Fillable Quitclaim Deed Document

A Quitclaim Deed is a legal document used to transfer ownership interest in property from one person to another without guaranteeing that the title is clear. This straightforward form allows the property owner, known as the granter, to relinquish any claim they may have on the property. For those interested in formally transferring property ownership, filling out this form is a crucial step; click the button below to proceed.

When it comes to transferring ownership of real estate, the Quitclaim Deed is a vital tool in a property owner's kit. This form allows one party, known as the grantor, to convey whatever interest they may have in a property to another party, called the grantee. Importantly, the grantor makes no guarantees about the validity of the title; they simply relinquish their stake. This makes Quitclaim Deeds particularly useful in situations like divorce settlements, gifting property to family, or correcting title issues. Because this form does not provide any warranty against claims on the property, it can be a quick and efficient means of transfer, but it does come with risks for the grantee. Therefore, understanding its implications is essential for anyone considering this option. Whether used to resolve disputes or facilitate quick transfers, the Quitclaim Deed plays a significant role in real estate transactions across the United States.

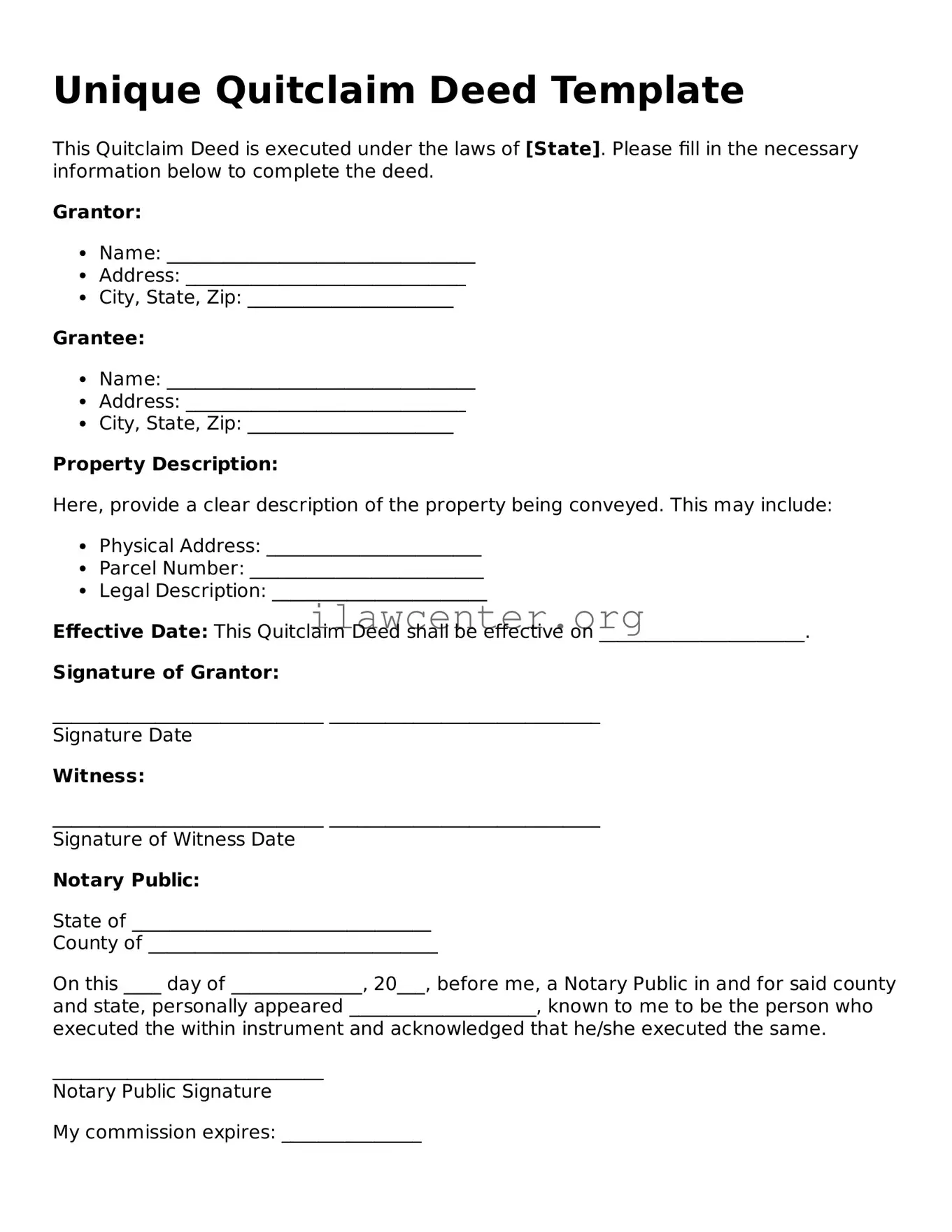

Quitclaim Deed Preview

Unique Quitclaim Deed Template

This Quitclaim Deed is executed under the laws of [State]. Please fill in the necessary information below to complete the deed.

Grantor:

- Name: _________________________________

- Address: ______________________________

- City, State, Zip: ______________________

Grantee:

- Name: _________________________________

- Address: ______________________________

- City, State, Zip: ______________________

Property Description:

Here, provide a clear description of the property being conveyed. This may include:

- Physical Address: _______________________

- Parcel Number: _________________________

- Legal Description: _______________________

Effective Date: This Quitclaim Deed shall be effective on ______________________.

Signature of Grantor:

_____________________________ _____________________________

Signature Date

Witness:

_____________________________ _____________________________

Signature of Witness Date

Notary Public:

State of ________________________________

County of _______________________________

On this ____ day of ______________, 20___, before me, a Notary Public in and for said county and state, personally appeared ____________________, known to me to be the person who executed the within instrument and acknowledged that he/she executed the same.

_____________________________

Notary Public Signature

My commission expires: _______________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of property from one person to another without making any guarantees about the title. |

| Governing Law | In the U.S., the laws governing quitclaim deeds vary by state. Generally, they are regulated by state property laws. |

