Instructions on Utilizing Promissory Note for a Car

Filling out the Promissory Note for a Car is an important step in managing vehicle financing and ensuring that all parties involved understand their commitments. It's essential to take your time and provide accurate information on the form.

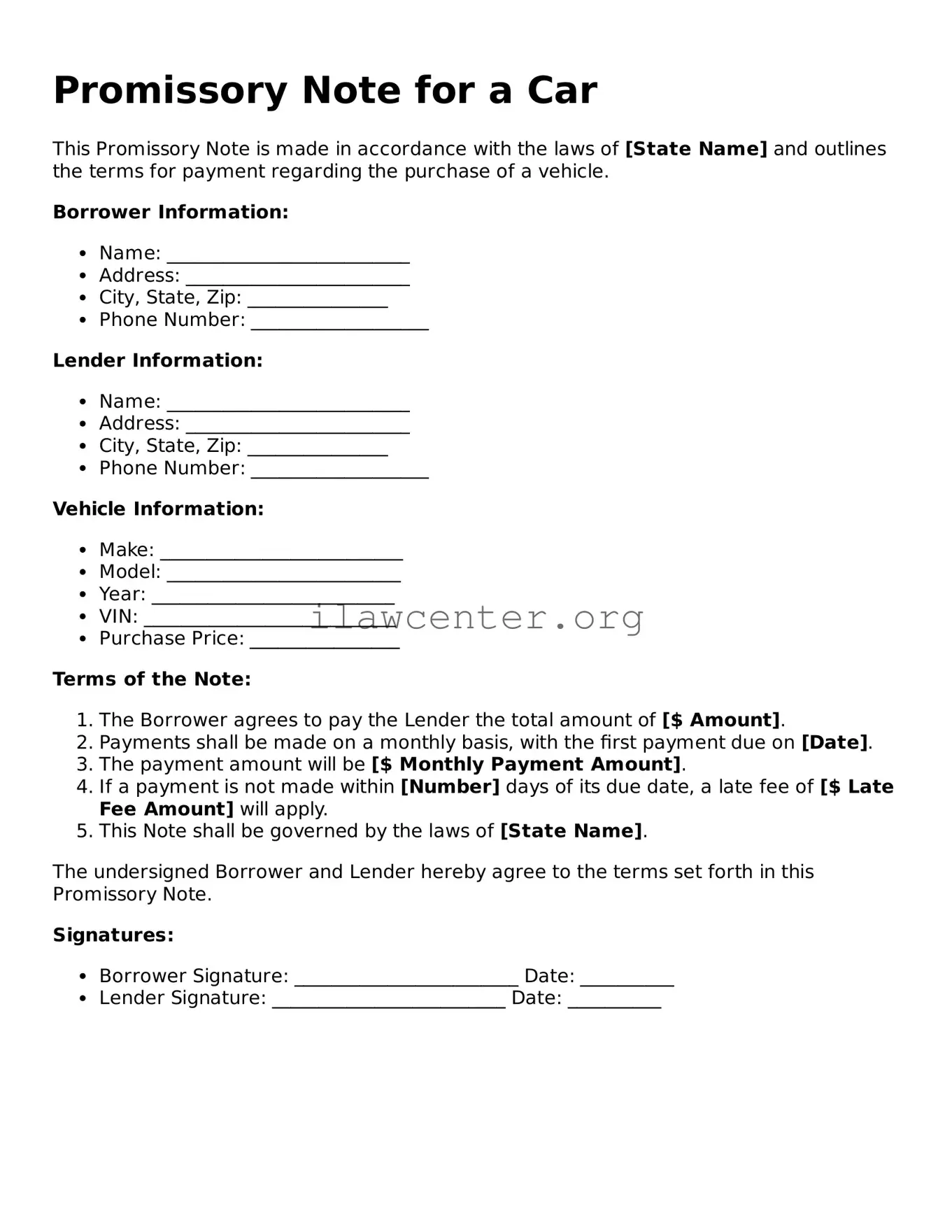

- Begin by entering the date at the top of the form. This date should reflect when the agreement is being made.

- Next, indicate the names of the parties involved. Clearly write the name of the borrower (the person who will be making payments) and the lender (the person or institution providing the loan).

- In the specified section, fill in the principal amount. This is the total amount of money being borrowed for the purchase of the car.

- Write down the terms of repayment. Specify the amount of each installment, the frequency of payments (monthly, bi-weekly, etc.), and the final due date when the loan will be fully paid off.

- Note the interest rate, if applicable. Make sure it’s clear whether this is a fixed or variable rate.

- Include details about any loan collateral. Typically, this would be the car being financed. An accurate description, including the make, model, year, and Vehicle Identification Number (VIN), should be provided.

- Designate any late fees or penalties. Clearly state what happens if a payment is made after the due date.

- If desired, include a section for additional terms or conditions. This can cover modifications to the agreement, or any specific provisions that apply.

- Once all sections are completed, both parties should read through the document carefully. After ensuring accuracy, both the borrower and the lender should sign and date the form to make it legally binding.

With all the information correctly filled out and signatures obtained, ensure that each party retains a copy of the signed Promissory Note for their records.