Fillable Power of Attorney Document

Power of Attorney is a legal document that allows one person to designate another to make decisions on their behalf. This powerful tool can encompass various areas, including financial matters and health care choices, giving someone you trust the authority to act in your best interest. Ready to take control of your future? Fill out the Power of Attorney form by clicking the button below.

The Power of Attorney (POA) form serves as a vital tool in personal and financial planning, offering individuals a way to designate another person, known as the agent or attorney-in-fact, to act on their behalf. This important legal document can grant broad or limited powers, depending on individual needs—such as managing finances, selling property, or making healthcare decisions. It is essential for people of all ages, especially those facing health challenges or requiring assistance due to age or disability. Transferring authority through a POA ensures that an individual’s preferences are upheld, even when they cannot personally advocate for themselves. The form typically requires specific details, including the names of the principal and agent, the extent of authority granted, and the duration of the agreement. Properly executed, this document provides peace of mind and protection, enabling someone trusted to handle essential affairs when unable to do so oneself.

Power of Attorney Document Categories

Power of Attorney Preview

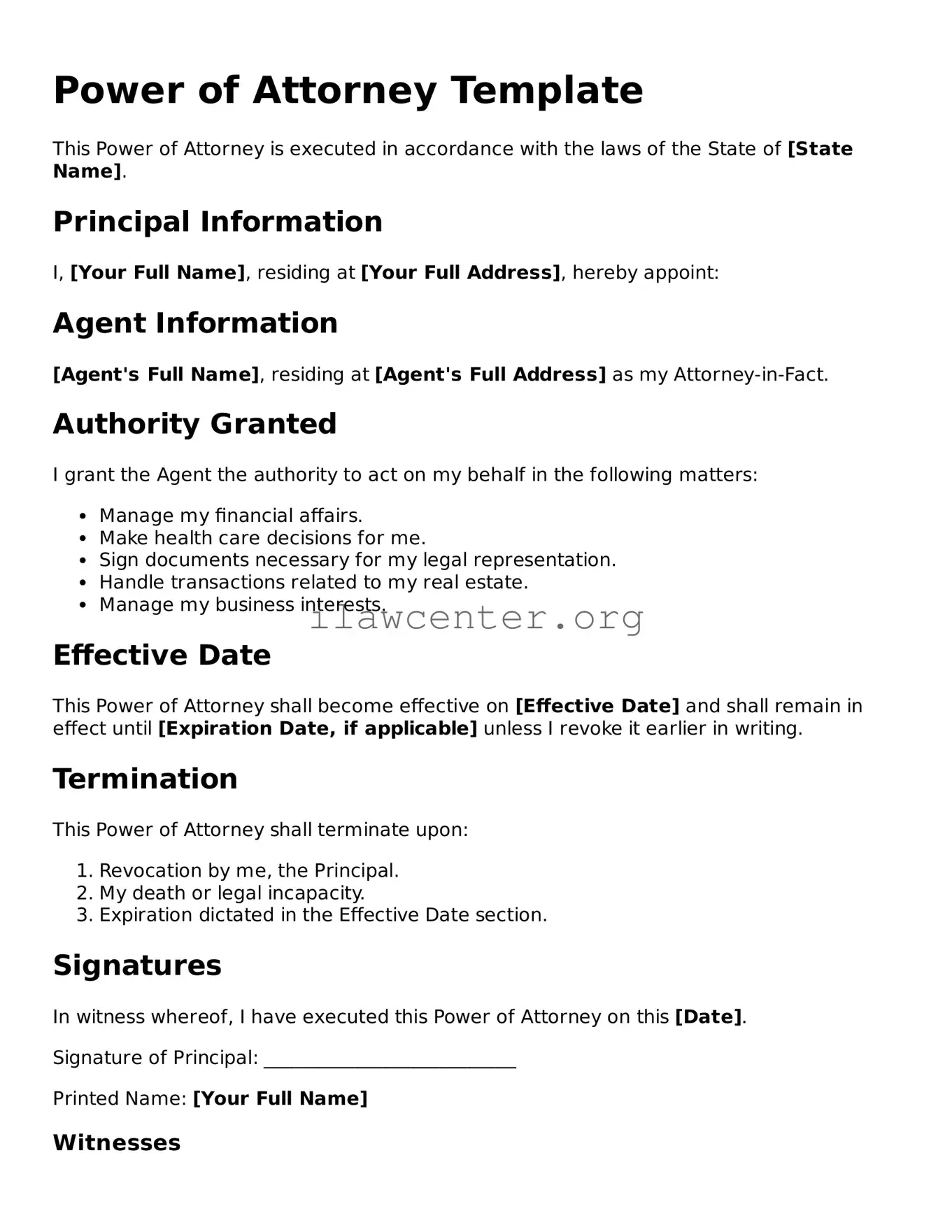

Power of Attorney Template

This Power of Attorney is executed in accordance with the laws of the State of [State Name].

Principal Information

I, [Your Full Name], residing at [Your Full Address], hereby appoint:

Agent Information

[Agent's Full Name], residing at [Agent's Full Address] as my Attorney-in-Fact.

Authority Granted

I grant the Agent the authority to act on my behalf in the following matters:

- Manage my financial affairs.

- Make health care decisions for me.

- Sign documents necessary for my legal representation.

- Handle transactions related to my real estate.

- Manage my business interests.

Effective Date

This Power of Attorney shall become effective on [Effective Date] and shall remain in effect until [Expiration Date, if applicable] unless I revoke it earlier in writing.

Termination

This Power of Attorney shall terminate upon:

- Revocation by me, the Principal.

- My death or legal incapacity.

- Expiration dictated in the Effective Date section.

Signatures

In witness whereof, I have executed this Power of Attorney on this [Date].

Signature of Principal: ___________________________

