What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their passing. This includes specifying who will inherit property, designating guardians for minor children, and naming an executor who will manage the estate. This document plays a critical role in ensuring that one’s wishes are honored, and can help minimize any potential disputes among family members or heirs.

Who can create a Last Will and Testament in New York?

In New York, anyone who is at least 18 years old and of sound mind can create a Last Will and Testament. Being of sound mind means that the person understands the nature of making a will, the extent of their property, and the impact of their decisions regarding their heirs. It is important that the testator (the person making the will) is able to make decisions clearly and knowingly.

How do I create a Last Will and Testament?

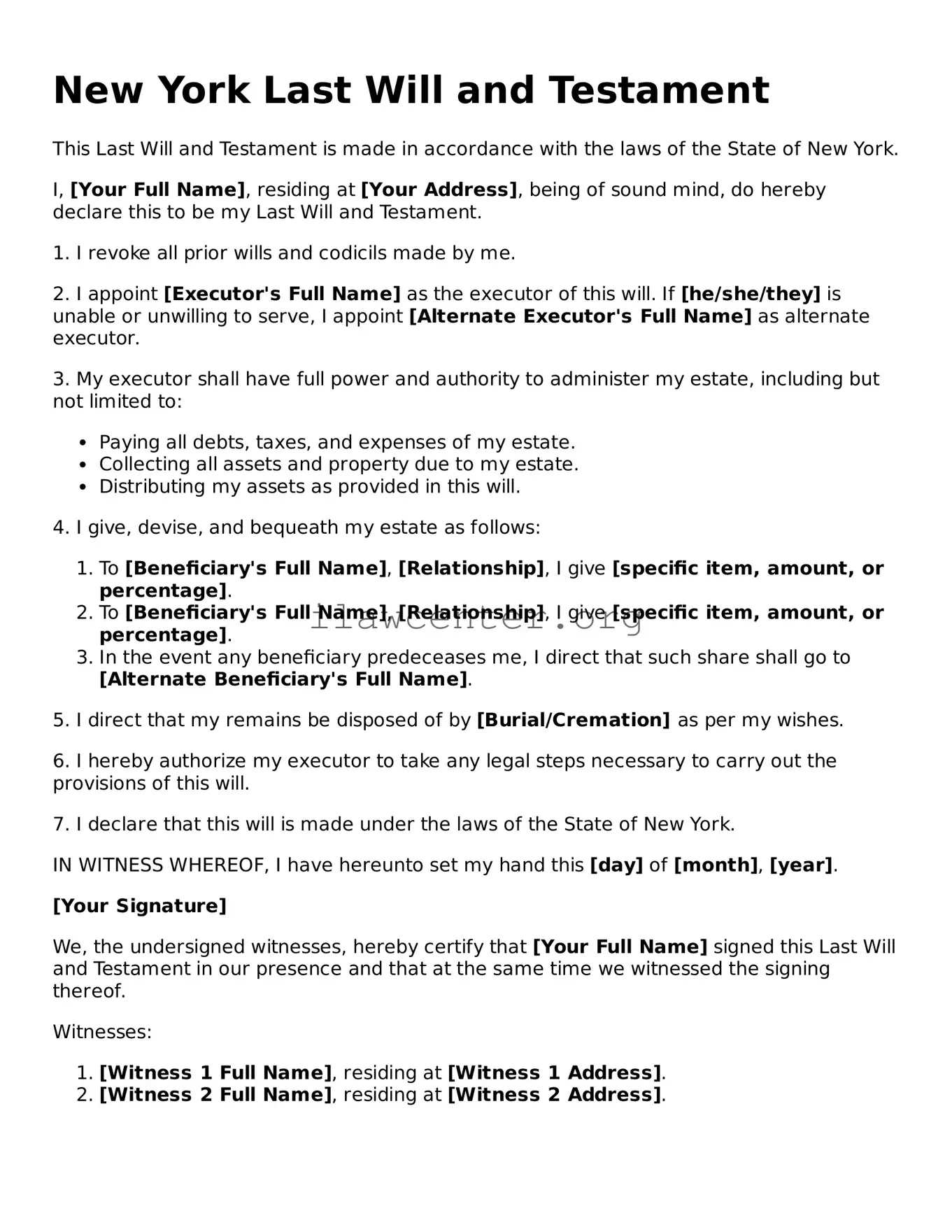

Creating a Last Will and Testament involves several steps. First, one must gather all necessary information about their assets and beneficiaries. Next, the will should be written, either by hand or typed, ensuring that it includes specific instructions regarding asset distribution. Once it is complete, the will must be signed in front of at least two witnesses who are not beneficiaries. These witnesses must also sign the document. This process helps validate the will and prevents potential challenges later.

Is it necessary to have a lawyer to write a Last Will and Testament?

While it is not legally required to have a lawyer draft your will, seeking legal assistance can be beneficial. A lawyer can ensure that the document complies with New York law and adequately reflects your wishes without ambiguity. They can also help navigate complex family situations or significant wealth, making the process smoother and providing peace of mind.

Can I change my Last Will and Testament after it is created?

Yes, you can change your Last Will and Testament at any time as long as you are of sound mind. Changes may be made through a process called a codicil, which is an amendment to the original will, or by creating an entirely new will that revokes the previous one. If changes affect the distribution of assets or other critical elements, it’s important that all modifications follow legal requirements to remain valid.

What happens if I die without a will in New York?

If you die without a will, known as dying "intestate," New York state law dictates how your assets will be distributed. Generally, assets will be divided among your closest relatives, such as your spouse and children. Without a will, you lose the opportunity to specify your preferences, which might lead to unintended distributions and family disputes. It's advisable for everyone to have a will to ensure their desires are followed.

What is the role of an executor in a Last Will and Testament?

The executor is responsible for managing your estate after your death. This includes tasks like notifying beneficiaries, collecting and managing assets, paying debts and taxes, and ultimately distributing the remaining assets as outlined in the will. It's crucial to choose someone trustworthy and organized to handle these responsibilities, as the process can be complex and time-consuming.

Can I disinherit someone in my Last Will and Testament?

Yes, you can disinherit someone in your Last Will and Testament. It is important to clearly state your intentions in the will. This could include specifically mentioning that a particular individual is not to receive any part of your estate. However, disinheriting a spouse may not always work the way one intends due to spousal rights in inheritance law, so it is helpful to consult with a legal professional to ensure your wishes are accurately reflected.