What is a New York General Power of Attorney form?

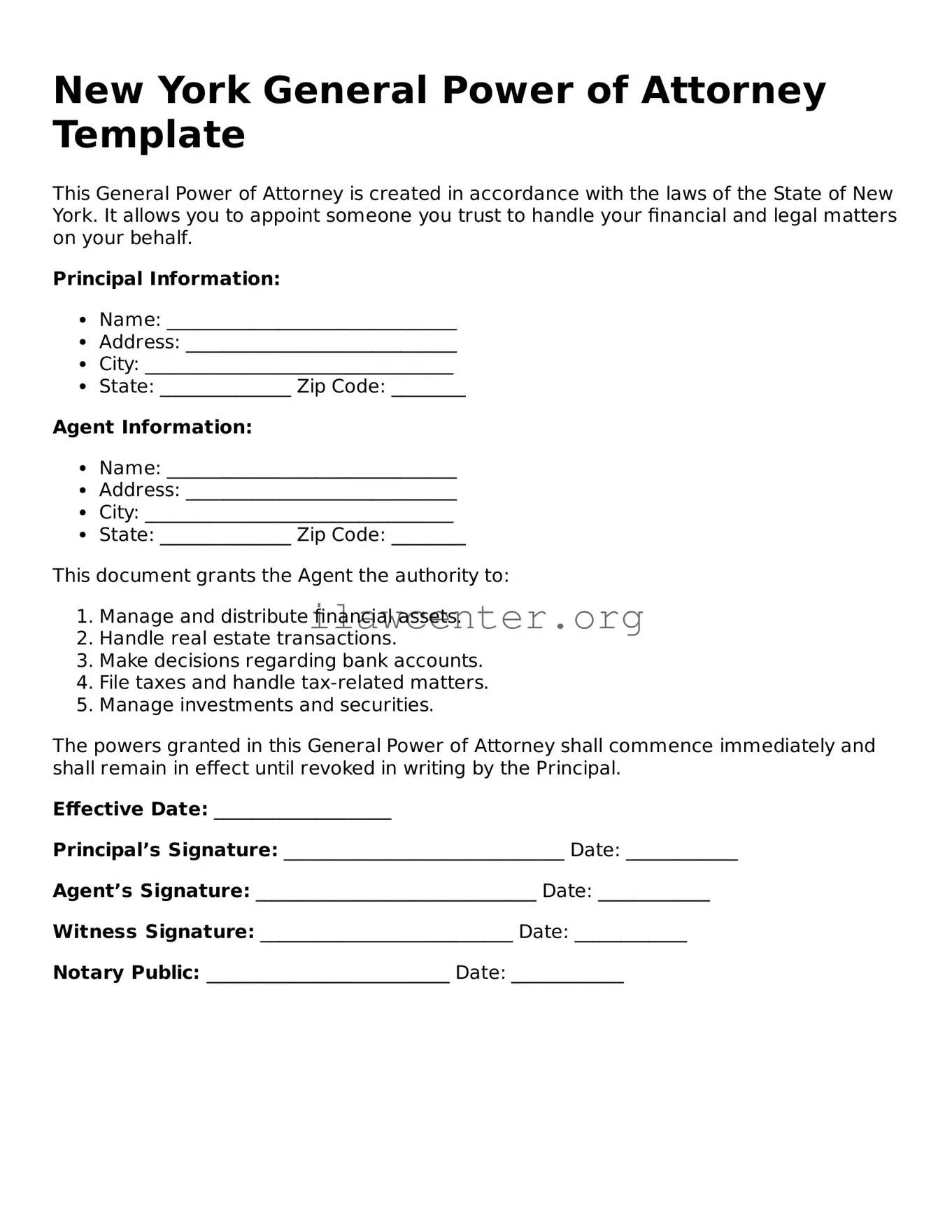

A New York General Power of Attorney form is a legal document that allows one person, called the agent or attorney-in-fact, to make decisions on behalf of another person, known as the principal. This document grants broad authority, enabling the agent to handle financial and legal matters for the principal.

What can an agent do under a General Power of Attorney?

The agent can perform various actions, such as managing bank accounts, paying bills, filing tax returns, buying or selling real estate, and making investment decisions. The powers granted can be tailored to the needs of the principal.

Is a General Power of Attorney valid in New York?

Yes, a General Power of Attorney is valid in New York, provided it meets state requirements. The document must be signed by the principal, acknowledged before a notary public, and must explicitly state the powers granted to the agent.

Can I revoke a General Power of Attorney?

Yes, a principal can revoke a General Power of Attorney at any time, as long as they are mentally competent. To do so, the principal should create a written revocation notice and provide copies to the agent and relevant financial institutions.

Do I need a lawyer to create a General Power of Attorney?

While it is not legally required to have a lawyer, consulting one can help ensure the document is correctly executed and fully meets the principal's needs. A lawyer can also provide guidance on the implications of granting power to an agent.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, the General Power of Attorney remains in effect unless it includes a provision for termination upon incapacity. This is often referred to as a "durable" power of attorney. If not durable, the power ends when the principal is no longer able to make decisions.

Can an agent be held responsible for their actions?

Yes, agents must act in the principal's best interests. If an agent acts outside the authority granted or engages in criminal behavior, they can be held liable for any damages caused. It is important for agents to understand their duties and responsibilities clearly.

Does a General Power of Attorney expire?

A General Power of Attorney does not expire in New York unless it is revoked by the principal, or unless the principal dies. Expiration can also occur if the document specifies a particular duration or event for termination.

Should I inform my agent about the General Power of Attorney?

Yes, it is essential to inform the agent about their appointment as your attorney-in-fact. Open communication ensures the agent understands their responsibilities, making it easier for them to act on your behalf when necessary.

Can multiple people be appointed as agents under a General Power of Attorney?

Yes, a principal can appoint multiple agents in a General Power of Attorney. However, the principal should specify whether the agents can act independently or must act together. Clear instructions will help avoid confusion in decision-making.