Instructions on Utilizing LLC Share Purchase Agreement

Once you have the LLC Share Purchase Agreement form in hand, it's time to ensure that you fill it out correctly. Following these steps will help you gather the necessary information and make the process seamless.

- Gather all relevant company information. This includes the name of the LLC, its address, and the name(s) of the seller(s) and buyer(s).

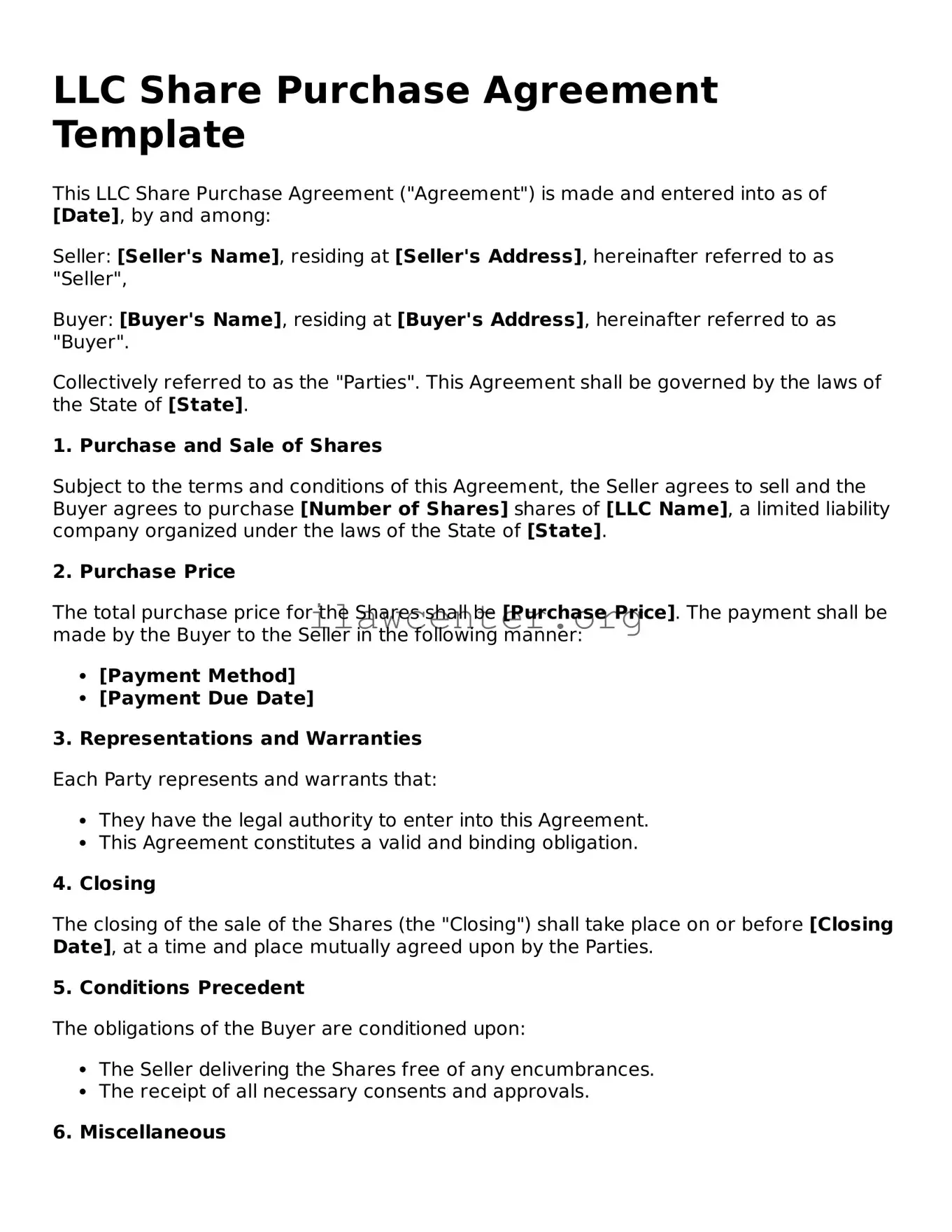

- Start with the title of the form. Clearly write “LLC Share Purchase Agreement” at the top of the document.

- Fill in the date of the agreement. This date typically represents when the purchase will take effect.

- Identify the parties involved. Provide full legal names and addresses for both the seller(s) and the buyer(s). Ensure this information is accurate.

- In the section detailing the shares being sold, specify the number of shares, classes of shares, and any rights associated with them.

- Define the purchase price. Clearly state the total amount being paid for the shares. If there are any payment terms or conditions, note those as well.

- Include any representations and warranties from both parties. This might cover conditions regarding the shares and the LLC itself.

- Add any additional terms or conditions that are important to the agreement. This might include restrictions on resale or management rights.

- Check if there are any signature lines at the end of the form. All parties should sign and date the agreement to make it valid.

- Make copies of the completed form for all parties involved before submitting or storing it securely.

After filling out the form, it’s a good idea to review it to ensure that everything is accurate and clear. Double-check names, dates, and figures to prevent any issues later on. Once satisfied, sign and share copies with all parties involved.