Instructions on Utilizing New York Deed in Lieu of Foreclosure

After completing the New York Deed in Lieu of Foreclosure form, it’s important to understand what comes next. This process will typically involve submitting the completed form to the appropriate parties, such as your lender, and ensuring that all necessary documents are aligned for a smooth transition. Below are the steps to accurately fill out the form.

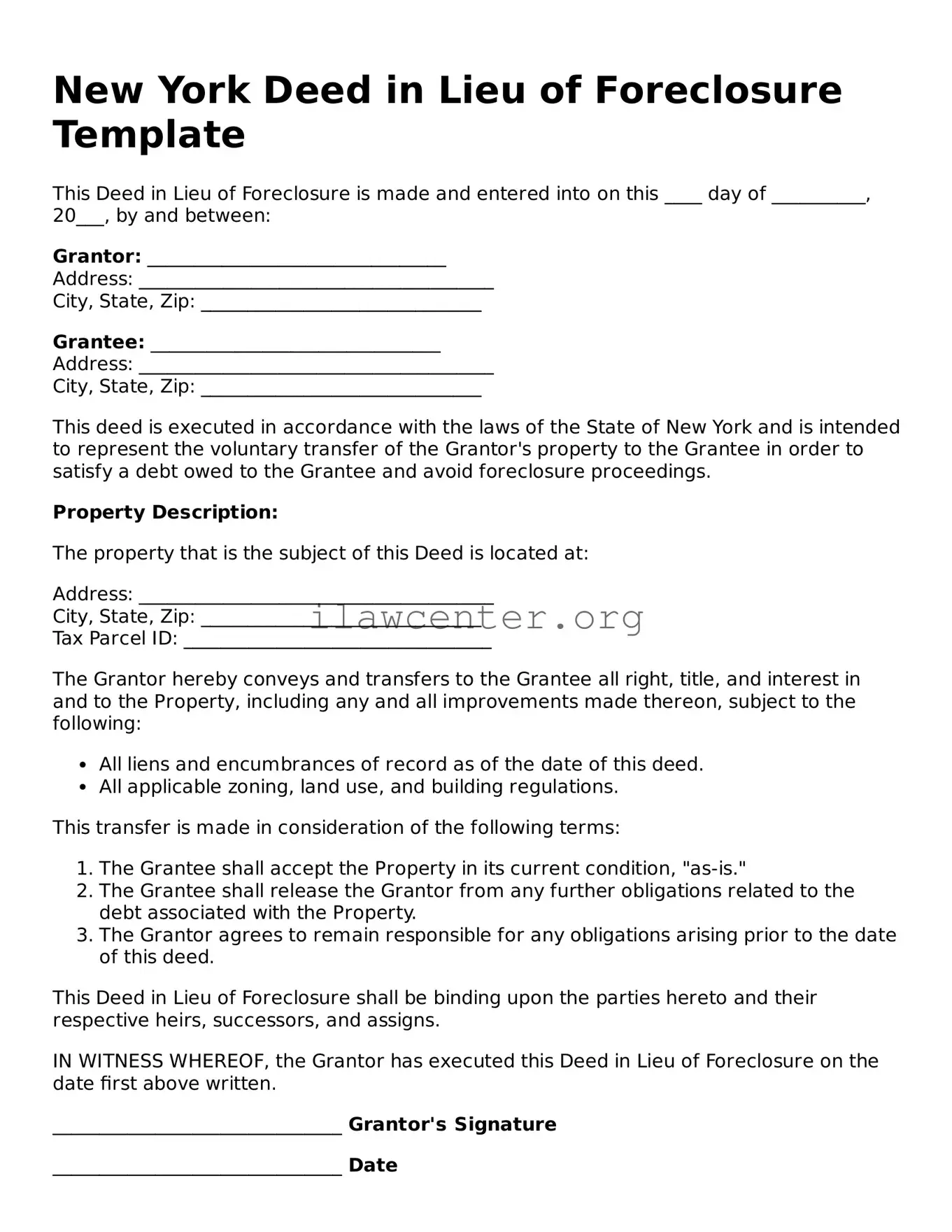

- Gather Required Information: Collect all necessary documents, including your mortgage agreement and any foreclosure-related notices.

- Fill Out the Personal Information: Start by entering your name and the address of the property involved.

- Provide Lender Information: Enter the name and address of the lender or bank you are dealing with.

- Property Description: Include a detailed description of the property, such as its legal description and parcel number.

- Statement of Ownership: Assert your ownership of the property by clearly stating that you are the owner and listing any co-owners if applicable.

- Sign the Form: Ensure all relevant parties (usually the owner(s)) sign the document. This often requires notarization.

- Review: Double-check the form for any errors or omissions. Accurate information is crucial.

- Make Copies: Before submission, make copies of the completed form for your records.

- Submit the Form: Send the form to your lender as instructed, keeping a record of how and when you submitted it.

Following these steps carefully will help ensure that the form is filled out correctly and efficiently. Adhering to this process can facilitate a smoother transition, allowing for an opportunity to address any outstanding mortgage obligations more effectively.