Printed Name: [Your Full Name]

Witnesses

We, the undersigned, hereby witness that the above-named Principal has executed this Power of Attorney in our presence:

Witness 1 Signature: ___________________________

Printed Name: [Witness 1 Full Name]

Witness 2 Signature: ___________________________

Printed Name: [Witness 2 Full Name]

Notarization

State of [State Name]

County of [County Name]

On this [Date], before me, a Notary Public, personally appeared [Your Full Name], known to me (or proved to me on the basis of satisfactory evidence) to be the person who executed the foregoing instrument and acknowledged that he/she signed it freely and voluntarily for the uses and purposes therein mentioned.

Notary Public Signature: ______________________

My Commission Expires: [Expiration Date]

PDF Form Characteristics

| Fact | Description |

|---|---|

| Definition | A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Types | There are various types of POA, including durable, non-durable, medical, and special. Each serves different purposes. |

| Durable POA | A durable power of attorney remains in effect even if the principal becomes incapacitated, ensuring that decisions can still be made. |

| State-Specific Forms | Each state has its own requirements for POA forms. For instance, California’s laws are governed by the California Probate Code. |

| Revocation | A Power of Attorney can be revoked at any time, provided the principal is still mentally competent to make decisions. |

| Notarization | Most states require the POA document to be notarized for it to be legally valid, although some may accept witnesses instead. |

| Risks | While a POA grants significant powers, it also poses risks. Choosing a trusted individual is crucial to avoid potential abuse. |

Instructions on Utilizing Power of Attorney

Before you dive into filling out the Power of Attorney form, it's essential to gather all necessary information and documents. Being prepared not only streamlines the process but also ensures accuracy. Let’s break it down into clear, actionable steps to help you complete the form correctly.

- Start with the form heading. Write “Power of Attorney” at the top of the document.

- Provide your name. Clearly state your full legal name as the principal (the person granting authority).

- Fill in your address. Include your complete mailing address where you currently reside.

- Identify the agent. Specify the name of the person you are appointing as your agent. This person will act on your behalf.

- Include the agent’s address. Write the full mailing address of your chosen agent to ensure accuracy in communication.

