What is a New York Deed Form?

A New York Deed Form is a legal document that facilitates the transfer of property ownership from one party to another within the state of New York. It includes the names of the grantor (seller) and grantee (buyer), a description of the property, and any relevant terms of the transaction. This form is essential for making the transfer legally binding and protecting the interests of both parties involved.

What types of deeds are there in New York?

In New York, the most commonly used types of deeds are the Warranty Deed and the Quitclaim Deed. A Warranty Deed guarantees that the grantor holds clear title to the property and has the right to sell it. A Quitclaim Deed, on the other hand, transfers whatever interest the grantor has in the property without making any guarantees. Each serves different purposes depending on the needs of the parties involved.

Do I need a lawyer to fill out a New York Deed Form?

While it is not legally required to have a lawyer complete a New York Deed Form, consulting one is recommended. Legal experts can ensure that the form is filled out correctly and that all legal requirements are met. Additionally, a lawyer can help navigate complexities related to property transfer and advise on any potential legal implications.

Where can I obtain a New York Deed Form?

New York Deed Forms can be found at various online legal resources, law offices, or local government websites. Local county clerk offices may also provide the relevant forms and guide you on how to fill them out. Always ensure you have the most current version of the form suitable for your specific needs.

How do I properly execute a New York Deed Form?

To properly execute a New York Deed Form, the grantor must sign the document in the presence of a notary public. The notary will verify the identity of the grantor and witness the signing. Afterward, the deed must be recorded with the county clerk’s office where the property is located to provide public notice of the change in ownership.

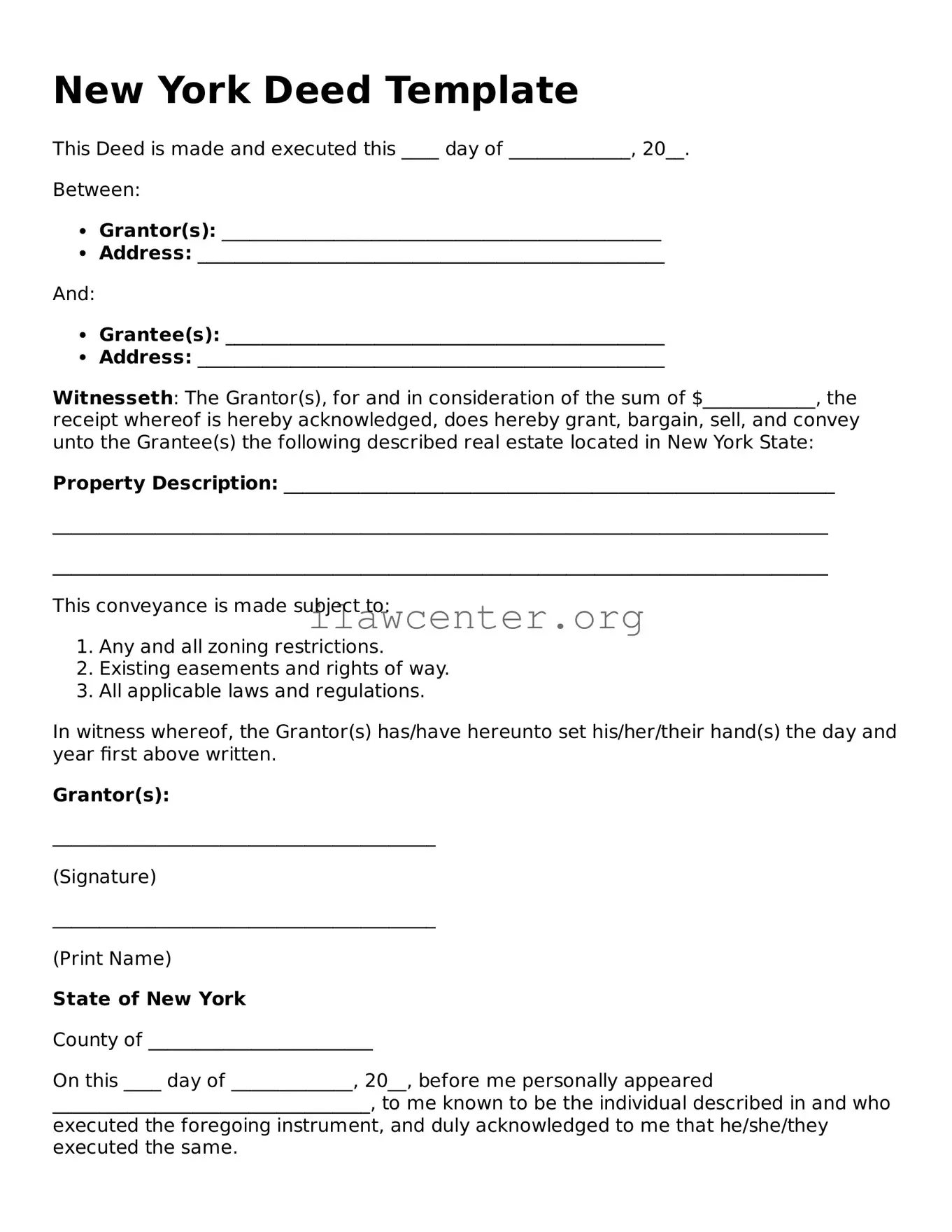

What information is required on a New York Deed Form?

A New York Deed Form typically requires various essential pieces of information: the names and addresses of both the grantor and grantee, a detailed legal description of the property, the signature of the grantor, and the acknowledgement by the notary public. Additional considerations may include the purchase price and any existing liens or encumbrances.

Is there a fee associated with filing a New York Deed Form?

Yes, filing a New York Deed Form usually incurs a fee. This fee varies by county and is based on various factors such as the type of deed and the value of the property. It is advisable to check with your local county clerk's office for specific fee schedules and any additional costs associated with the recording process.

What happens if a New York Deed Form is not recorded?

If a New York Deed Form is not recorded, the transfer of property ownership may not be recognized by third parties. This could lead to complications regarding title disputes in the future. Recording the deed with the appropriate county office provides public notice that the property has changed hands, protecting both the seller and the buyer.

Can a New York Deed Form be revoked or modified?

Once executed and recorded, a New York Deed Form generally cannot be revoked or modified unilaterally. If changes are necessary, a new deed should be prepared and executed. In some cases, a court may intervene if there are grounds to challenge the validity of the original deed, but these situations can be complex and typically require legal guidance.