| Title Assurance | A quitclaim deed offers no title insurance or warranty. The grantee receives whatever interest the grantor has, which may be none. |

| Common Uses | This type of deed is often used among family members, in divorce settlements, or to clear up title issues. |

| Execution Requirements | Most states require the quitclaim deed to be signed by the grantor, and some may need notarization. |

| Filing | Once completed, the quitclaim deed should be filed with the relevant county recorder's office to ensure proper documentation. |

Instructions on Utilizing Quitclaim Deed

After you complete the Quitclaim Deed form, the next step involves submitting it to the appropriate county office where the property is located. This will ensure that the transfer of ownership is officially recorded. Be prepared to pay any necessary fees and provide the required identification when you file the document. Below are the steps to fill out the form correctly.

- Obtain the Form: You can find a Quitclaim Deed form online or at your local county clerk’s office.

- Fill in the Grantor's Information: Enter your name and, if applicable, the name of any co-grantors who are transferring the property.

- Fill in the Grantee's Information: Provide the name of the person(s) receiving the property, known as the grantee. Be sure to include any middle names for clarity.

- Describe the Property: Include the full legal description of the property. This may involve referencing an old deed or property tax records for accuracy.

- Sign the Form: You must sign the Quitclaim Deed in the presence of a notary public. Your signature confirms your intention to transfer the property rights.

- Notarization: The notary will verify your identity and witness your signature before signing and sealing the document.

- File the Deed: Once notarized, take the completed form to your county recorder’s office for filing. There may be a small filing fee.

Important Facts about Quitclaim Deed

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer interest in real estate from one party to another. Unlike other types of deeds, it does not guarantee that the property is free of liens or encumbrances. Essentially, it conveys whatever interest the grantor (the person transferring the property) may have in the property, which can be very useful in specific situations like divorce settlements or family transfers.

When should I use a Quitclaim Deed?

This type of deed is particularly useful in scenarios where the parties know each other and trust that the property title is clear. For example, it’s often employed when a home is being transferred between family members or in cases of divorce when one spouse wishes to relinquish ownership to the other. It's a quick and simple way to change ownership without going through a lengthy process.

What are the risks associated with a Quitclaim Deed?

While Quitclaim Deeds are straightforward, they come with risks. The most significant one is that there is no warranty as to the property's title. This means if there are existing claims against the property (like unpaid taxes or liens), the new owner may be held responsible. Therefore, it's essential to ensure due diligence before making any transactions using this type of deed.

