Instructions on Utilizing North Carolina General Power of Attorney

Filling out a General Power of Attorney form in North Carolina is an important step in appointing an agent to act on your behalf. This process requires careful attention to detail. Please follow the steps below to ensure accuracy and clarity in your documentation.

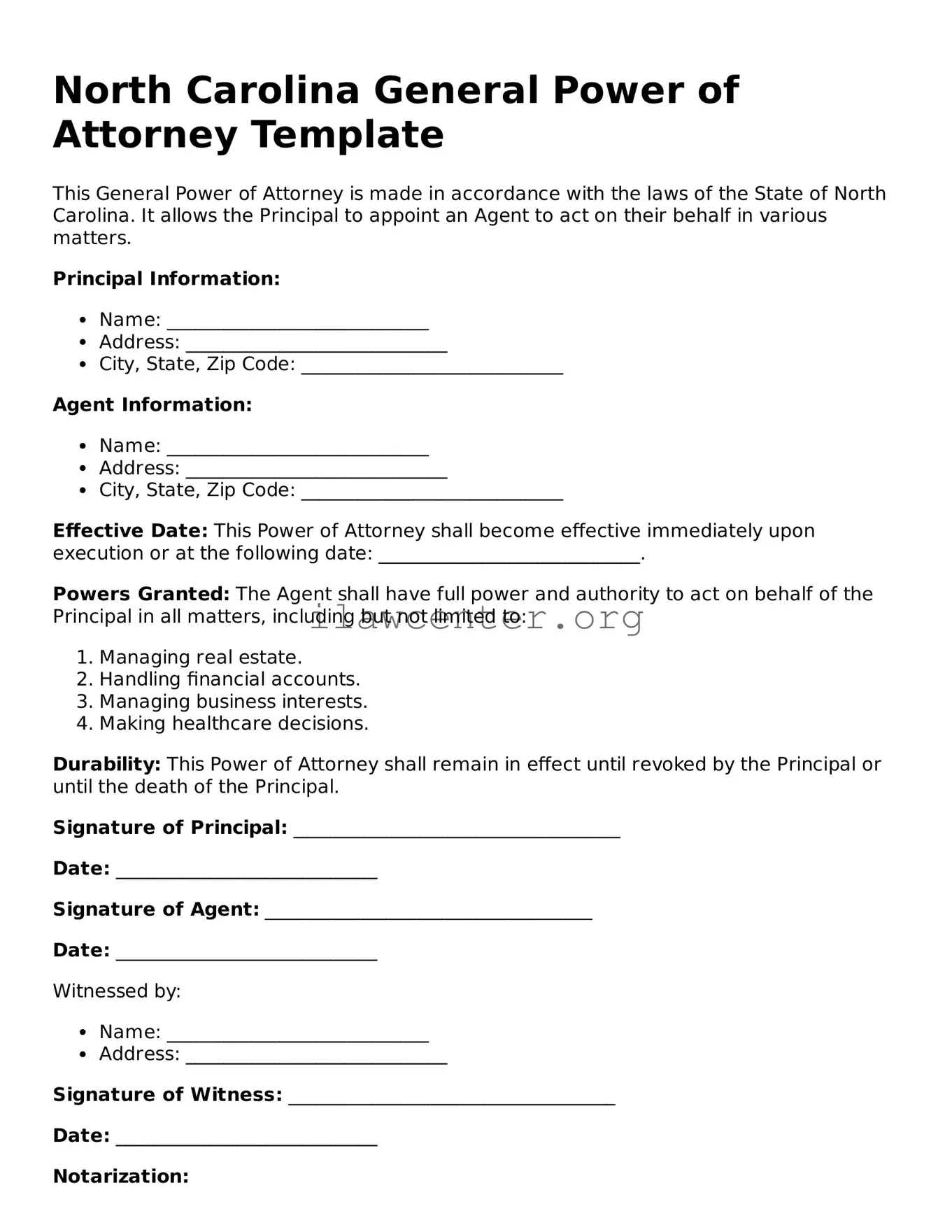

- Obtain the North Carolina General Power of Attorney form from a trusted legal resource or website.

- Enter your full legal name and address at the top of the form as the "Principal."

- Provide the name and address of the individual you are appointing as your agent. This person should be reliable and trustworthy.

- Choose the powers you wish to grant to your agent. You may allow them to handle financial matters, property transactions, or health care decisions.

- Review the section outlining any limitations or specific instructions you would like to place on your agent's powers.

- Sign and date the form in the presence of a Notary Public. Ensure that your signature matches the name you provided at the top.

- Have the Notary Public sign and affix their seal on the form to validate it.

- Make copies of the completed form for yourself and your agent for their records.

- Provide copies to any relevant institutions, such as banks or hospitals, where your agent may need to use the power granted.

After completing the form, it is essential to keep it in a safe place. Make sure that your appointed agent knows where to find it. This form will allow them to act on your behalf when needed.