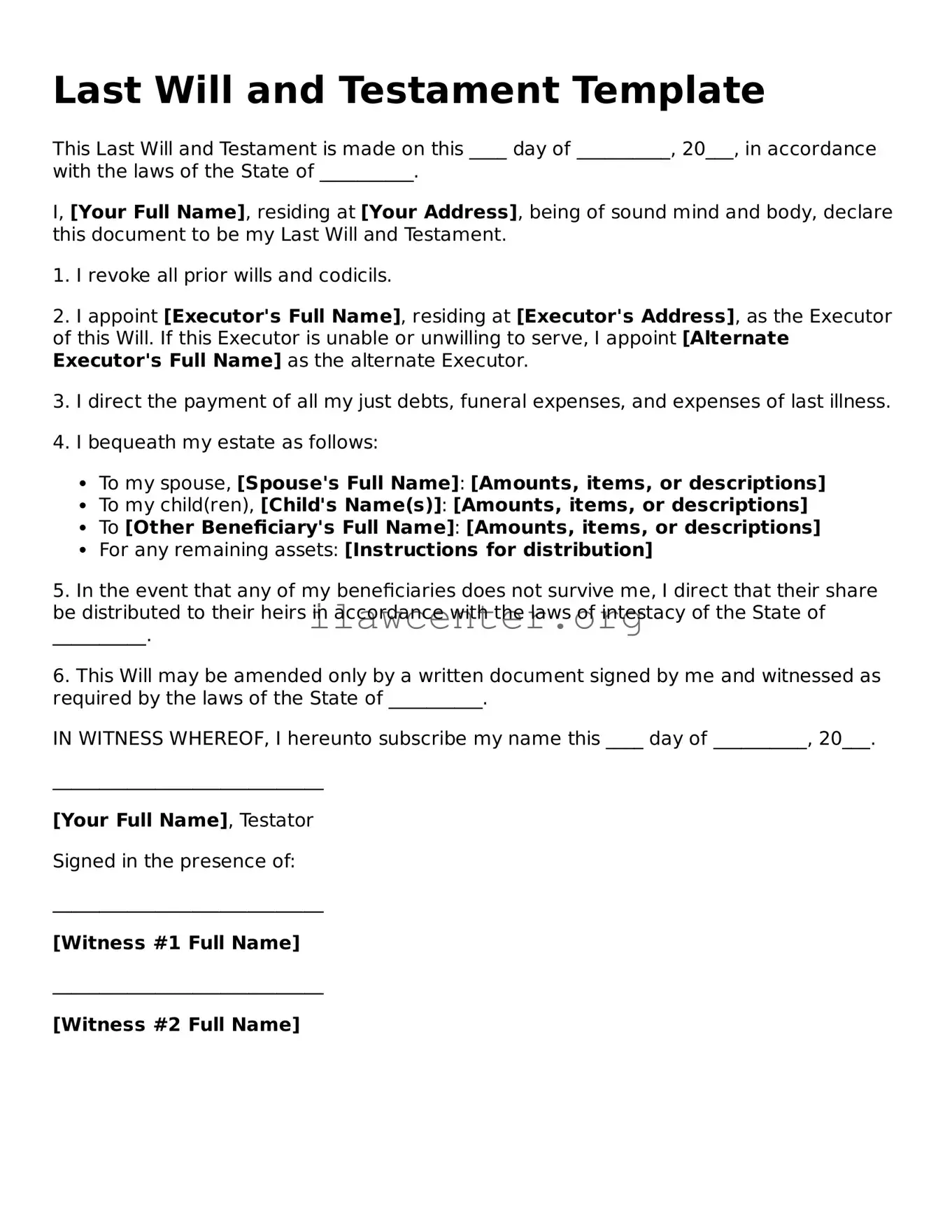

Last Will and Testament Template

This Last Will and Testament is made on this ____ day of __________, 20___, in accordance with the laws of the State of __________.

I, [Your Full Name], residing at [Your Address], being of sound mind and body, declare this document to be my Last Will and Testament.

1. I revoke all prior wills and codicils.

2. I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of this Will. If this Executor is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the alternate Executor.

