Fillable Prenuptial Agreement Document

A Prenuptial Agreement is a legal document that couples create before marriage to outline the distribution of assets and responsibilities in the event of a divorce. This agreement can help manage expectations and reduce conflict, ensuring that both partners feel secure in their financial future. If you're considering a prenuptial agreement, fill out the form by clicking the button below.

Navigating the journey of love and partnership often leads to discussions about financial responsibilities and assets. A prenuptial agreement, also known as a prenup, serves as a vital tool for couples planning to marry. It outlines the financial arrangements and property rights should the marriage end in divorce or separation. Typically, the agreement covers property ownership, debt responsibilities, and potential spousal support. This document not only provides clarity but also sets mutual expectations regarding financial matters. Couples may choose to include provisions for the division of assets acquired during the marriage, protecting both parties’ interests. While not the most romantic topic, a prenuptial agreement can foster open communication and trust between partners, allowing them to focus on their future together while addressing potential financial uncertainties. Understanding the essential components and implications of this form can empower couples to make informed decisions about their legal and financial commitment to one another.

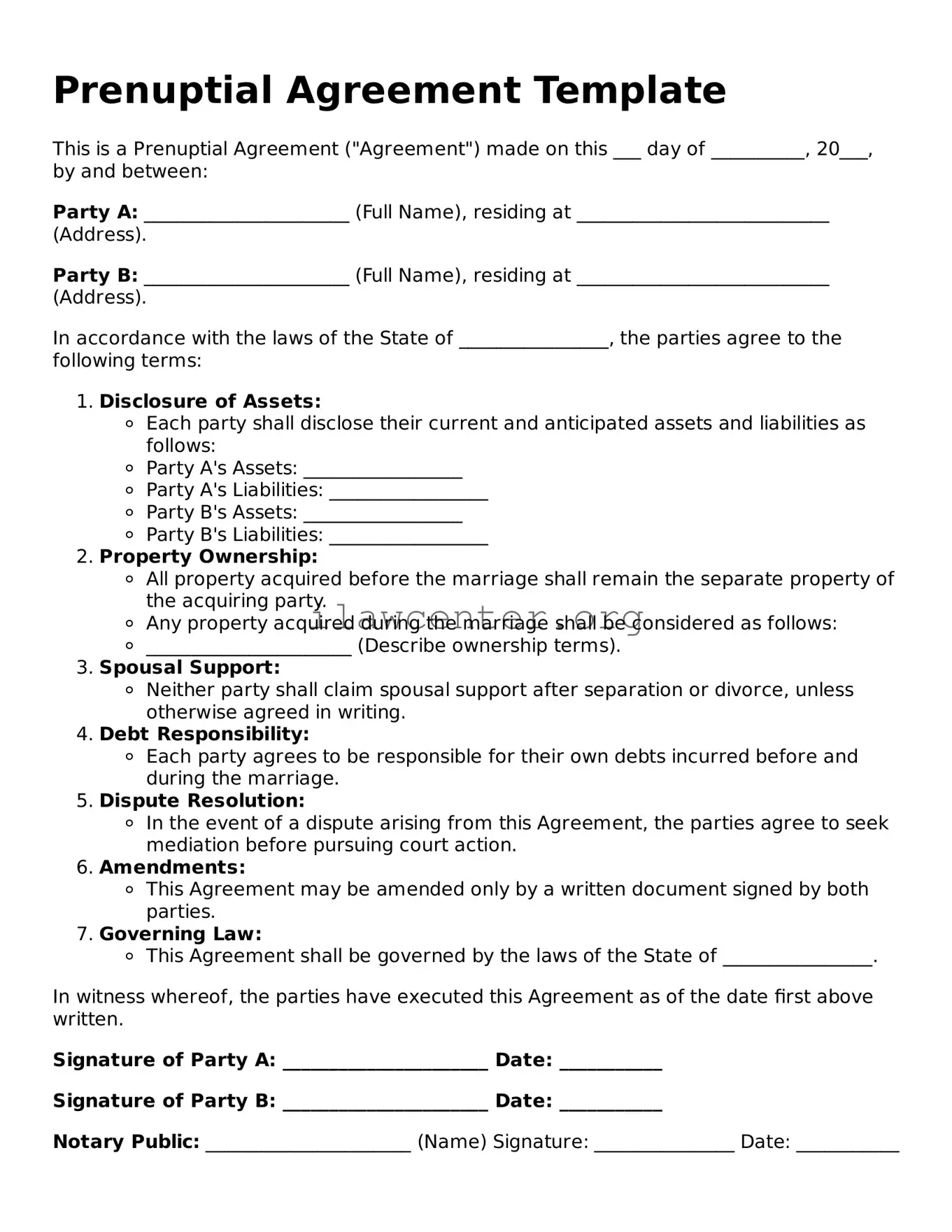

Prenuptial Agreement Preview

Prenuptial Agreement Template

This is a Prenuptial Agreement ("Agreement") made on this ___ day of __________, 20___, by and between:

Party A: ______________________ (Full Name), residing at ___________________________ (Address).

