What is a New York Transfer-on-Death Deed?

A New York Transfer-on-Death Deed is a legal document that allows an individual to transfer ownership of real property to a beneficiary upon the death of the property owner. This deed simplifies the transfer process and avoids the need for probate, making it a useful estate planning tool.

Who can create a Transfer-on-Death Deed in New York?

Any individual who is the owner of a piece of real estate in New York can create a Transfer-on-Death Deed. The owner must be of legal age and mentally competent to enter into contracts. It is advisable for individuals to consult with a legal expert to ensure the deed meets all necessary criteria.

How does a Transfer-on-Death Deed work?

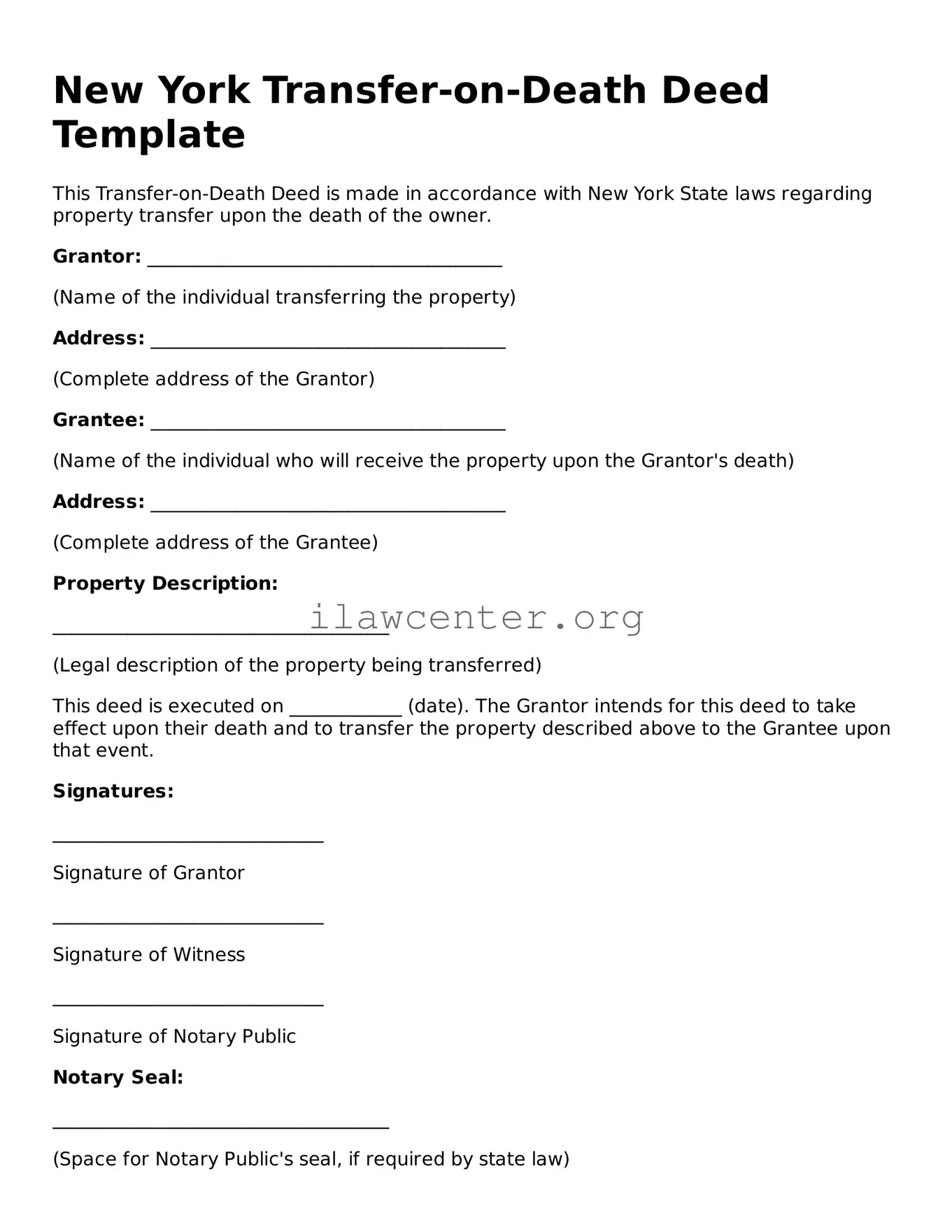

To use a Transfer-on-Death Deed, the property owner completes the form, designates a beneficiary, and then records the deed with the county clerk's office where the property is located. The transfer of ownership takes place automatically when the owner passes away, without needing to go through the court system.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. The original owner must complete and record a revocation form with the county clerk’s office. This process helps clearly indicate the owner’s intent not to transfer the property upon death. Ensure that the revocation is done before the owner's passing to avoid complications.

What are the legal considerations of using a Transfer-on-Death Deed?

While a Transfer-on-Death Deed can simplify real estate transfers, it is important to consider several factors. The deed should be legally valid and comply with New York state laws. Furthermore, the chosen beneficiary should be trustworthy, as they will receive the property directly after the owner's death.

Does a Transfer-on-Death Deed affect taxes?

The creation of a Transfer-on-Death Deed does not typically affect property taxes during the owner's lifetime. However, upon death, the property may transfer to the beneficiary, which could have potential tax implications. Beneficiaries are advised to consult a tax professional for guidance specific to their situation.

Can I name multiple beneficiaries in a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can include multiple beneficiaries. The property can be divided among them, or they can co-own the property following the owner's death, based on the instructions provided in the deed. Clear language must be used to avoid any misunderstandings about the distribution of the property.

Are there any limitations to using a Transfer-on-Death Deed?

There are some limitations to be aware of when using a Transfer-on-Death Deed. It cannot transfer property held in joint tenancy, property in a business entity, or frequently changing real estate assets. Additionally, real estate should not have any outstanding liens if transfer to a beneficiary is desired.

Where can I obtain a Transfer-on-Death Deed form in New York?

The Transfer-on-Death Deed form can typically be obtained from legal document websites, state government resources, or through an attorney. It is essential to ensure that the form is compliant with New York laws. Always consider consulting a legal professional for assistance in completing and filing the deed correctly.