- Outline the powers granted. Describe in detail the specific powers you are granting to your agent. Be clear to avoid any confusion.

- Set the duration of the authority. Indicate how long the powers will last - whether it's for a specific time frame or until revoked.

- Sign the document. As the principal, you must sign the form in the designated area.

- Date your signature. Adding the date ensures clarity about when the Power of Attorney takes effect.

- Have the document witnessed. Depending on your state’s requirements, locate witnesses to sign the form, if necessary.

- Consider notarization. To add an extra layer of validity, have the form notarized if required by your state.

Completing these steps will create a valid Power of Attorney form. After filling it out, consider keeping copies for your records and providing one to your agent, so they are prepared to act on your behalf as needed.

Important Facts about Power of Attorney

What is a Power of Attorney?

A Power of Attorney is a legal document that allows one person (the principal) to grant another person (the agent or attorney-in-fact) the authority to make decisions on their behalf. This can include financial matters, healthcare decisions, or other legal matters. The principal can specify the extent of the agent's powers, whether general or limited, depending on their individual needs.

Why might I need a Power of Attorney?

Having a Power of Attorney ensures that someone you trust can act for you in the event you become incapacitated or unable to make decisions for yourself. This can help avoid delays in important financial transactions or healthcare decisions during critical times. Preparing this document proactively allows you to choose who will represent your interests, rather than leaving it up to the court to decide.

What types of Power of Attorney are there?

There are mainly two types of Power of Attorney: General and Durable. A General Power of Attorney grants broad powers to the agent, allowing them to handle a wide range of financial or legal matters. In contrast, a Durable Power of Attorney remains effective even if the principal becomes incapacitated. There’s also a Limited Power of Attorney, which restricts the agent's authority to specific tasks, such as selling a property or managing a bank account for a defined period.

How do I choose an agent for my Power of Attorney?

Choosing an agent is a critical decision. Select someone you trust completely, as this person will have significant control over your affairs. Consider their ability to take on the responsibility, their understanding of your wishes, and their availability to act when needed. It’s also a good practice to discuss the role with your chosen agent to ensure they are willing and prepared to accept this responsibility.

Can I revoke my Power of Attorney?

Yes, you can revoke a Power of Attorney at any time, as long as you are mentally competent. To do so, it's advisable to create a formal revocation document and inform your agent and any relevant institutions (such as banks or hospitals). This written notice should clearly state that the previous Power of Attorney is no longer valid. Keep copies for your records and provide them to your agent and any third parties that had relied on the old authority.

Do I need a lawyer to create a Power of Attorney?

While it is not mandatory to have a lawyer draft your Power of Attorney, seeking legal advice can be beneficial. A lawyer can help ensure that the document meets state requirements and reflects your specific wishes. They can also assist in addressing any unique situations concerning your estate or financial matters, which could be valuable in avoiding misunderstandings later on.

What happens if I don’t have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, a court may need to appoint a guardian or conservator to manage your affairs. This process can be lengthy, emotionally taxing, and less aligned with your wishes. Having a Power of Attorney in place allows you to maintain control over who handles your affairs and how they are managed, providing peace of mind for you and your loved ones.

Common mistakes

Filling out a Power of Attorney form can seem straightforward, but many people make common mistakes that can lead to complications down the road. One frequent error is neglecting to specify what powers the agent should have. A vague or broad statement can create confusion and disagreement among family members when the time comes to use the document. It’s vital to clearly outline the specific powers granted to the agent, whether it be financial decisions, medical decisions, or something else entirely.

Another mistake often made is failing to date the form. Without a proper date, questions may arise about when the Power of Attorney takes effect or whether it remains valid. It's essential to ensure that all signatures are dated accurately to avoid potential legal disputes later.

In many cases, individuals forget to choose a successor agent. If the primary agent is unable or unwilling to act, having a backup is crucial. This oversight can leave a gap in decision-making authority at a critical time.