Party B: ______________________ (Full Name), residing at ___________________________ (Address).

In accordance with the laws of the State of ________________, the parties agree to the following terms:

- Disclosure of Assets:

- Each party shall disclose their current and anticipated assets and liabilities as follows:

- Party A's Assets: _________________

- Party A's Liabilities: _________________

- Party B's Assets: _________________

- Party B's Liabilities: _________________

- Property Ownership:

- All property acquired before the marriage shall remain the separate property of the acquiring party.

- Any property acquired during the marriage shall be considered as follows:

- ______________________ (Describe ownership terms).

- Spousal Support:

- Neither party shall claim spousal support after separation or divorce, unless otherwise agreed in writing.

- Debt Responsibility:

- Each party agrees to be responsible for their own debts incurred before and during the marriage.

- Dispute Resolution:

- In the event of a dispute arising from this Agreement, the parties agree to seek mediation before pursuing court action.

- Amendments:

- This Agreement may be amended only by a written document signed by both parties.

- Governing Law:

- This Agreement shall be governed by the laws of the State of ________________.

In witness whereof, the parties have executed this Agreement as of the date first above written.

Signature of Party A: ______________________ Date: ___________

Signature of Party B: ______________________ Date: ___________

Notary Public: ______________________ (Name) Signature: _______________ Date: ___________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a contract created before marriage to outline the division of assets and responsibilities in the event of a divorce. |

| Purpose | It protects individual assets and clarifies financial responsibilities, helping to prevent disputes later on. |

| State-Specific Forms | Each state has its own rules regarding prenuptial agreements, so it's essential to use the correct form for your state. |

| Governing Law | Common laws governing prenuptial agreements include the Uniform Premarital Agreement Act, adopted in many states. |

| Enforceability | For the agreement to be enforceable, it typically must be in writing and signed by both parties voluntarily. |

| Full Disclosure | Both parties must fully disclose their assets and liabilities to ensure the agreement is fair and valid. |

| Legal Advice | It's advisable for both parties to seek independent legal counsel before signing a prenuptial agreement to ensure comprehension and fairness. |

Instructions on Utilizing Prenuptial Agreement

Completing a Prenuptial Agreement form is a process that requires careful attention. By following these instructions, you can ensure that all necessary information is accurately captured, paving the way for a clear and well-structured agreement with your partner.

- Begin with basic personal information. Fill in your full name, your partner's full name, and both of your current addresses.

- Indicate the date the agreement will be signed. This is essential for the legal documentation.

- List all assets owned by each individual. Be thorough; include real estate, bank accounts, retirement accounts, and any valuables.

- Detail any debts that either party has. Clear disclosure promotes transparency and trust.

- Specify how assets and debts will be handled during the marriage and in the event of a divorce.

- Include any specific provisions for spousal support and how it will be determined, if applicable.

- Review the document for clarity and correctness. Ensure all sections are filled out and make necessary corrections.

- Sign the document in the presence of a notary public. Two witnesses may also be needed, depending on state laws.

- Each partner should keep a signed copy for their records.

Important Facts about Prenuptial Agreement

What is a prenuptial agreement?

A prenuptial agreement, often referred to as a "prenup," is a legal contract that a couple signs before getting married. It outlines how assets, debts, and other financial matters will be handled in the event of divorce or separation. This agreement can help protect individual interests and provide clarity regarding financial expectations in the marriage.

Who should consider a prenuptial agreement?

While prenuptial agreements are often associated with wealthy individuals, anyone can benefit from one. Couples with significant assets, debts, children from previous relationships, or business interests may find it especially useful. It creates a framework for how assets will be managed during the marriage and in case of a divorce, ensuring that both parties are protected.

What can be included in a prenuptial agreement?

A prenuptial agreement can cover a wide range of topics. Common provisions include the division of property, responsibility for debts, spousal support, and how to manage joint accounts. You can also include terms regarding inheritances, business interests, and even stipulations about future children. However, it cannot include provisions related to child custody or child support, as these are determined based on the best interests of the child at the time of a divorce.

Are prenuptial agreements enforceable?

