Instructions on Utilizing North Carolina Deed

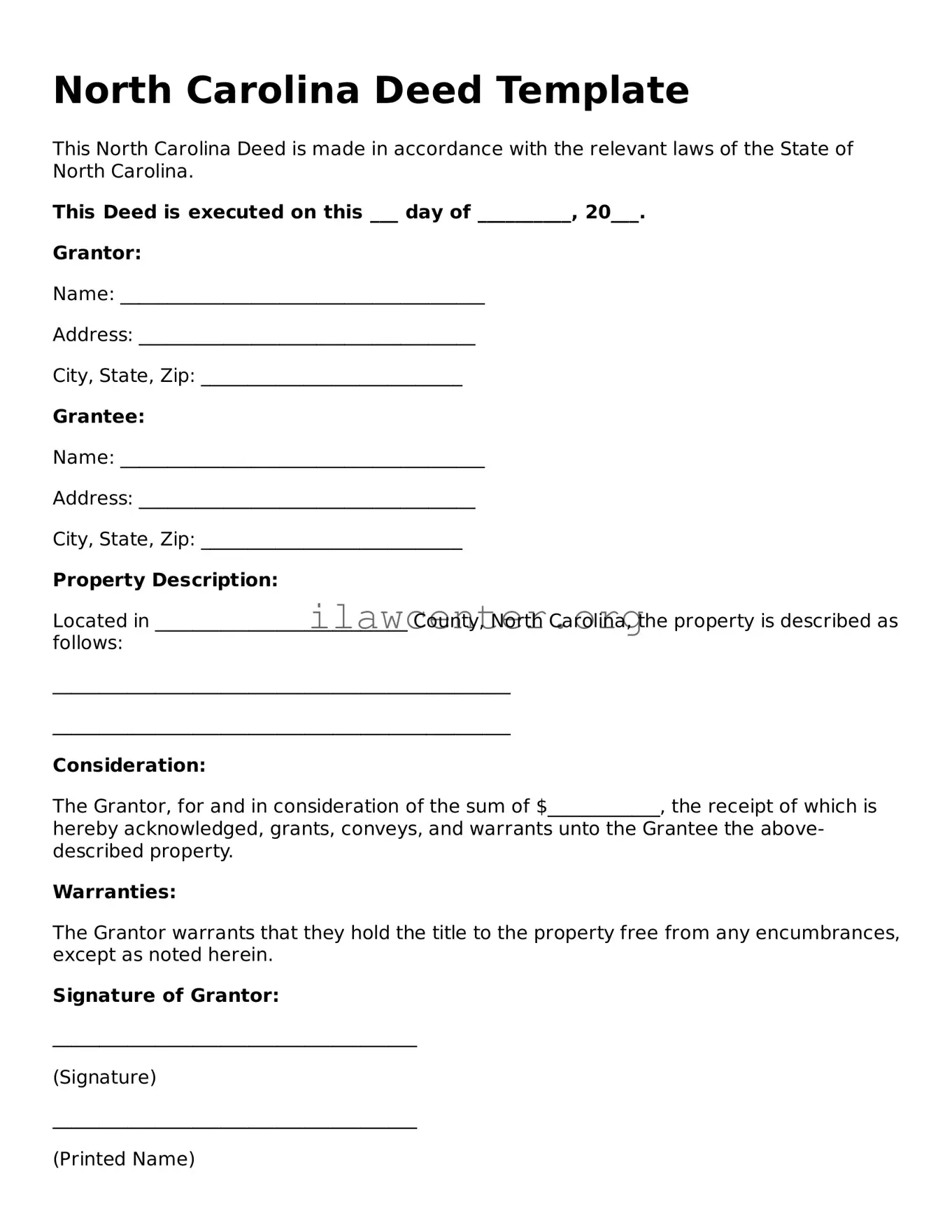

Filling out the North Carolina Deed form is a straightforward process that involves providing specific details about the transaction, the parties involved, and the property being transferred. Once completed, the form will need to be executed properly before it can be submitted to the appropriate county register of deeds for recording.

- Begin with the title of the document. Write “Deed” at the top of the form.

- Enter the names of the parties involved in the transaction. Clearly identify the Grantor (the seller or giver) and the Grantee (the buyer or receiver).

- Include the address of the Grantor. This should be a complete address where the Grantor can be reached.

- Provide the address for the Grantee. Similarly, make sure to include a complete address for the Grantee.

- Describe the property being transferred. Include a legal description of the property. If you have a tax parcel number, include that as well.

- Identify any relevant consideration (payment or compensation for the property). This can be specified in terms of dollars or as “love and affection” if no money is involved.

- Sign and date the document. The Grantor must sign in the presence of a notary public.

- Have the document notarized. This confirms the identity of the Grantor and the authenticity of the signature.

- Make copies of the completed Deed form for your records.

- Submit the original Deed to the county register of deeds for recording, along with any applicable fees.