Do I need a lawyer to create a Quitclaim Deed?

While having a lawyer is not a requirement to prepare a Quitclaim Deed, it can be beneficial, especially if you have any concerns about the property's title or the implications of transferring ownership. If you're comfortable with the process and believe you know what you’re doing, you can draft the deed yourself or utilize a service to assist you.

How do I complete a Quitclaim Deed?

Completing a Quitclaim Deed involves filling out the necessary information accurately. This typically includes the names of the parties involved, the legal description of the property, and the date of the transfer. Once filled, the document needs to be signed in the presence of a notary public to make it legally binding. After this, it’s important to file the deed with the appropriate county office to ensure it's recorded officially.

Will a Quitclaim Deed affect my mortgage?

Common mistakes

Filling out a Quitclaim Deed form can be straightforward, but mistakes can easily happen. One common error is not including the name of the grantee. The grantee is the person receiving the property. If their name is missing, the deed may not be valid. Always double-check that you have clearly written the full legal name of the person who will own the property after the transfer.

Another frequent oversight is neglecting to sign the document properly. The person transferring the property must sign the Quitclaim Deed. If the signature is missing or not done correctly, the deed can't be executed. This can lead to delays and complications. Always use your legal name as it appears on the title.

Sometimes, people forget to fill in the property description accurately. A typical Quitclaim Deed includes a precise description of the property being transferred. This description must be clear enough to identify the property without confusion. If it is vague or incorrect, it might create issues in future property transactions.

Incorrectly providing the notary information is another common mistake. A Quitclaim Deed usually needs to be notarized to make it legally binding. Ensure that all details regarding the notary, such as name and signature, are accurately filled in. Errors here could render the deed ineffective.

Finally, failing to record the Quitclaim Deed after execution can lead to problems down the road. Once the deed is signed and notarized, it must be filed with the appropriate governmental office. Not recording it means that the property transfer may not be recognized by legal authorities. You lose legal protection when the deed isn't officially recorded, which can cause problems for future owners.

Documents used along the form

A Quitclaim Deed is an important legal document often used in property transfers, especially when the seller does not guarantee that they hold a clear title to the property. When dealing with the transfer of ownership, several other forms and documents may accompany the Quitclaim Deed to ensure the process is smooth and legally compliant. Below are some commonly used documents along with a brief description of each.

- Title Search Report: This document provides information on the history of the property title, including any liens, easements, or ownership disputes. It is essential to identify any potential issues before the transfer.

- Affidavit of Loss: If a property owner loses the original Quitclaim Deed, this affidavit can be filed to declare the loss and affirm the validity of a copy of the deed, helping to prevent fraudulent claims.

- Transfer Tax Declaration: Many states require this document to report the sale of property and determine the applicable transfer taxes. It provides the tax authority with necessary information about the transaction.

- Homeowners’ Association (HOA) Disclosure: If the property is part of an HOA, this document outlines the association's rules, fees, and required regulations. This information helps the buyer understand their responsibilities after the purchase.

- Property Survey: This document shows the property lines and measurement, ensuring that the buyer is aware of exactly what is included in the sale. It can help prevent disputes with neighbors about boundaries.

- Warranty Deed: In some instances, a buyer might prefer or require a Warranty Deed instead of a Quitclaim Deed. This deed guarantees that the seller holds clear title to the property and is responsible for any claims that arise after the sale.

Understanding these additional documents can significantly improve the real estate transaction experience. They help protect both the buyer and seller by ensuring clarity and transparency in the process, contributing to a smoother ownership transfer and more peace of mind for all parties involved.

Similar forms

- Warranty Deed: This document provides a guarantee that the grantor has a clear title to the property and will defend it against any claims. In contrast, a quitclaim deed makes no promises about the title's status.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property and assures that the grantor has not sold it to anyone else. However, it does not offer the same level of protection as a warranty deed.

- Lease Agreement: This document allows a tenant to use a property for a specific period, similar to how a quitclaim deed transfers ownership rights. Both involve rights to property, but a lease does not transfer ownership.