Yes, prenuptial agreements are generally enforceable if they meet certain legal requirements. For the agreement to be valid, both parties must fully disclose their assets and liabilities. Additionally, it must be entered into voluntarily, without coercion, and each party should ideally have independent legal counsel. Courts will also check that the terms are fair and reasonable at the time of enforcement.

When should we start discussing a prenuptial agreement?

Timing is important when it comes to prenuptial agreements. It’s best to start the conversation well in advance of the wedding to avoid stress. Discussing this topic allows both partners to understand each other's views on finances and marriage. Open dialogue can strengthen your relationship and help ensure that both parties feel comfortable with the agreement's terms.

Can we modify or revoke a prenuptial agreement after marriage?

Yes, a prenuptial agreement can be modified or revoked after marriage. This typically requires a written agreement signed by both parties. Changes may be warranted due to significant life events such as the birth of a child, changes in income, or acquiring new assets. Regularly reviewing the agreement ensures it meets the current needs of both partners.

What happens if we don’t have a prenuptial agreement?

If you don’t have a prenuptial agreement and divorce occurs, the division of assets and debts will generally follow state property laws. This could lead to an outcome that neither party finds ideal, especially if there are significant discrepancies in income or asset ownership. Without a prenup, couples may end up in contentious negotiations that could have been avoided with a clear agreement in place.

How can we get started with a prenuptial agreement?

Getting started with a prenuptial agreement involves a few steps. First, have open discussions about each other’s financial situations and expectations for the marriage. Then, consult a lawyer who specializes in family law to draft the agreement. It’s crucial for both parties to seek independent legal advice to ensure that the final document is fair and legally binding.

Common mistakes

Filling out a Prenuptial Agreement can be a vital step for couples looking to establish clear financial boundaries before marriage. However, mistakes during this process can lead to complications down the line. One common error is failing to provide full disclosures about assets and debts. Transparency is key. If either party hides financial information, it could render the agreement unenforceable.

Another frequent pitfall is neglecting to consider future changes. Life events such as having children or changing jobs can significantly affect financial situations. It’s crucial to note that a Prenuptial Agreement should be adaptable to these changes. Couples should include provisions that allow for renegotiation if significant life events occur.

Many individuals also mistakenly believe that a Prenuptial Agreement can cover everything, including child custody and support. In reality, courts often invalidate any terms regarding custody or child support found in these documents. Couples should focus on financial matters and keep agreements about child-related issues separate, as these must consider children’s best interests.

Some individuals overlook the importance of seeking legal advice. Attempting to draft a prenup without the assistance of a qualified attorney can lead to critical oversights. Each state has its own laws governing prenuptial agreements. An attorney can ensure that the document complies with local regulations and adequately protects both parties.

Lastly, another misstep is allowing high emotions to dominate the discussion. Filling out a Prenuptial Agreement often occurs during a stressful time. Couples might rush the process or pressure each other into unfavorable terms, leading to resentment later. It’s essential to approach this conversation with openness and to allow adequate time for thoughtful discussion.

Documents used along the form

When considering a prenuptial agreement, it's important to understand that this document often works in tandem with other forms and documents. These papers help clarify financial arrangements, property division, and other relevant matters before marriage. Below is a list of forms commonly associated with prenuptial agreements, each with a brief description.

- Financial Disclosure Statement: This document details the assets, debts, and income of both parties. It ensures transparency and provides a clear picture of each partner’s financial situation.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines how assets will be handled in case of divorce or separation, serving as an additional layer of protection.

- Separation Agreement: If a marriage encounters difficulties, a separation agreement can dictate terms such as asset division and support until a divorce is finalized, often preventing conflict during a tumultuous time.

- Will: Establishing a will illustrates how one's assets will be divided after death. Couples may choose to modify their wills according to their prenuptial agreement to ensure clarity and adherence to their wishes.

- Power of Attorney: This document allows one partner to make financial or medical decisions on behalf of the other in case of incapacity. It fosters trust and ensures that each partner's preferences are respected.

- Living Will: A living will expresses an individual’s wishes regarding medical treatment in circumstances when they are unable to communicate. It reassures the other partner about fulfilling those wishes.

- Property Title Documents: When property is purchased, titles should reflect ownership to clarify what is individually owned versus jointly owned. This documentation can help in the event of a divorce.

- Debt Agreement: If one or both parties carry substantial debt, a debt agreement ensures that responsibilities are clearly outlined. This can prevent misunderstandings about financial obligations during a marriage or separation.

Understanding these documents can empower couples as they prepare for marriage. Each form carries its significance and can contribute to a stronger foundation for a lasting partnership, ensuring that both partners feel secure and informed. Taking the time to consider these associated documents can foster a healthy dialogue about finances, expectations, and future planning.

