Instructions on Utilizing North Carolina Durable Power of Attorney

After gathering the necessary information and carefully considering your wishes, you're ready to fill out the North Carolina Durable Power of Attorney form. Completing this form accurately is crucial, as it will allow you to appoint someone to act on your behalf in financial or legal matters, should you become unable to do so. Follow these steps to ensure everything is filled out correctly.

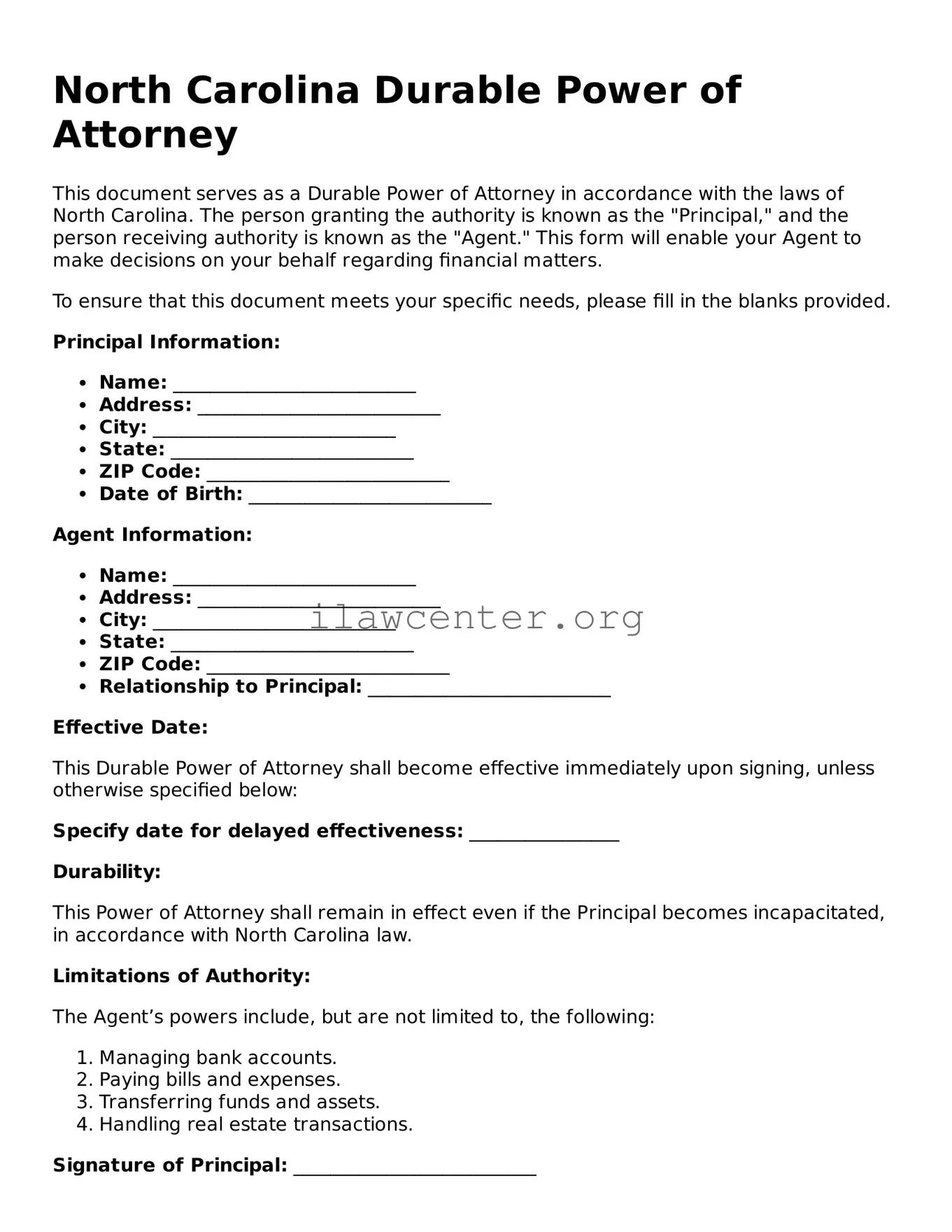

- Begin by downloading the North Carolina Durable Power of Attorney form from a trusted source.

- Provide your full name as the principal at the top of the document.

- Clearly state your home address, including the city, state, and zip code.

- Next, designate an agent by writing their full name, addressing them in the appropriate section.

- Add the agent’s home address, ensuring accuracy for effective communication.

- If you wish to name an alternate agent, include their name and address in the designated area.

- Carefully review the powers you want to grant to your agent, checking the boxes next to the specific powers applicable (e.g., managing bank accounts or real estate transactions).

- Leave any powers that you do not wish to grant unchecked.

- Include your initials next to any additional specifics or limitations, if necessary.

- Sign and date the form at the bottom, in the presence of a witness.

- Ensure that the witness also signs and includes their name, address, and date of signing.

- Lastly, have the document notarized to validate its authenticity, if required.

Once you have completed and signed the form, store it in a safe place and provide copies to your agent and any relevant parties, so they are aware of their responsibilities. This step marks the beginning of your readiness to manage your personal and financial affairs effectively, no matter what the future holds.