Instructions on Utilizing New York Durable Power of Attorney

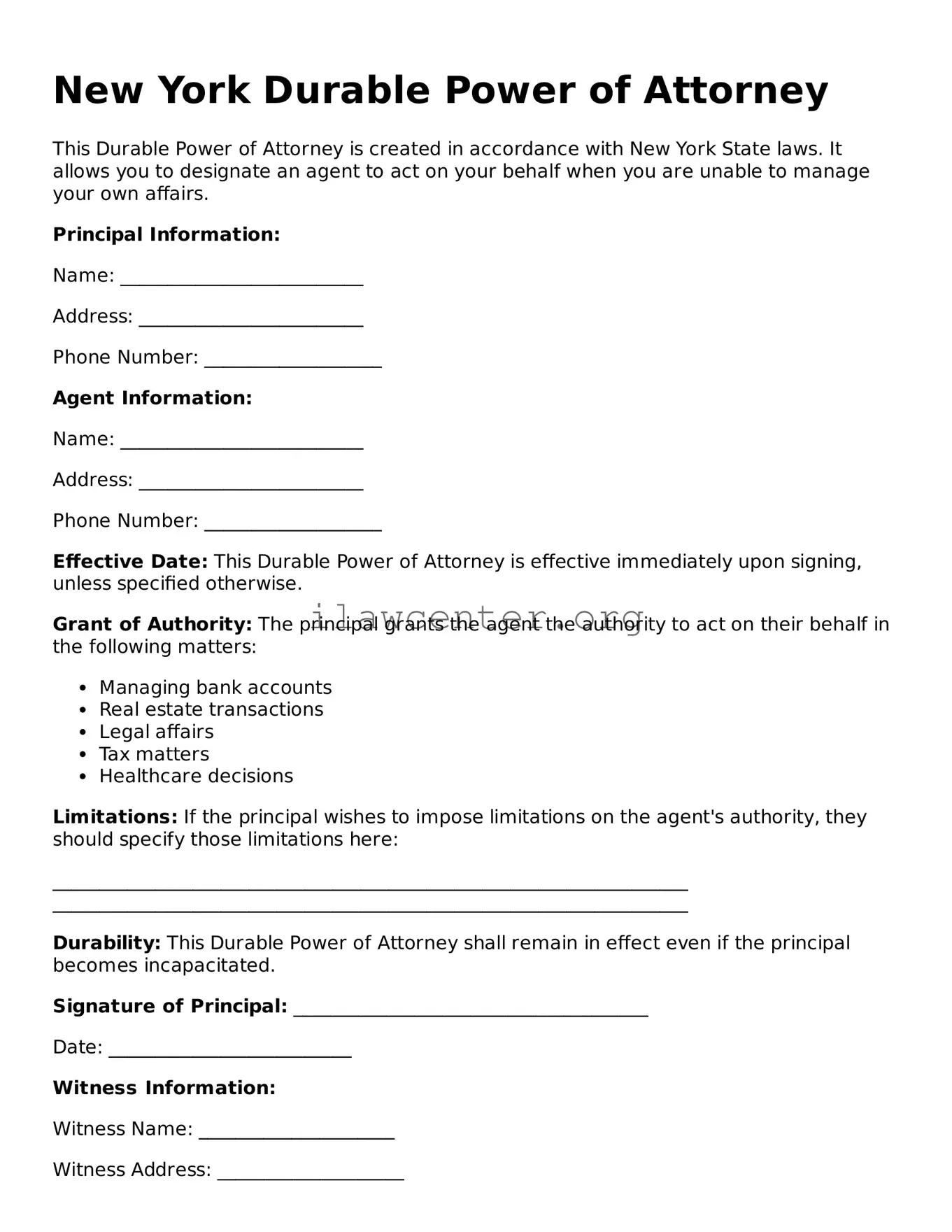

Completing the New York Durable Power of Attorney form is a straightforward process that requires careful attention. Once you have filled out the form, it should be signed and notarized to make it legally binding.

- Download or obtain the New York Durable Power of Attorney form. You can find it online or at legal offices.

- Read the instructions at the top of the form carefully to understand what information is required.

- Fill in your full name and address in the designated section. This identifies you as the principal.

- Select an agent to act on your behalf. Provide their full name, address, and any relevant contact information.

- If you wish to name an alternate agent, complete that section with their details as well.

- Indicate the powers you wish to grant to your agent. Review each option carefully and check the boxes for the powers you want to include.

- Include any specific instructions or limitations on the powers, if desired, in the provided section.

- Sign and date the form in the presence of a notary public. This step is essential to validate the document.

- Provide a copy of the completed form to your agent and keep one for your records.