Similar forms

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after a couple marries. It outlines how assets and debts will be managed, provided both parties agree.

- Separation Agreement: When couples decide to live apart, this agreement addresses asset division, support obligations, and custody issues—similar in nature to a prenup but occurs when a relationship is already strained.

- Living Together Agreement: For couples who choose cohabitation without marriage, this document can outline each partner’s rights and responsibilities, mirroring the intent of a prenup but for unmarried partners.

- Divorce Settlement Agreement: Once a marriage ends, this agreement sorts out the terms of the divorce, like asset division and alimony, focusing on what was planned in a prenup but applied retrospectively.

- Spousal Support Agreement: This document specifically details the financial obligations one partner has to another during or after a separation, akin to certain elements found in a prenuptial agreement.

- Property Settlement Agreement: Similar in function to a prenuptial agreement, this document deals with how property and assets are divided during a divorce, creating clarity much like a prenup aims to.

- Child Custody Agreement: In cases involving children, this document outlines custody arrangements. Like a prenup, it seeks harmony and clear expectations, albeit focusing on parenting rather than finances.

- Debt Agreement: Couples may draft this agreement to manage how each partner will handle debts incurred during the relationship. Its purpose aligns closely with a prenup, offering financial clarity.

- Will or Trust: These estate planning documents dictate how assets will be distributed upon death, similar to how a prenuptial agreement addresses asset division during a marriage.

- Business Partnership Agreement: If spouses own a business together, this document can ensure a mutual understanding of roles and asset management, much like a prenup that protects assets in marriage.

Dos and Don'ts

When filling out a Prenuptial Agreement form, it’s important to approach the process thoughtfully. Here’s a straightforward list of dos and don’ts to guide you.

- Do openly discuss your intentions with your partner.

- Do seek legal advice to ensure your agreement is valid.

- Do disclose all your assets and debts honestly.

- Do consider the future and how you want to protect yourself.

- Don’t rush through the process without careful consideration.

- Don’t hide any financial information.

- Don’t use coercive tactics to get your partner to agree.

- Don’t forget to review and update the agreement as circumstances change.

Taking these steps seriously can help set a solid foundation for your marriage.

Misconceptions

When it comes to prenuptial agreements, many people hold onto common misconceptions that can cloud their understanding. Here are four prevalent myths about prenups, along with the truths that debunk them.

- Prenups are only for the wealthy. This myth suggests that only individuals with considerable assets need a prenuptial agreement. In reality, anyone entering a marriage can benefit from a prenup. It can address issues like debt, future income, and the division of assets, regardless of wealth.

- Prenups imply a lack of trust. Many believe that asking for a prenup signals doubt about the relationship. However, a prenup can actually enhance trust by clarifying financial expectations and responsibilities. Open discussions about finances can strengthen the partnership.

- Prenuptial agreements are only enforceable if signed under pressure. Some think that a prenup is only valid if both parties were pressured to sign it. All parties should understand what they are agreeing to and do so willingly. With the right legal guidance, prenups can be crafted to ensure fairness and voluntary consent.

- You can’t change a prenup after marriage. There is a belief that once a prenuptial agreement is signed, it cannot be modified. In fact, prenups can be revised or updated as circumstances change. Open communication about finances can lead to amendable agreements that reflect evolving situations.

Understanding these misconceptions can help couples make informed decisions about prenuptial agreements, paving the way for a healthier financial future together.

Key takeaways

Understand the purpose of a prenuptial agreement. It is designed to clarify financial rights and responsibilities before marriage.

Gather financial information. Both parties should provide a comprehensive list of assets, debts, and income.

The agreement should be fair and reasonable. Items within the prenup must be balanced and consider both partners’ interests.

Consult with separate legal counsel. Each partner should have an attorney review the agreement to ensure that their rights are protected.

Be transparent. Full disclosure of financial situations is critical for the validity of the agreement.

Consider future changes. The agreement might need adjustments if significant life events occur, such as the birth of children or major financial changes.

Ensure the document is in writing. Oral agreements may not be enforceable, so it must be documented and signed.

Sign the agreement well in advance of the wedding. This helps prevent any claims of coercion or duress.

Review state laws regarding prenuptial agreements. Different states have varying requirements and enforceability standards.

Find Popular Templates

Quick Bill of Sale - The Bill of Sale can be a simple yet vital part of trailer ownership transfer.

Pdf Printable Puppy Shot Record - Vital for rescue organizations and adoption processes.

Broward Animal Care and Adoption - Requires the complete street address, including city, state, and zip code.