Instructions on Utilizing Reimbursement

Making sure you properly fill out the Reimbursement form helps ensure everything goes smoothly. This guide will walk you through the steps to complete it correctly, so you can get your reimbursement processed without any hitches.

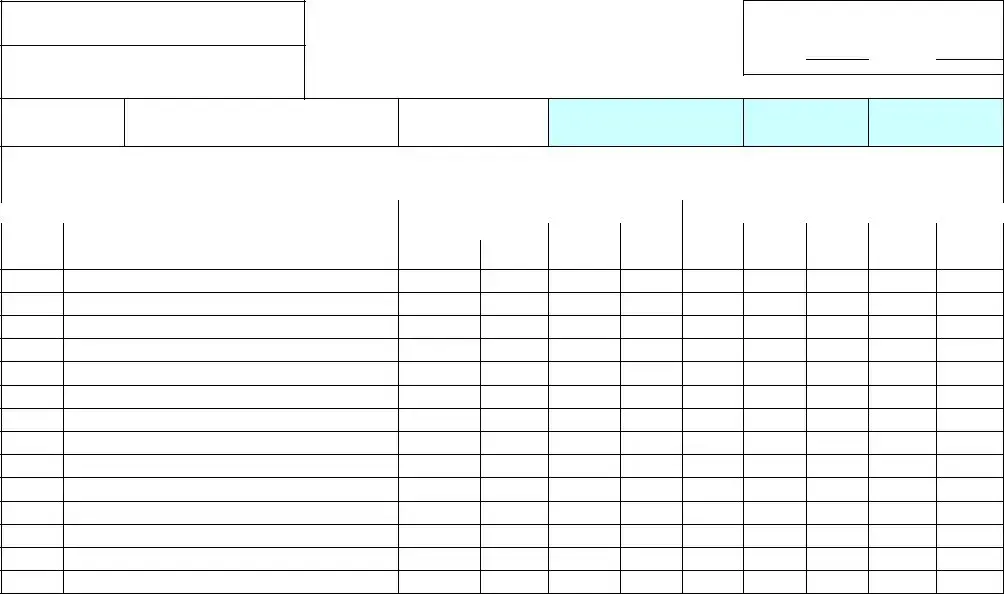

- Begin by entering your Employee ID # in the designated space.

- Fill in the Institution/Division Name.

- Provide your Name and Address in the designated field.

- Indicate your Title in the appropriate section.

- Specify your Bargaining Unit if applicable.

- Enter the Appropriation Unit number, as required.

- List the Object Budget for the expenses.

- Fill in the Fiscal Year (FY) for the current reimbursement.

- Now, document the total amount Document Total: for all expenses.

- Provide the date for Reconciliation Date.

- Enter the Schedule Pay Date accordingly.

- Document your travel details. For private auto mileage, note the Date, Description, Odometer Readings, Total Miles, and Amount.

- Break down your expenses into the categories: Meals, Fares, Hotel, and Other. Note the corresponding amounts for each.

- Calculate your total expenses and write it down Total Expenses:.

- At the bottom of the form, sign and date where it says Employee's Signature.

- Fill out the Supervisor's Approval section with title and date.

- Complete the Fiscal Verification and Fiscal Approval sections with names, titles, and dates.

- Finally, ensure someone enters your information into HR/CMS and document the title and date.

Once all fields are completed, ensure you keep a copy of this form for your records before submitting it. Following these steps will help facilitate a seamless reimbursement process.