Instructions on Utilizing New York Quitclaim Deed

Once you have the New York Quitclaim Deed form, you'll need to complete it accurately before submitting it for recording. This process ensures the legal transfer of property rights, so it’s important to take your time and fill in each section correctly.

- Obtain the form: You can find the New York Quitclaim Deed form online or at your local county clerk's office.

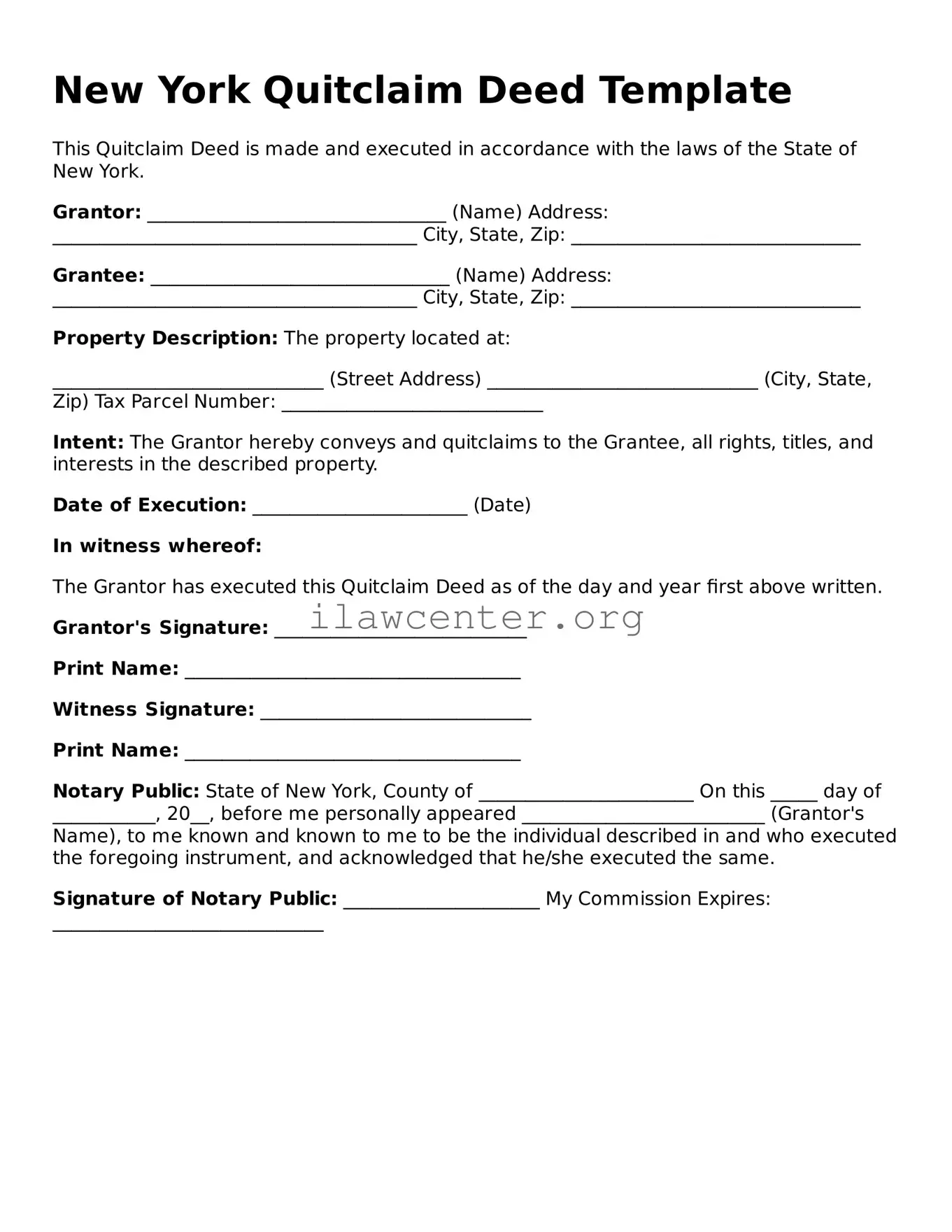

- Fill out the grantor's information: Enter the full legal name and address of the person or entity transferring the property (the grantor).

- Fill out the grantee's information: Input the full legal name and address of the person or entity receiving the property (the grantee).

- Describe the property: Provide a complete legal description of the property being transferred. Include details such as the street address, city, and county. If applicable, attach a legal description document.

- Include consideration: State the amount of consideration (payment) for the property, if applicable, or indicate if the transfer is for love and affection.

- Sign the form: The grantor must sign the deed in the appropriate space. If there are multiple grantors, each must sign.

- Notarization: Have the grantor’s signature notarized. This ensures the document is legally binding and can be recorded.

- Submit for recording: Bring the completed and notarized deed to the county clerk's office for recording. Be prepared to pay any applicable fees.

- Obtain a copy: Once recorded, request a copy of the quitclaim deed for your records.