- Life Estate Deed: This type of deed gives someone the right to use a property for their lifetime while allowing the property to pass to someone else afterward. Both types of deeds transfer interests in real property.

- Real Estate Transfer Disclosure Statement: While this document provides information about the property's condition, a quitclaim deed transfers ownership without such disclosures.

- Deed of Trust: This document secures a loan with property as collateral, much like a quitclaim deed can transfer the property as collateral for an obligation.

- Mortgages: A mortgage agreement allows a borrower to obtain funds by pledging property. This is similar to a quitclaim deed's property transfer, focusing on the interest in the property.

- Affidavit of Title: This sworn statement assures that there are no undisclosed claims against the property. A quitclaim deed, on the other hand, does not include such assurances about ownership claims.

Dos and Don'ts

When filling out a Quitclaim Deed form, it's important to approach the task carefully. Here are some things to do and not to do.

- Do: Ensure the legal description of the property is accurate.

- Do: Include the names of all parties involved, both grantor and grantee.

- Do: Sign the document in front of a notary public.

- Do: Check state-specific requirements before finalizing the document.

- Don't: Leave any fields blank; incomplete forms may lead to issues.

- Don't: Forget to file the completed deed with your local government office.

- Don't: Assume all quitclaim deeds are the same; each state may have different requirements.

Misconceptions

Understanding the quitclaim deed form is essential for anyone involved in real estate transactions. Unfortunately, misconceptions abound. Here is a list of eight common misunderstandings about quitclaim deeds:

- Quitclaim deeds transfer ownership rights. Many believe they automatically grant full ownership. In reality, they only transfer whatever interest the grantor has at that moment. If the grantor has no ownership, the recipient gains nothing.

- Quitclaim deeds are only used between family members. While it's true they often facilitate family transfers, quitclaim deeds can be utilized in various situations, including among strangers during property sales or exchanges.

- Quitclaim deeds are always quick and easy. Although they simplify the process of transferring property, complications can arise. Issues such as unclear property titles or outstanding liens must be considered, making careful review necessary.

- Quitclaim deeds eliminate future claims. Some think that by using a quitclaim deed, all claims are resolved. However, other parties may still contest an interest if legal issues or disputes exist.

- False information on a quitclaim deed is harmless. This is a risky misconception. Providing false or misleading information can lead to legal challenges or complications in property rights down the line.

- Quitclaim deeds do not require notarization. While some may assume this, notarization is typically necessary for the deed to be valid. This step confirms the identities of the signatories and provides a layer of authenticity.

- Using a quitclaim deed is the same as a warranty deed. This is misleading. A warranty deed provides guarantees about the property’s title, while a quitclaim deed carries no such assurances. The two forms serve different purposes.

- A quitclaim deed cannot be revoked. Individuals may think once signed, it is permanent. However, if the grantor retains certain conditions or if future agreements arise, there might be ways to contest or amend the deed.

By dispelling these misconceptions, individuals can navigate property transactions more effectively, making informed choices regarding their real estate interests.

Key takeaways

Understand the Purpose: A Quitclaim Deed is primarily used to transfer ownership of property without any warranty of the title. This means that the person transferring the property is not guaranteeing that they have full rights or that the property is free of liens.

Identify the Parties: Clearly list the names and addresses of both the person transferring the property (the grantor) and the person receiving the property (the grantee). Accurate identification helps avoid any future legal complications.

Be Accurate with Property Description: The Quitclaim Deed must include a clear and complete description of the property being transferred. This typically consists of the legal description found in public records. Ambiguities in this part can lead to disputes.

Sign and Notarize: While some states may vary, generally, the quitclaim deed should be signed in the presence of a notary. This helps legitimize the document and may be required for it to be recorded.

Record the Deed: After completing and signing the Quitclaim Deed, it is important to file it with the appropriate local county office. This step ensures that the property transfer is public record, protecting the rights of the new owner.

Fill out Common Types of Quitclaim Deed Templates

Deed of Gift Property - Gift Deeds can help eliminate misunderstandings about property ownership among family and friends.

Deed in Lieu Meaning - After signing, the lender typically assumes responsibility for the property and its associated liabilities.

California Corrective Deed - It provides a clear record of adjustments made to a property's title.