Filling out the North Carolina Lady Bird Deed form can seem straightforward, but there are common mistakes that can lead to complications down the road. First and foremost, one frequently overlooked mistake is not providing correct legal names. The names on the form should match exactly with how they appear on legal documents. Failing to do so can create confusion and legal challenges later.

Another common error involves the omission of pertinent property information. Every detail matters when you’re transferring property. Be sure to include the property’s legal description, which typically resides in the property deed. Missing this vital information can render the deed invalid.

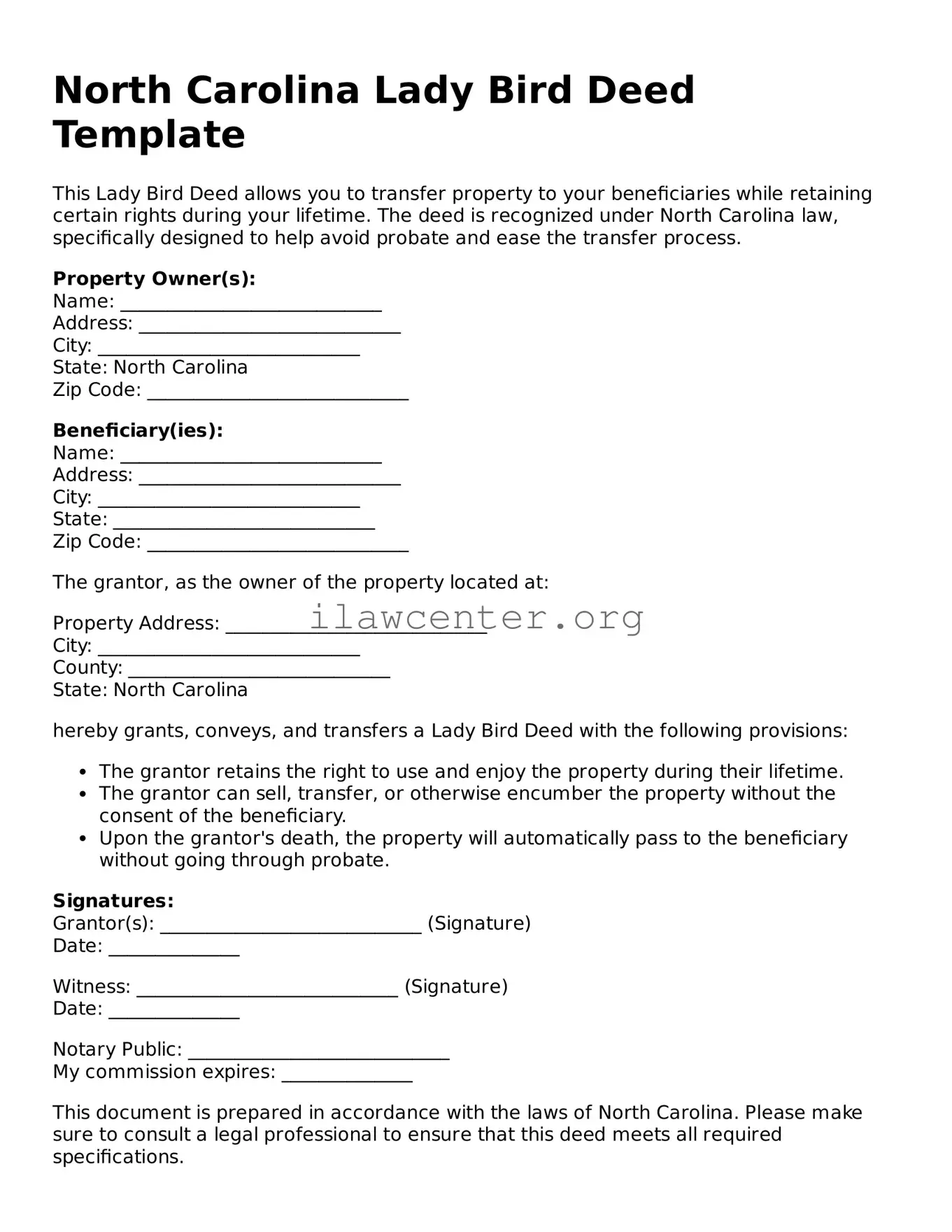

Additionally, people sometimes forget to fill in all required sections. Many are so focused on transferring ownership that they overlook important fields. Each section of the form is designed to ensure clarity and enforceability. Leaving out even one can lead to unnecessary delays or complications.

Not understanding the implications of “life estate” is another pitfall. Though this concept is integral to the Lady Bird Deed, some individuals mistakenly believe they can transfer more rights than intended. It’s essential to grasp the ramifications of this deed type fully. Ensure you are comfortable with the terms and conditions before you finalize any part of the process.

Another area of confusion arises from signatures. A common mistake is either not having witnesses or failing to notarize the document properly. In North Carolina, the deed must be signed by the grantor in the presence of a notary public. Neglecting to follow this requirement can invalidate the agreement.

Inaccurate recording of the deed also presents a problem. After completing the form, it must be filed with the local register of deeds. Many people either forget this step or file it incorrectly. It's essential to keep a copy for personal records, ensuring that the deed is easily accessible in the future.

Moreover, misunderstandings regarding tax obligations can complicate matters. The property transfer may trigger tax implications, and individuals often underestimate the potential consequences. Consult a tax professional to avoid surprises that may arise after the deed is executed.

Lastly, failing to communicate with heirs can lead to disputes. Don’t assume that your family members understand the significance of a Lady Bird Deed. Clearly outline your intentions and the provisions of the document to curb any resentment or confusion among heirs. Open and honest dialogue goes a long way toward smooth transitions.