What is a Mobile Home Bill of Sale?

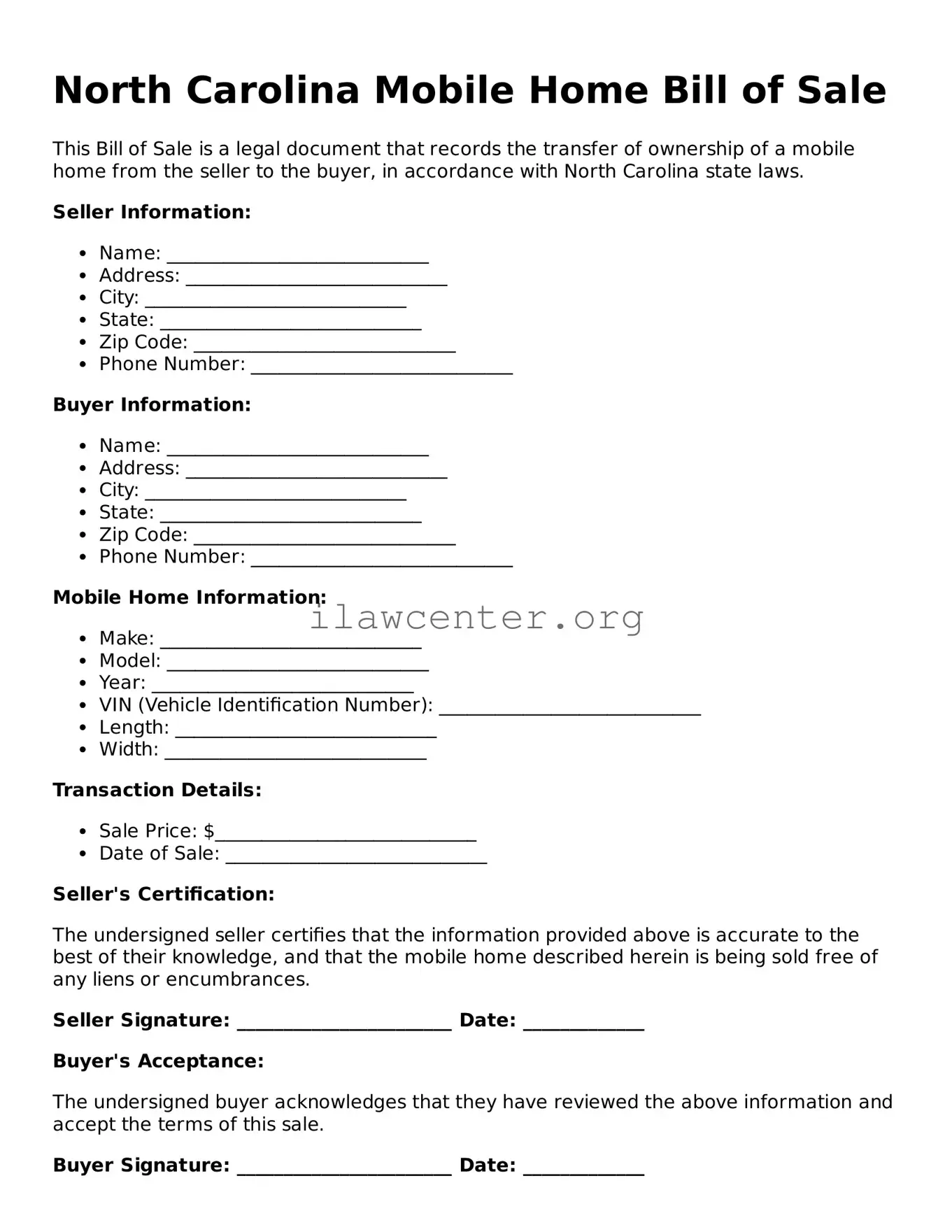

A Mobile Home Bill of Sale is a legal document that outlines the transfer of ownership from a seller to a buyer for a mobile home. It serves as proof of the transaction and provides details about the mobile home, such as its make, model, year, and identification number. This document can be crucial for future reference or if there are any disputes regarding ownership.

Why is a Bill of Sale important in North Carolina?

In North Carolina, a Bill of Sale is important because it establishes clear ownership of the mobile home. It protects both the seller and the buyer by documenting the transaction. Furthermore, North Carolina law requires such a document to register the mobile home with the Department of Motor Vehicles (DMV) and to apply for a title, making it an essential step in the buying and selling process.

What information is typically included in the Mobile Home Bill of Sale form?

The Mobile Home Bill of Sale usually includes crucial details like the full names and addresses of both the seller and the buyer, the mobile home’s description (including year, make, model, and serial number), and the sale price. It may also contain information regarding any warranties or additional terms agreed upon by both parties.

Is the Mobile Home Bill of Sale form required to be notarized?

While notarization is not a strict requirement for a Mobile Home Bill of Sale in North Carolina, having the document notarized can add an extra layer of authenticity. It can help in establishing the validity of the signatures in case of disputes in the future, so while it may not be mandatory, it is often recommended.

Can a Mobile Home Bill of Sale be completed electronically?

Yes, a Mobile Home Bill of Sale can be completed electronically. However, both parties should be careful to ensure that all necessary details are accurately transmitted. It is advisable to print the final version and sign it in the presence of witnesses or a notary to strengthen its validity.

What should one do if the Mobile Home Bill of Sale is lost?

If a Mobile Home Bill of Sale is lost, it’s crucial to act quickly. The original seller should be contacted to create a duplicate document. Both parties may need to sign the new Bill of Sale together to reaffirm the transfer of ownership. It is also wise to keep duplicates in a secure place in the future.

Are there any specific laws in North Carolina regarding mobile home sales?

Yes, North Carolina has specific laws governing the sale of mobile homes. One major aspect involves ensuring that the seller has clear title to the mobile home being sold. Sellers must disclose any liens or encumbrances on the home. Adhering to these regulations helps protect buyers from potential legal issues down the road.

How does the Mobile Home Bill of Sale affect taxes?

The Mobile Home Bill of Sale can have tax implications for both the buyer and the seller. Typically, the buyer may be responsible for sales tax, which is usually calculated based on the sale price of the mobile home. Sellers should be aware that capital gains taxes might apply if they sell the home for more than they originally paid. It is often beneficial to consult a tax professional when navigating these responsibilities.

Can the Mobile Home Bill of Sale be modified after it is signed?

Generally, once a Mobile Home Bill of Sale is signed, it becomes a binding agreement. Modifications may not be valid unless both parties consent to them and sign a new document reflecting the changes. It is essential to maintain clear communication to avoid misunderstandings regarding any alterations to the original agreement.