3. I direct the payment of all my just debts, funeral expenses, and expenses of last illness.

4. I bequeath my estate as follows:

- To my spouse, [Spouse's Full Name]: [Amounts, items, or descriptions]

- To my child(ren), [Child's Name(s)]: [Amounts, items, or descriptions]

- To [Other Beneficiary's Full Name]: [Amounts, items, or descriptions]

- For any remaining assets: [Instructions for distribution]

5. In the event that any of my beneficiaries does not survive me, I direct that their share be distributed to their heirs in accordance with the laws of intestacy of the State of __________.

6. This Will may be amended only by a written document signed by me and witnessed as required by the laws of the State of __________.

IN WITNESS WHEREOF, I hereunto subscribe my name this ____ day of __________, 20___.

_____________________________

[Your Full Name], Testator

Signed in the presence of:

_____________________________

[Witness #1 Full Name]

_____________________________

[Witness #2 Full Name]

PDF Form Characteristics

| Fact Name | Details |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| State-Specific Requirements | Each state has its own laws governing wills, including requirements for witnesses, notarization, and capacity. |

| Revocation | A will can be revoked or modified at any time by the testator, as long as they are of sound mind. |

| Probate Process | After a person dies, the will typically goes through probate, a legal process to validate the will and distribute assets. |

Instructions on Utilizing Last Will and Testament

Completing a Last Will and Testament is an important step in planning for your future. After you fill out the form, it’s crucial to ensure that it’s signed and witnessed according to your state’s laws. This will help validate your will and make your wishes clear to your loved ones.

- Title the Document: Begin by writing “Last Will and Testament” at the top of the page.

- Identify Yourself: State your full name and address. Mention that you are of sound mind and at least the legal age to make a will.

- Revoke Previous Wills: If applicable, include a statement revoking any previous wills you have made.

- Appoint an Executor: Choose someone to execute your will. Write their name and relationship to you.

- Detail Your Beneficiaries: Clearly name the individuals or organizations who will inherit your assets. Specify what each beneficiary will receive.

- Specify Guardianship: If you have minor children, name a guardian who will take care of them in the event of your passing.

- Sign the Document: Sign your will at the bottom. It's best to do this in the presence of witnesses.

- Include Witness Signatures: Have at least two witnesses sign the will, confirming that they saw you sign it and that you are of sound mind.

- Date the Will: Write the date on which you signed the will.

After completing these steps, consider storing your will in a safe place and inform your executor where it can be found. This ensures that your wishes are honored and facilitates the distribution of your estate in accordance with your desires.

Important Facts about Last Will and Testament

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It allows individuals to specify who will inherit their belongings, name guardians for minor children, and appoint an executor to oversee the distribution of their estate. This document serves as a crucial part of estate planning, ensuring that one's wishes are followed and reducing conflicts among surviving family members.

Do I really need a Last Will and Testament?

Can I write my own Last Will and Testament?

Yes, you can write your own will, but there are specific legal requirements that must be met for it to be valid. It must be in writing, signed by you, and witnessed by at least two people who are not beneficiaries. However, seeking legal advice can help ensure that your will is properly executed and meets all necessary legal standards.

What happens if I don’t have a will?

If you die without a will, your estate will be distributed according to the intestacy laws of your state. This means your assets will be allocated according to a predetermined hierarchy, often starting with your spouse and children. This distribution might not reflect your wishes and could lead to complications, such as guardianship issues for minor children.

How often should I update my will?

It's advisable to review and update your will periodically or after significant life events, such as marriage, divorce, the birth of a child, or the acquisition of new assets. Changes in your financial situation or relationships can affect your intended distribution and should be reflected in your will.

What is an executor, and what do they do?

An executor is the person you designate in your will to carry out your wishes after your death. Their responsibilities include locating and managing your assets, settling debts and taxes, and distributing the remaining property to your beneficiaries. Choosing a trustworthy and organized person is essential, as this role involves many important tasks.

Can a will be contested?

Yes, a will can be contested. Family members or other interested parties may challenge the validity of a will based on various grounds, such as lack of capacity at the time of signing, undue influence from others, or improper execution. If successfully contested, the distribution of your estate may differ from your original intentions.

Are there any assets that cannot be included in a will?

Certain assets typically cannot be included in a will. For example, property held in a living trust or assets that have designated beneficiaries, such as life insurance policies and retirement accounts, bypass the probate process. These assets will go directly to the named beneficiaries regardless of the contents of your will.

What is the probate process?

Probate is the legal process through which a deceased person's estate is administered and distributed. This process involves validating the will, inventorying the assets, paying off debts, and distributing the remaining property to the beneficiaries. Probate can take several months to a few years, depending on the complexity of the estate and any potential disputes.

