Instructions on Utilizing New York Motor Vehicle Bill of Sale

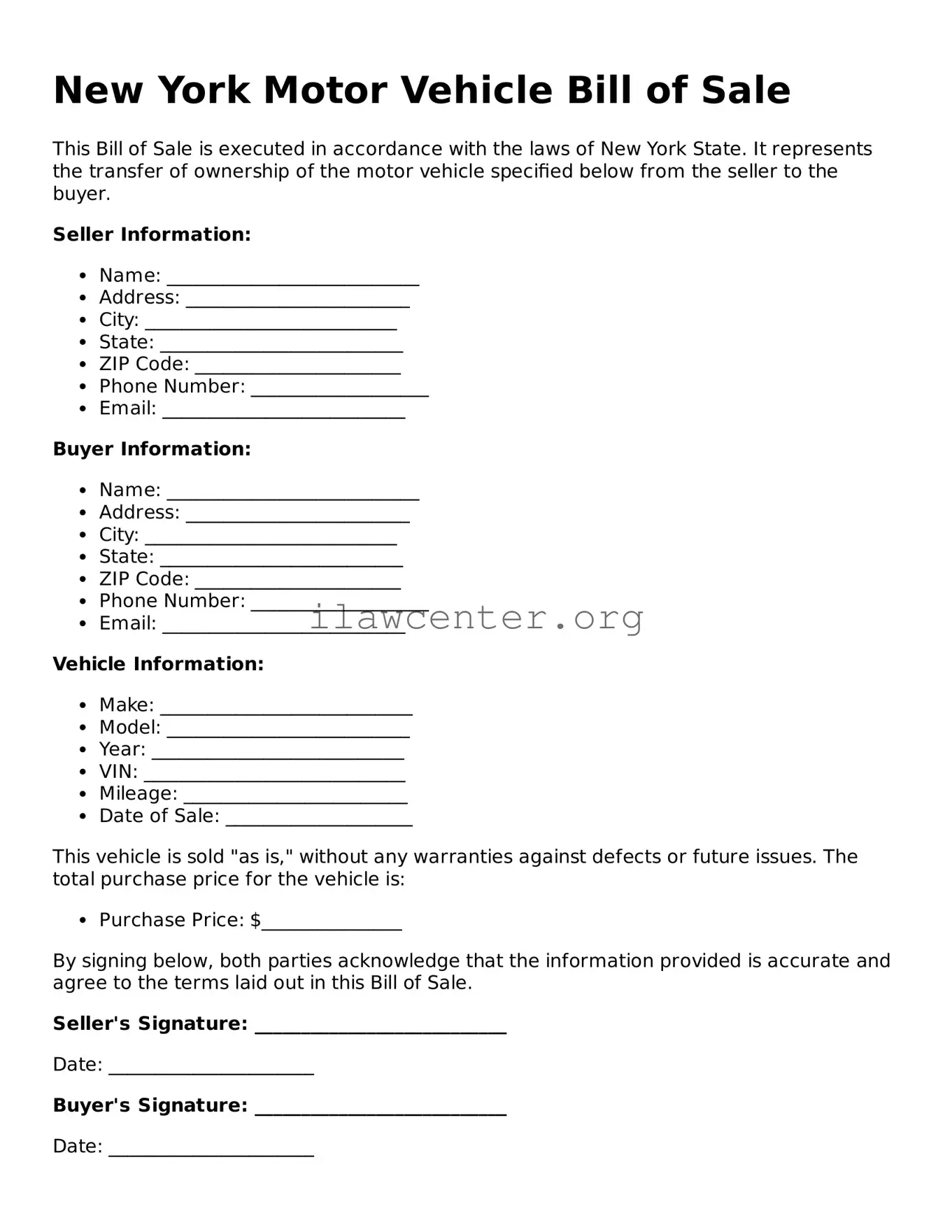

Filling out the New York Motor Vehicle Bill of Sale form is an important step in the process of transferring ownership of a vehicle. This form ensures that both the buyer and the seller have a clear understanding of the transaction details. Once completed, the form can serve as a valuable record for both parties, demonstrating the sale's legitimacy.

- Obtain the New York Motor Vehicle Bill of Sale form from a reliable source or the New York State Department of Motor Vehicles (DMV) website.

- Start by entering the date of the sale in the designated field. This should be the date when the transaction takes place.

- Fill in the seller's information. Include the full name, address, and contact number of the seller. Ensure that the details are accurate.

- Next, provide the buyer’s information. Similarly, write down the full name, address, and contact number of the buyer.

- In the vehicle description section, include essential details about the vehicle. This includes the make, model, year, color, vehicle identification number (VIN), and mileage at the time of sale.

- Indicate the total sale price of the vehicle clearly. This is the amount agreed upon by both parties.

- Both the buyer and seller must sign the form. The seller's signature confirms that the vehicle is sold, while the buyer's signature indicates agreement with the sale terms.

- Finally, take a moment to print or make copies of the completed form for both parties. This provides each party with an official record of the transaction.