What is a Power of Attorney in New York?

A Power of Attorney in New York is a legal document that allows one person, known as the principal, to appoint another person, referred to as the agent or attorney-in-fact, to make decisions and act on their behalf. This arrangement can apply to a wide range of decisions, including financial, legal, and health care matters, depending on the specific powers granted in the document.

Why would someone need a Power of Attorney?

Individuals may need a Power of Attorney for several reasons. It often becomes essential when a person is unable to manage their affairs due to illness, aging, or absence. This document provides a way to ensure that someone trustworthy can handle important matters, such as paying bills or making medical decisions, when the principal is not in a position to do so themselves.

What are the different types of Power of Attorney available in New York?

New York recognizes several types of Power of Attorney. The most common are the General Power of Attorney, which grants broad powers to the agent, and the Limited Power of Attorney, which restricts the agent’s powers to specific tasks. There is also a Durable Power of Attorney, which remains in effect even if the principal becomes incapacitated, and a Springing Power of Attorney, which only becomes effective under certain conditions, such as incapacitation.

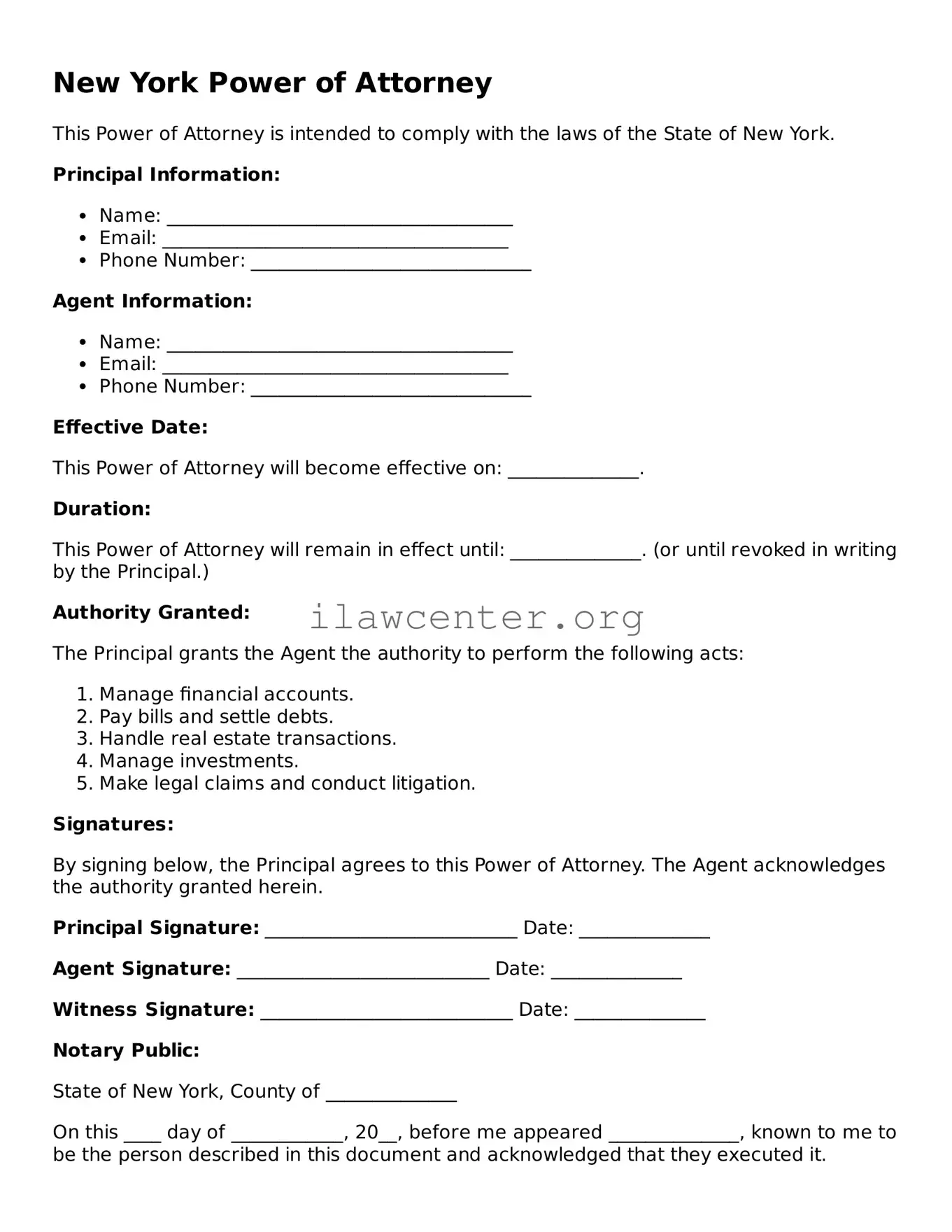

How is a Power of Attorney executed in New York?

To execute a Power of Attorney in New York, the principal must sign the document in the presence of a notary public. In some cases, witnesses may also be required. It’s important for the principal to be of sound mind when signing the document to ensure legality. Once executed, the Power of Attorney should be stored safely and copies provided to the agent and relevant institutions.

Can the principal revoke a Power of Attorney?

Yes, a principal has the right to revoke a Power of Attorney at any time, as long as they are mentally competent. Revocation can be done by creating a written document that clearly states the Power of Attorney is revoked. It is also advisable to notify the agent and any institutions that had previously relied on the Power of Attorney of the revocation.

What protections are in place for the principal?

New York law provides important protections for individuals who create a Power of Attorney. For instance, the agent has a fiduciary duty to act in the principal's best interests and must keep accurate records of all transactions. This accountability helps prevent misuse or abuse of the powers granted. Furthermore, specific language in the Power of Attorney can limit the agent's authority, providing additional safeguards.

What happens if the principal becomes incapacitated and has not set up a Power of Attorney?

If a person becomes incapacitated without having established a Power of Attorney, their family may face difficulties managing their affairs. In such cases, it may be necessary for a court to appoint a guardian or conservator to handle the individual’s finances or healthcare decisions. This process can be lengthy and complicated, making it crucial to set up a Power of Attorney in advance when possible.

How does a Power of Attorney affect medical decisions?

A Power of Attorney can specifically grant the agent authority to make healthcare decisions on behalf of the principal. This is often addressed in a Health Care Proxy, which designates someone to make medical choices if the principal is unable to do so. It is vital to communicate personal healthcare wishes to the agent to ensure their decisions align with the principal’s values and preferences.

Can a Power of Attorney be used for real estate transactions?

Yes, a Power of Attorney can be used for real estate transactions. The document can grant specific authority to the agent to handle buying, selling, or managing property on behalf of the principal. However, it is recommended that the Power of Attorney includes explicit powers related to real estate to ensure that the agent can act appropriately in these matters.

How should someone choose an agent for their Power of Attorney?

Choosing an agent for a Power of Attorney is a significant decision. It’s crucial to select someone trustworthy, responsible, and capable of handling the tasks assigned. Consider the individual’s experience and understanding of financial and legal matters, as well as their ability to act in the principal’s best interest. Open communication about responsibilities and expectations can help ensure a positive experience for both the principal and the agent.