Can I revoke or change my will?

Yes, you can revoke or change your will at any time while you are alive, as long as you are of sound mind. This usually involves creating a new will that explicitly states your intentions to revoke previous versions. Additionally, you may also physically destroy an old will to signify its invalidity, but it's advised to document the changes formally to avoid confusion.

Common mistakes

Creating a Last Will and Testament is an important step in ensuring that one's wishes are carried out after passing. However, many individuals make critical mistakes in this process. One common error is failing to properly identify heirs. When beneficiaries are not clearly named or if only the relationship is stated, it can lead to confusion and potential disputes among family members, complicating the execution of the will.

Another frequent mistake is not appointing an executor or choosing someone who may not be suitable for the task. An executor should be trustworthy, organized, and capable of handling financial matters. If no executor is named, the court will need to appoint one, which can lead to delays and additional stress for the surviving family members.

Additionally, individuals often neglect to update their wills after significant life events. Changes such as marriage, divorce, or the birth of a child necessitate revising the will to ensure that it accurately reflects current wishes. Failing to make these updates can lead to unintended consequences, where assets may not be distributed as intended.

People may also underestimate the importance of witnessing the will correctly. Many states require a will to be signed in the presence of at least two witnesses, who are not beneficiaries. If witnesses are not present or do not meet the legal requirements, the validity of the will could be challenged, leading to complications in its enforcement.

In some cases, individuals may use generic templates found online without tailoring them to their specific needs. While templates can provide a useful starting point, every situation is unique, and these documents may not capture all necessary details or adhere to state law requirements. This oversight could render the will invalid.

Finally, a common mistake is not storing the completed will in a safe and accessible location. If a will cannot be located upon the individual's passing, it may be presumed revoked, leading to intestacy laws being applied, which may not align with the individual's wishes. Organizing the will and informing trusted family members or an attorney about its location can help avoid such complications.

Documents used along the form

A Last Will and Testament is a crucial document that outlines how a person's assets will be distributed after their death. When preparing a will, individuals often find it helpful to consider several other forms and documents that can complement their estate planning efforts. Each of these documents serves a specific purpose and may provide additional clarity or assurance regarding one's wishes.

- Living Will: A Living Will is a document that communicates an individual’s wishes regarding medical treatment in situations where they can no longer express their preferences. It typically addresses end-of-life care and outlines the types of life-sustaining treatments a person may or may not want.

- Durable Power of Attorney: This form designates a trusted person to handle financial and legal decisions on an individual's behalf if they become incapacitated. It ensures that someone is in place to manage affairs according to the individual's wishes.

- Healthcare Proxy: Similar to a Durable Power of Attorney, this document appoints someone to make medical decisions for a person if they are unable to do so themselves. This empowers an agent to act in the best interest of the individual during medical emergencies.

- Trust Agreement: A Trust Agreement establishes a trust, allowing an individual to transfer assets to a trustee who will manage them on behalf of beneficiaries. This can help avoid probate and provide more control over how and when assets are distributed.

- Affidavit of Heirship: This document is often used when someone dies without a will. It helps establish the lineage and heirs of the deceased, which can be important for distributing property and settling the estate without legal disputes.

By carefully considering the use of these supplementary documents alongside a Last Will and Testament, individuals can create a more comprehensive estate plan. This serves not only to respect their wishes but also to ease the process for their loved ones during a challenging time.

Similar forms

Living Will: This document outlines an individual's preferences for medical treatment in case they become incapacitated and unable to communicate their wishes. Like a Last Will and Testament, a Living Will ensures that a person's wishes are respected, but it specifically focuses on healthcare decisions rather than asset distribution.

Durable Power of Attorney: This document allows a person to designate someone else to make important legal and financial decisions on their behalf if they are unable to do so. Similar to a Last Will and Testament, it provides guidance for handling personal matters, but it operates during the individual's lifetime rather than after death.

Revocable Living Trust: A Revocable Living Trust is a legal arrangement that allows individuals to transfer their assets into a trust during their lifetime. Much like a Last Will and Testament, it determines how those assets will be managed and distributed, but it avoids the probate process, enabling a quicker transition of assets to beneficiaries.

Healthcare Proxy: A Healthcare Proxy allows an individual to appoint someone to make healthcare decisions on their behalf if they become unable to do so. While a Last Will and Testament deals with property and assets after death, a Healthcare Proxy focuses on crucial medical decisions while the individual is still alive.

