Instructions on Utilizing North Carolina Quitclaim Deed

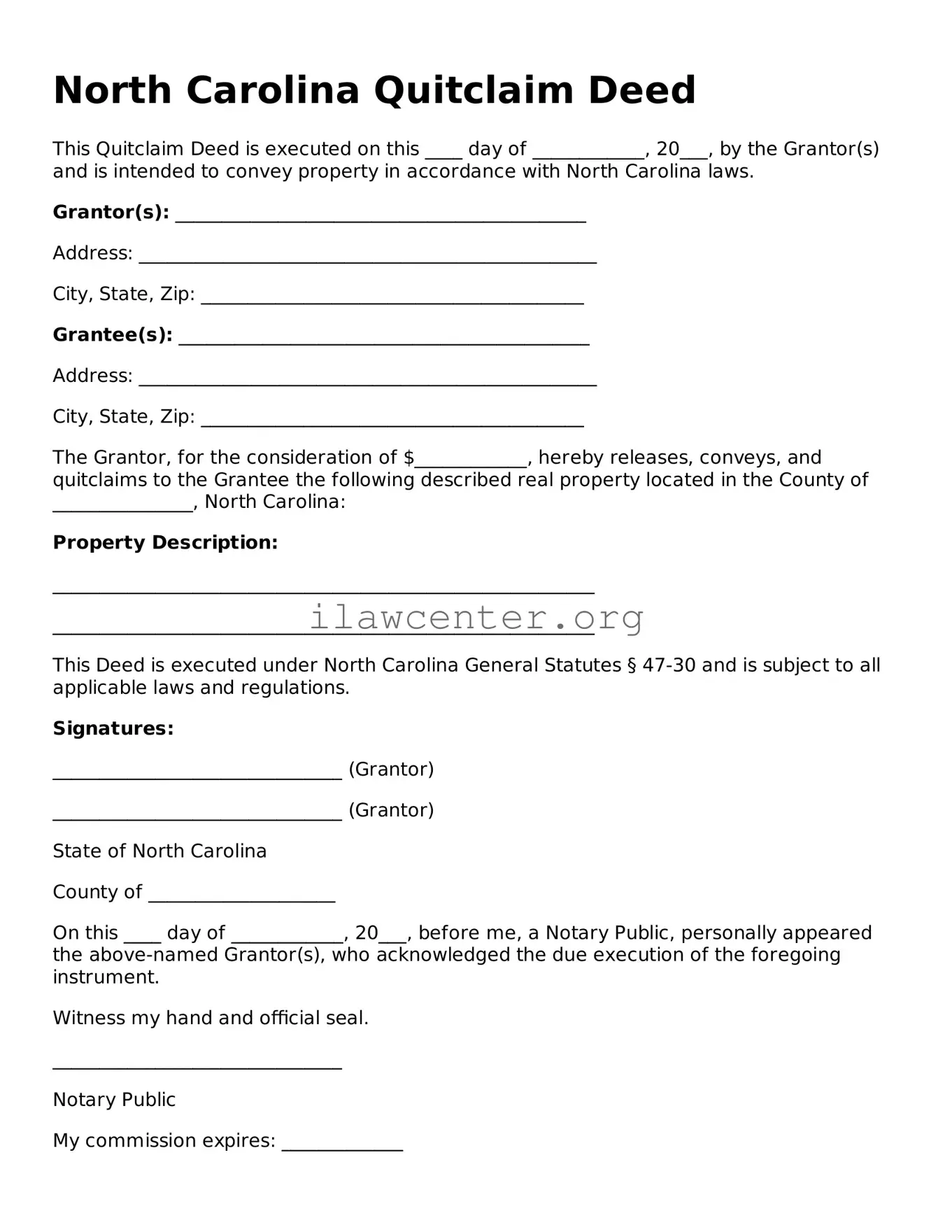

After ensuring you have the necessary information, proceed to fill out the North Carolina Quitclaim Deed form carefully. Accurate completion is essential for proper documentation.

- Obtain the form: Access the North Carolina Quitclaim Deed form from a reliable source, such as a local government office or a trusted legal website.

- Identify the parties: Clearly state the names of the current property owner(s) (grantor) and the person receiving the property (grantee). Ensure spelling is correct and consistent.

- Provide property description: Include a detailed description of the property. This should encompass the address and any legal description that delineates the property's boundaries.

- State the consideration: Indicate the amount of consideration, or value, exchanged for the property. This could be monetary or other forms of compensation.

- Include date: Write the date on which the deed is being executed. This is typically the date you are signing the form.

- Sign the document: The grantor must sign the form. If there are multiple grantors, each must sign.

- Have the deed notarized: A notary public must observe the signing and then notarize the document to validate it officially.

- Record the deed: Finally, file the completed and notarized Quitclaim Deed with the appropriate county register of deeds office in North Carolina to ensure it is legally recognized.

Following these steps will help complete the Quitclaim Deed accurately. After filing, you should retain a copy for your records, as it serves as a formal transfer of property rights.