Instructions on Utilizing North Carolina Power of Attorney

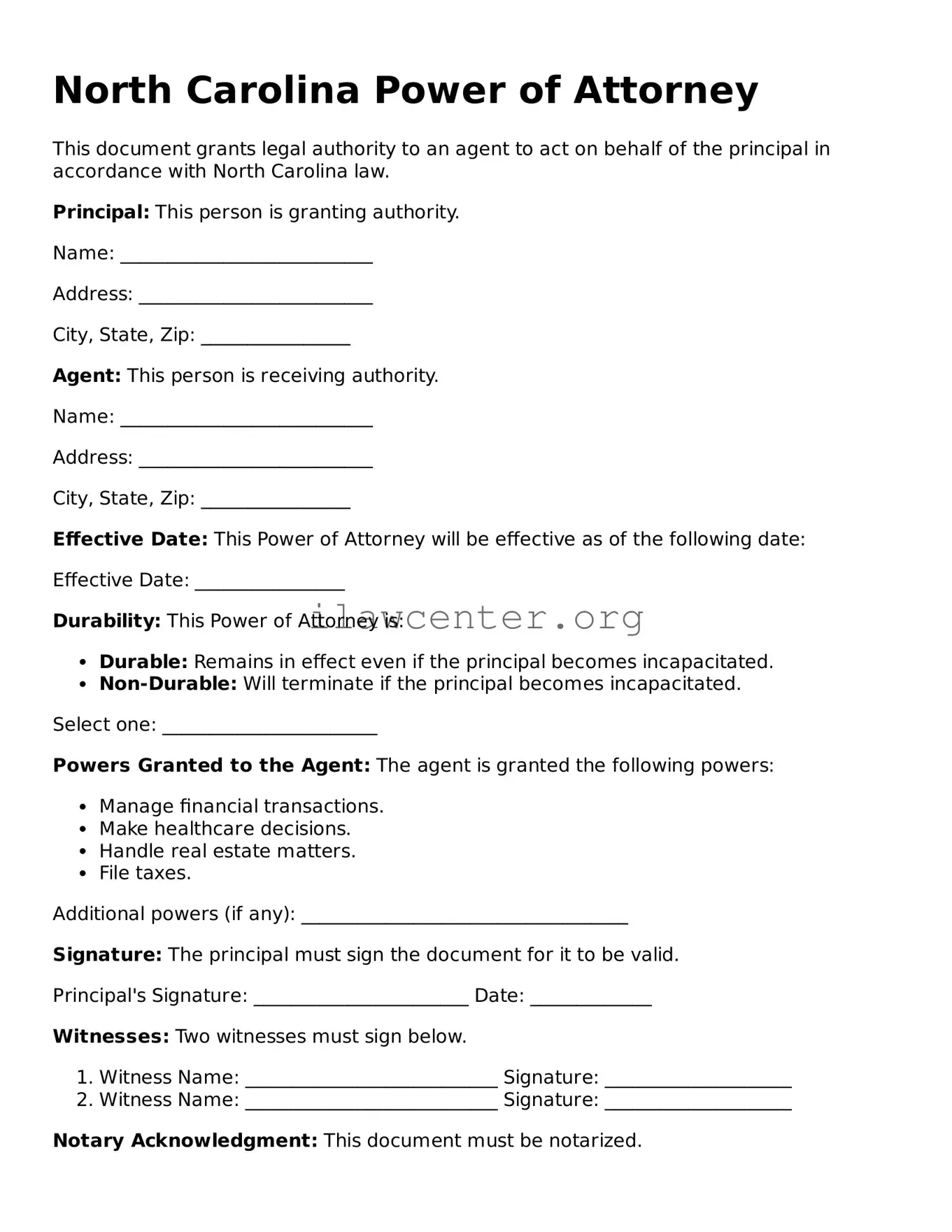

Filling out the North Carolina Power of Attorney form requires clarity and attention to detail. This document allows one person to appoint another to act on their behalf in financial or legal matters. Once you have the form completed, it will need to be signed and possibly notarized, depending on your specific needs and circumstances.

- Obtain the North Carolina Power of Attorney form from a reliable source or download it from a legal website.

- Carefully read the instructions included with the form to ensure you understand the requirements.

- Begin filling out the form by providing the full name and address of the person granting the power (the principal).

- Next, enter the name and address of the person receiving the power (the agent or attorney-in-fact).

- Specify the powers you wish to grant. Be clear and thorough. You may choose general powers or specific powers.

- State any limitations or conditions if you do not want the agent to have full authority.

- Include the effective date, indicating when the authority should begin. You may choose to date it immediately or specify a future date.

- Both the principal and agent should sign and date the form. If required, have the signatures witnessed.

- If necessary, arrange for the document to be notarized to ensure its validity.

- Make copies of the completed form for your records and for the agent.