Beneficiary Designation Forms: These forms enable individuals to specify who will receive certain assets, such as life insurance proceeds or retirement accounts, upon their death. While a Last Will and Testament provides comprehensive instructions for an entire estate, beneficiary designations allow for a streamlined transfer of specific assets, often bypassing probate.

Dos and Don'ts

When filling out a Last Will and Testament form, it’s vital to follow specific guidelines to ensure clarity and legality. Here’s a concise list of what to do and what to avoid:

- Do: Use clear and specific language to outline your wishes.

- Do: Make sure to include all necessary information such as names, addresses, and relationships.

- Do: Sign the will in the presence of witnesses, following your state's requirements.

- Do: Keep the will in a safe place and inform your executor about its location.

- Don't: Use ambiguous terms or phrases that could lead to confusion.

- Don't: Forget to date the document; this is essential for validating your intentions.

- Don't: Ignore your state's laws regarding the number of witnesses and notarization.

- Don't: Leave significant assets or dependents out of your will without clear reasoning.

Misconceptions

Misconceptions about a Last Will and Testament can lead to confusion and sometimes distress. Understanding these misunderstandings is crucial for anyone interested in estate planning. Here are seven common misconceptions:

- A Will Is Only for the Wealthy. Many people believe that only those with significant assets need a will. In reality, everyone should have a will to ensure their wishes are respected, regardless of their financial situation.

- A Will Covers All Estate Planning Needs. A will does not address every aspect of estate planning. It does not manage assets held in trusts or designate beneficiaries for life insurance or retirement accounts. These details require separate considerations.

- Once a Will Is Written, It Cannot Be Changed. While it is important to have a will, it is not set in stone. Individuals can revise their wills as circumstances change, such as through marriage, the birth of children, or major life transitions.

- A Will Avoids Probate. Many mistakenly believe that having a will allows them to bypass the probate process. In truth, a will must go through probate, which is the legal process of validating the will and settling the estate.

- All Wills Are Automatically Valid. A will must meet specific legal requirements to be valid. Factors like proper signatures and witness presence can affect its legitimacy. Understanding these requirements is essential.

- Joint Ownership Means No Need for a Will. Some think that holding property jointly with another person renders a will unnecessary. However, this only addresses specific assets; a will is still valuable for distributing other belongings and assets.

- Verbal Wills Are Just as Valid as Written Ones. While some states recognize oral wills, they are often difficult to enforce and can lead to disputes. A written will provides clear documentation of intentions, reducing ambiguity and possible conflicts.

Understanding these misconceptions can empower individuals to take the necessary steps in planning for the future. A well-considered will is an important part of that journey.

Key takeaways

Creating a Last Will and Testament is an important step in ensuring that your wishes regarding your assets and estate are honored after your passing. Here are some key takeaways to keep in mind when filling out and using this vital document:

- Understand the Purpose: A last will outlines how you want your assets distributed, appoints guardians for minors, and names an executor to administer your estate.

- Choose an Executor: This person will be responsible for carrying out the instructions in your will. Choose someone trustworthy and willing to take on the responsibility.

- Be Clear and Specific: Clearly specify who receives what. Vague wording can lead to confusion or disputes, so detail your wishes as much as possible.

- Consider State Laws: Each state has different laws regarding wills. Ensure your document complies with the laws of your state for it to be legally binding.

- Sign and Date the Document: Most states require your will to be signed by you and dated. This is essential for validating your wishes.

- Witness Requirement: Many states require witnesses to sign your will. Ensure you understand your state's requirements regarding the number of witnesses and their eligibility.

- Review Regularly: Life changes, such as marriage, divorce, or the birth of a child, warrant a review of your will. Update it regularly to reflect your current situation.

- Store Safely: Keep your will in a safe place, and inform your executor and loved ones where it can be found. Avoid hiding it in places where it could be lost or destroyed.

- Consider Professional Help: While you can create a will on your own, consulting an attorney can provide peace of mind and ensure that your will meets legal standards.

By keeping these takeaways in mind, you can craft a Last Will and Testament that effectively expresses your wishes and protects your loved ones.

Find Popular Templates

Aia A305 Form Pdf - The A305 form is an industry-standard qualification tool.

Power of Attorney Example - You may need a Power of Attorney for estate planning purposes.

How to Get a No Trespass Order - Filling out this form correctly can streamline the legal process if needed.