What is the Payroll Check form?

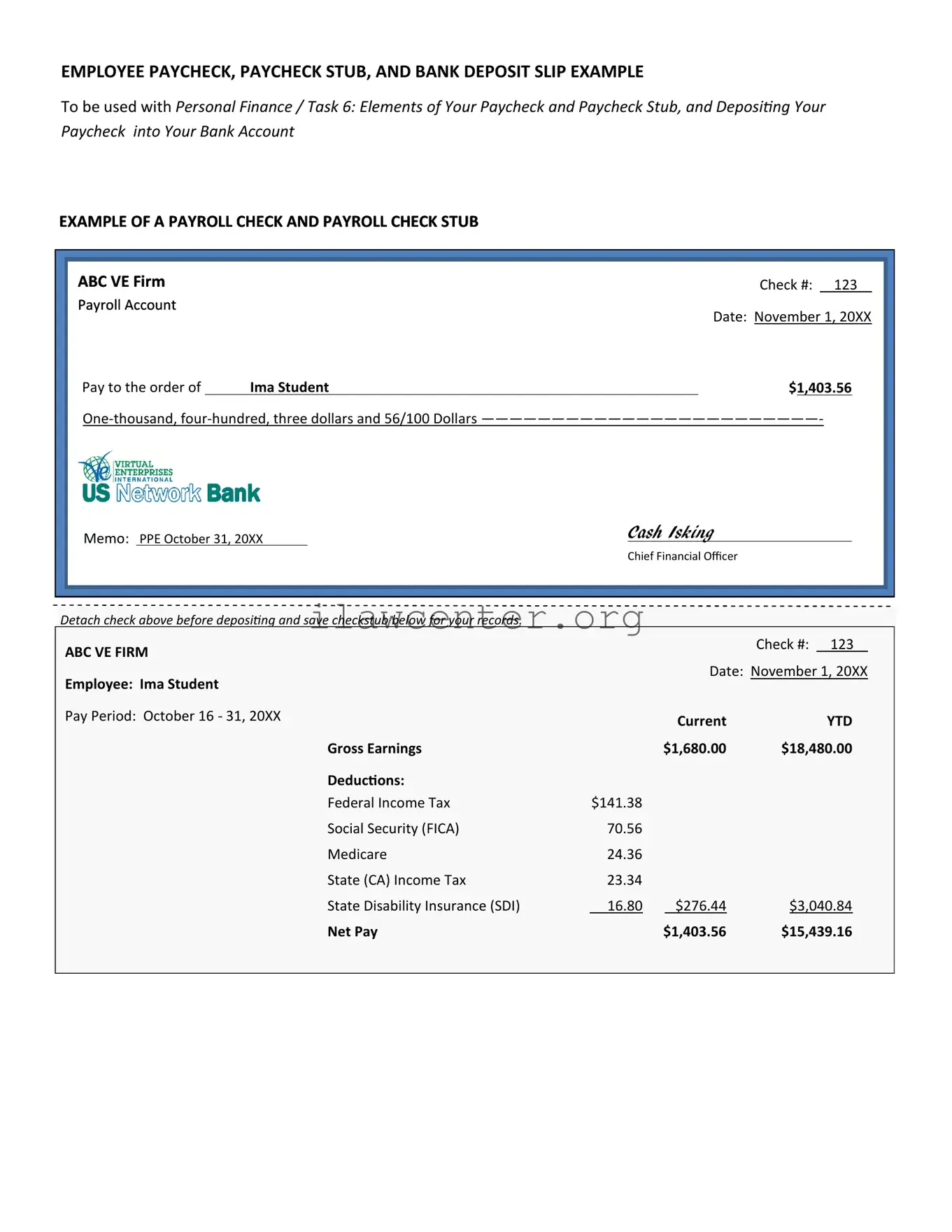

The Payroll Check form is a document used by employers to disburse wages to employees regularly. It provides vital information, including the employee's name, the pay period, and the amount owed for that specified time. This form serves as a record of payment for both the employee and employer, helping to ensure transparency in wage distribution.

How do I fill out the Payroll Check form?

Filling out the Payroll Check form generally requires basic information. Employers should start with the employee's personal details, including their name and identification number. Next, include the pay period during which the services were provided. Finally, indicate the gross pay, deductions, and net pay. Accuracy is essential, as errors can lead to incorrect payments or tax implications.

What information is necessary on the Payroll Check form?

Key information includes the employee's full name, the pay period dates, gross earnings, deductions (such as taxes and benefits), and the net amount to be paid. Additionally, the employer's name and signature should be present to validate the payment. Including this information ensures clarity for both parties and facilitates record-keeping.

Do employees need to sign the Payroll Check form?

Typically, employees do not need to sign the Payroll Check form itself; however, they may be required to endorse the physical check upon receipt. This process verifies that the employee has received their payment. Moreover, record-keeping practices may vary, so it is advisable for employers to check their specific policies or consult relevant regulations.

What should I do if I find an error on my Payroll Check form?

If an error is discovered on the Payroll Check form, employees should promptly inform their employer or the payroll department. It's essential to address mistakes quickly, especially concerning underpayments or overpayments, as these issues can affect both employee satisfaction and tax obligations. Employers should have a process in place to rectify the situation, which may involve issuing a corrected check or adjusting future payments.

How long should Payroll Check forms be retained?

Employers are generally advised to retain Payroll Check forms for a minimum of three years, as per IRS guidelines. Keeping these records aids in proper financial management and may be necessary for audits or tax-related inquiries. Additionally, retaining records longer can be beneficial for resolving disputes or verifying compensation history.