Many people also overlook the importance of notifying relevant parties about the Power of Attorney. It’s not enough to simply fill out the form and store it away. Informing banks, family members, and healthcare providers ensures that they know who holds the authority and can act accordingly when needed.

Additionally, failing to have the document notarized can pose issues. While not always a strict requirement, notarization adds an extra layer of legitimacy to the form, which can help eliminate disputes about its validity in the future.

Some individuals mistake the Power of Attorney for a living will, leading to confusion about these different legal documents. A Power of Attorney grants authority to an agent to make decisions on your behalf, whereas a living will outlines your wishes regarding end-of-life care. Understanding these distinctions is vital for ensuring that your intentions are honored.

Another common oversight is not reviewing the form once it’s filled out. Regularly revisiting the document is necessary, especially after significant life events such as marriage, divorce, or the birth of a child. These changes may require updates to the Power of Attorney to reflect current circumstances.

Moreover, failing to communicate with the chosen agent about your wishes can create challenges. Open discussions about your preferences can make their job easier and ensure that your choices are respected when decisions must be made.

Lastly, many forget to keep copies of the Power of Attorney in easily accessible places. While the original must be stored securely, having copies ready for various institutions or family members can streamline the process when the document is needed.

Documents used along the form

A Power of Attorney (POA) is a critical document that allows a person to act on someone else's behalf in legal and financial matters. However, it often works best in conjunction with other documents. Here’s a list of important forms and documents that you might consider using alongside a Power of Attorney.

- Durable Power of Attorney: This variation remains effective even if the principal becomes incapacitated. It's important for long-term planning.

- Living Will: This document outlines a person's wishes regarding medical treatment and end-of-life care, particularly in situations where they cannot communicate those wishes themselves.

- Health Care Proxy: This allows a designated individual to make medical decisions on behalf of someone who is unable to do so, complementing the Living Will.

- Will: A legal document that dictates how a person's assets will be distributed upon their death. It's essential for estate planning.

- Revocable Living Trust: A trust that can be altered or revoked during the trustor's lifetime, helping to manage assets and avoid probate after death.

- Banking Authorization Form: This grants permission to someone to access or manage bank accounts, often alongside a POA for financial matters.

- Advance Directive: A broader term that includes both Living Wills and Health Care Proxies, indicating what type of care individuals want to receive.

- Financial Power of Attorney: Focused specifically on financial matters, this empowers someone to handle banking, investments, and other monetary concerns on behalf of another.

Having these documents in place ensures that your wishes are respected and can ease the burden on loved ones during difficult times. It is always advisable to consult with a professional to tailor these documents to your specific situation and needs.

Similar forms

- Will: A legal document that outlines how a person's assets and affairs are to be handled after their death. Like a Power of Attorney, it designates decision-makers but for after the individual passes away rather than during their lifetime.

- Trust Agreement: Establishes a trust to manage assets during one's life and after death. Similar to a Power of Attorney, it involves appointing a fiduciary to manage your affairs, but trusts often provide more comprehensive asset management options.

- Living Will: A document specifying a person's healthcare preferences in case they are unable to communicate. Both documents support decision-making, but a Living Will focuses solely on healthcare choices.

- Healthcare Proxy: This form allows a person to appoint someone else to make healthcare decisions on their behalf. Like a Power of Attorney, it grants authority to act, but is specific to medical decisions.

- Advance Directive: Combines a Living Will and a Healthcare Proxy. It serves a similar purpose as a Power of Attorney in the medical context, ensuring healthcare wishes are respected.

- Financial Power of Attorney: While a general Power of Attorney may cover various areas, this document specifically grants someone authority to handle financial matters. Both forms involve fiduciary roles but are focused on different aspects of a person's life.

- Durable Power of Attorney: Unlike a regular Power of Attorney, this version remains effective even if the individual becomes incapacitated. Both grant authority, but the durable variety provides broader protection in cases of incapacity.

- Executor Appointment: This document designates someone to administer an estate after someone passes away. Similar to a Power of Attorney, it involves appointing an individual to handle important decisions, but it operates in the context of estate management.

