Instructions on Utilizing Real Estate Power of Attorney

Completing a Real Estate Power of Attorney form is an important step if you need someone to handle your real estate transactions on your behalf. This process requires careful attention to detail to ensure everything is filled out correctly. Following these steps can help you navigate through the form effectively.

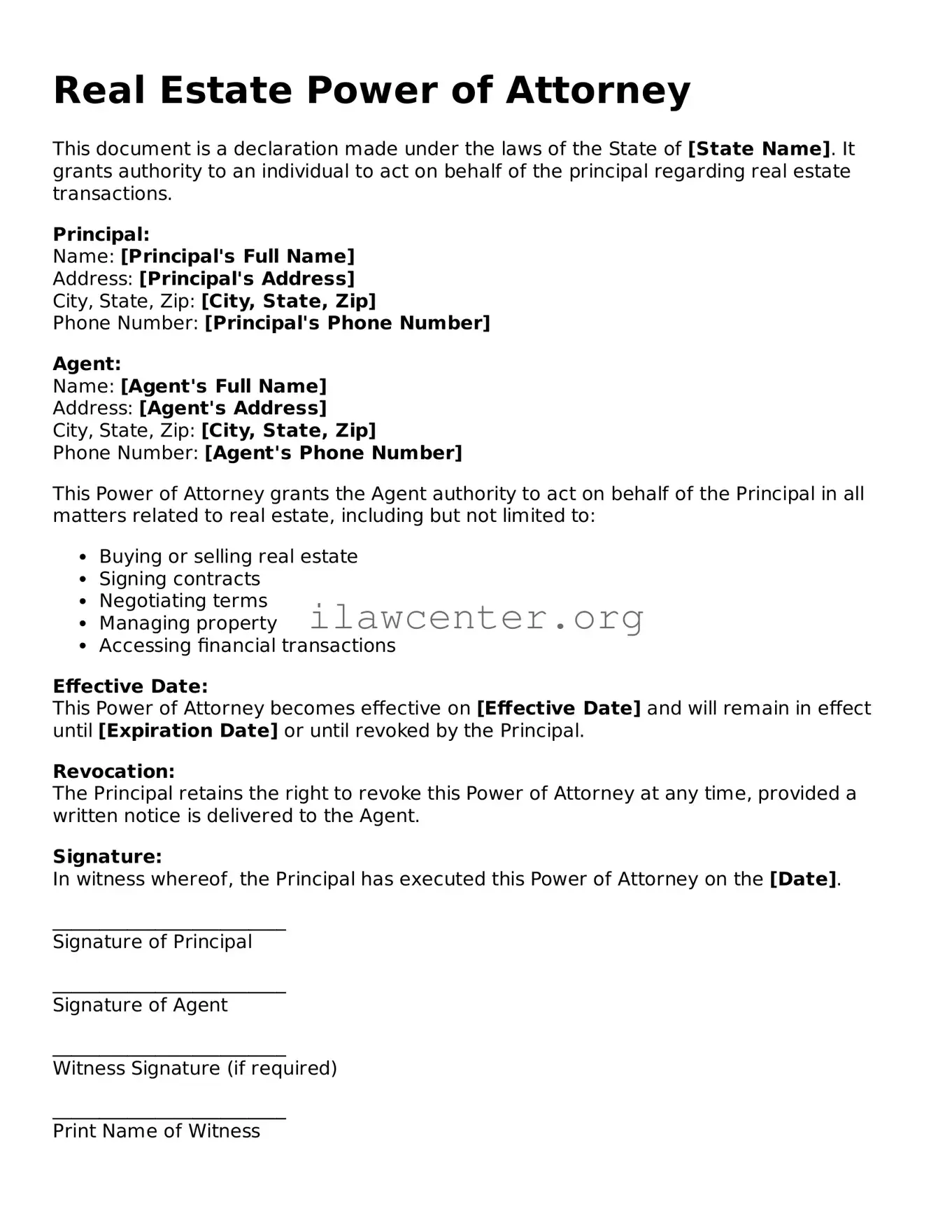

- Start the form by entering the date at the top, in the designated space.

- Provide your full name and address. This identifies you as the principal in the agreement.

- Next, write the name and address of the person you are granting authority to. This person is referred to as the agent or attorney-in-fact.

- Clearly specify the powers you are granting to your agent. You can list specific types of real estate transactions or provide a blanket authority for all real estate matters.

- Indicate any limitations on the powers if applicable. This helps clarify the boundaries of the agent's authority.

- Include a section for the date when the authority begins and if there’s an expiration date.

- After reviewing the form for accuracy, sign it. Ensure you do this in the presence of a notary public to validate your signature.

- Have the notary public sign and stamp the document to complete the notary process.

- Make copies of the signed and notarized document for your records and for the agent.

Following these steps will ensure that the Real Estate Power of Attorney form is completed correctly and is ready to be used. Always check local laws, as requirements might vary by state.