Instructions on Utilizing North Carolina Last Will and Testament

Completing a Last Will and Testament in North Carolina is an important process for ensuring your estate is handled according to your wishes. After filling out the form, it's crucial to ensure that it is signed appropriately and witnessed, according to state requirements.

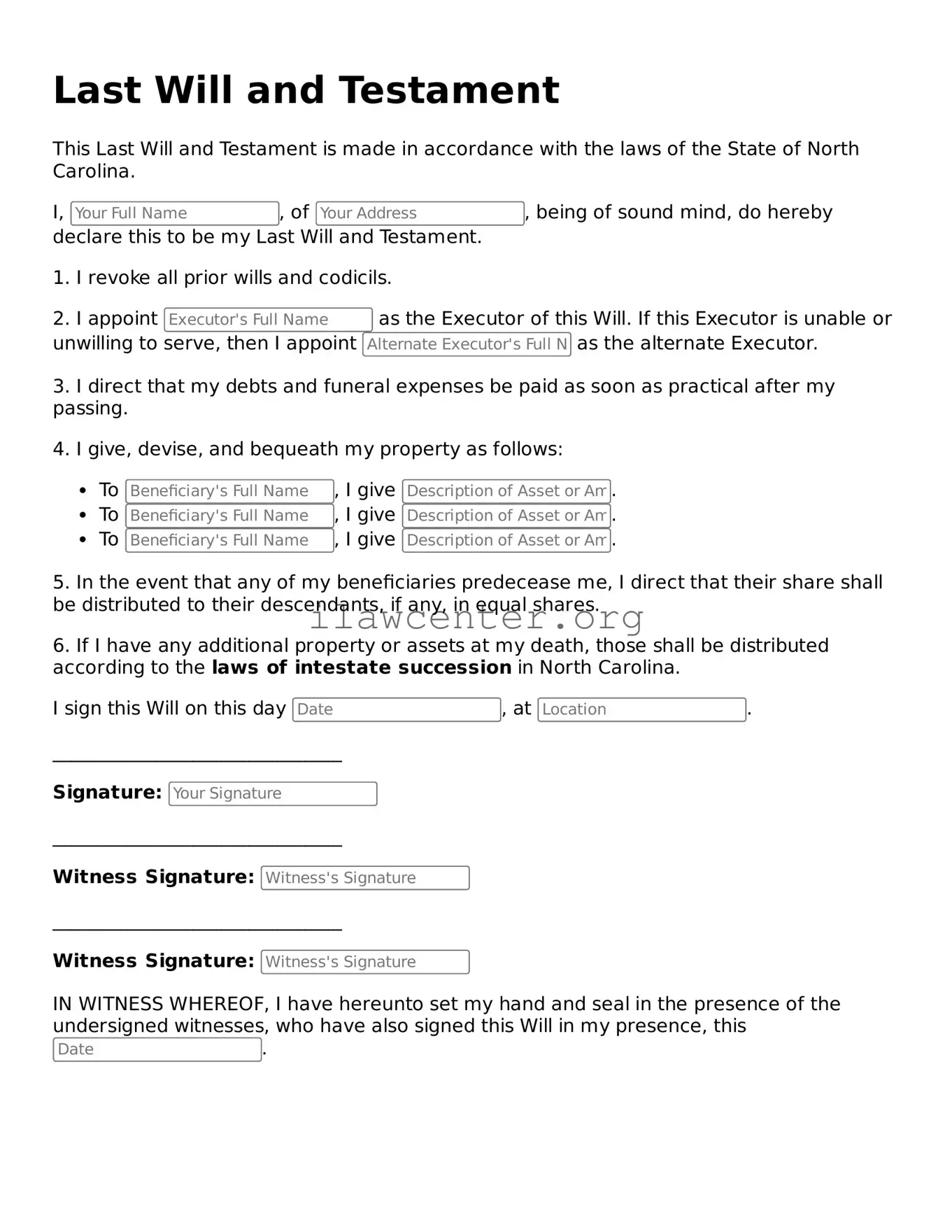

- Begin by gathering personal information, including your full name, address, and the date.

- State your declaration as the testator, clearly identifying that this document is your Last Will and Testament.

- Designate an executor, the person responsible for carrying out the terms of your will. Include their full name and relationship to you.

- Clearly define how you wish your assets to be distributed among your beneficiaries. Be specific about who gets what.

- If applicable, name a guardian for any minor children, including their full name and relationship to the children.

- Include any additional provisions, such as the handling of debts or funeral arrangements.

- Sign and date the document in the presence of at least two witnesses, who must also sign the will.

- Ensure that your will is stored in a safe place and inform your executor of its location.