- Appointment of Agent for Business: This agreement allows individuals to designate someone to make business decisions on their behalf. Like a Power of Attorney, it creates a fiduciary relationship, but is specifically tailored for business contexts.

Dos and Don'ts

When filling out a Power of Attorney form, attention to detail is crucial. Here are five things to remember:

- Do read the entire form carefully before starting. Understanding every section is vital.

- Don't rush through the process. Take your time to ensure accuracy.

- Do clearly identify the person you are appointing. Their name should be spelled correctly.

- Don't leave important sections blank. Fill out every required field to avoid complications.

- Do consult with a legal professional if you have questions. Getting advice can clarify uncertainties.

Keeping these points in mind will help you avoid common pitfalls and ensure that the document serves its intended purpose effectively.

Misconceptions

Understanding the Power of Attorney (POA) form is essential, but several misconceptions can lead to confusion. Here’s a list clarifying these common myths:

- Only lawyers can create a Power of Attorney. Many individuals can draft a POA without attorney assistance, although legal guidance can ensure it meets all state requirements.

- A Power of Attorney is the same as a living will. This is incorrect. A POA gives someone the authority to act on your behalf, while a living will expresses your wishes regarding medical treatment.

- All Power of Attorney forms are the same. There are various types of POA forms, including durable, springing, and general. Each serves different purposes and has unique powers.

- A Power of Attorney can make decisions after I die. A POA ceases to be effective upon your death. After that, your estate plan and will take precedence.

- I cannot revoke a Power of Attorney once it's created. This is false. You can revoke a POA at any time, as long as you are mentally competent.

- The agent must be a family member. Your agent can be anyone trusted, including friends or professionals, as long as they understand their responsibilities.

- A Power of Attorney gives unlimited power. A POA can limit the authority granted. You can specify what the agent can and cannot do.

- Power of Attorney forms are only for financial matters. While many use it for finances, POAs can also cover medical decisions depending on the type.

- Once signed, I lose control over my decisions. This isn’t true. If you are still competent, you control your decisions, even if someone holds your POA.

- POAs are only necessary for older individuals. Anyone can benefit from a POA, especially those with health concerns or involved in significant financial decisions.

Understanding these misconceptions can lead to better decisions regarding your Power of Attorney arrangements. Always consider consulting with a professional to ensure your intentions are clearly expressed.

Key takeaways

Filling out and using a Power of Attorney (POA) form is an important step that can provide security and flexibility in managing your affairs. Here are nine key takeaways to consider:

- Understand the Purpose: A Power of Attorney allows you to appoint someone to act on your behalf. This can be useful in situations where you're unable to manage your affairs personally.

- Choose Your Agent Wisely: Selecting a trustworthy individual as your agent is crucial. They will have significant authority over your financial and medical decisions.

- Specific vs. General Authority: You can grant either specific powers (such as selling a property) or general powers (wide-ranging authority). Be clear about your intentions.

- Consider Time Limits: You may specify when the POA goes into effect and when it expires. This can provide you with peace of mind.

- Include Alternate Agents: It is beneficial to name alternate agents in case your first choice is unable or unwilling to serve.

- Signature Requirements: Different states have varying requirements for signing the POA. Ensure you follow your state's guidelines to make the document valid.

- Revoking a POA: You have the right to revoke a POA at any time. To do this, notify your agent and any relevant institutions in writing.

- Communication is Key: Discuss your decisions with your chosen agent. Clarity can help avoid misunderstandings and ensure your wishes are followed.

- Consult a Professional: If you have any doubts, seeking legal advice can help you understand the implications of creating a POA.

Find Popular Templates

How to Resign From Usps - The form is essential for maintaining the integrity of USPS employment records.

Third Party Authorization Form - Proper completion ensures that all necessary parties are included in the communication loop.

Affidavit Letter for Immigration Marriage - This affidavit describes family interactions that showcase the couple's genuine relationship.