Instructions on Utilizing North Carolina Transfer-on-Death Deed

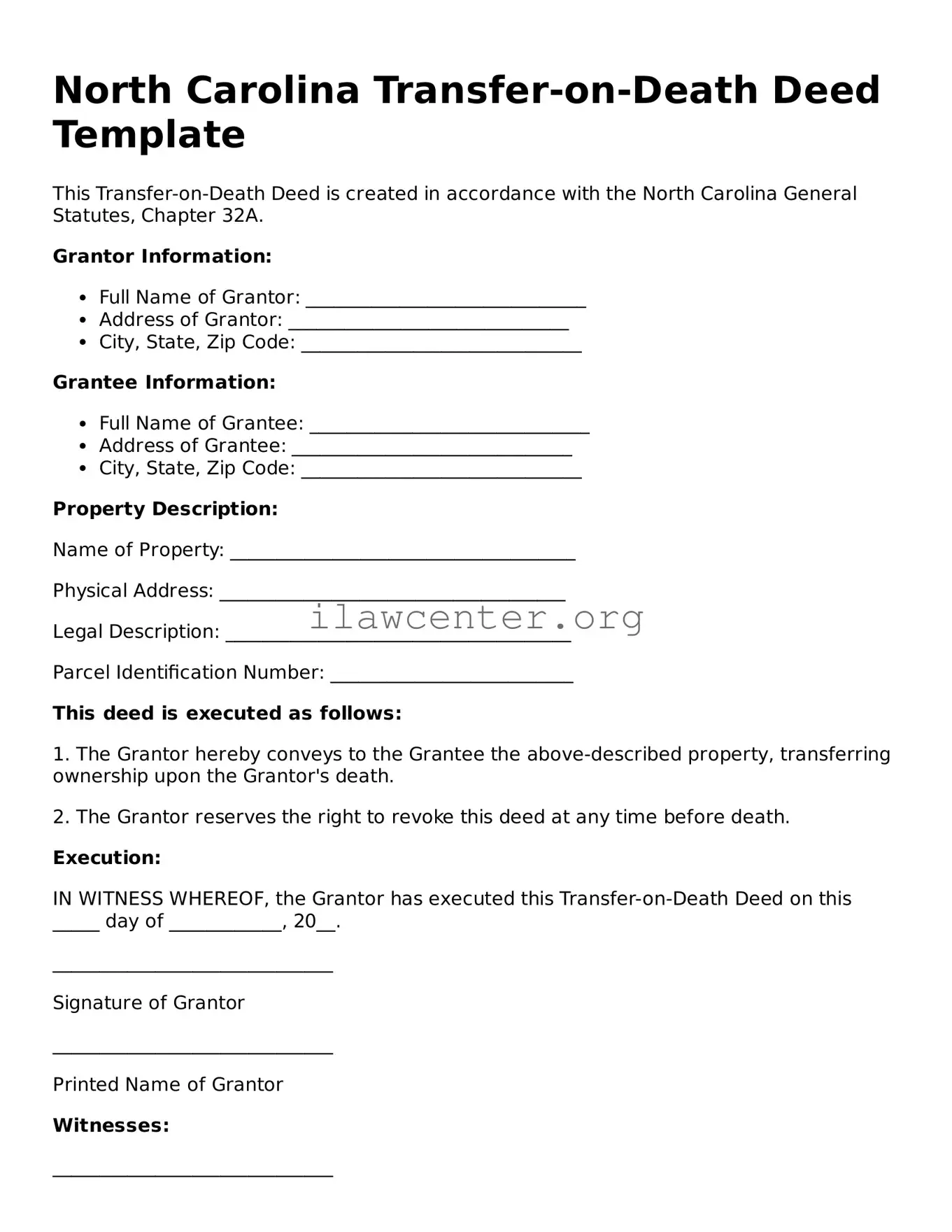

After obtaining the North Carolina Transfer-on-Death Deed form, you’ll be ready to designate a specific beneficiary for your real estate property. It is important to ensure that all information is correctly filled out, as this document will be crucial for transferring your property after your passing.

- Gather the necessary information. Before you begin filling out the form, collect all relevant details about yourself and the beneficiary. This includes your name, address, and any necessary identification numbers, as well as the name and address of the beneficiary.

- Input your information. Start filling in the first section of the deed with your full name and address. Make sure to double-check the spelling and accuracy of your details.

- Describe the property. In the designated section, provide a complete description of the real estate you wish to transfer. This should include the property address, parcel number, and any additional identifying details to avoid confusion.

- Enter beneficiary information. In the next area, clearly write the full name and address of the individual you wish to designate as the beneficiary for the property.

- Sign the document. You must sign the deed at the bottom. Your signature will serve as your acknowledgment of the information provided. Ensure that the date is also included along with your signature.

- Notarization. This deed requires notarization. Take the completed form to a notary public, who will verify your identity and witness your signature. The notary will then add their signature and seal to the document.

- Record the deed. After notarization, take the signed and notarized deed to the local register of deeds office where the property is located. There may be a recording fee, so be prepared with payment options.

Once you complete these steps, your deed will be officially recorded, ensuring that your property is set to transfer smoothly upon your passing.