Instructions on Utilizing State Farm Authorization To Pay

Filling out the State Farm Authorization To Pay form is an important step in facilitating payments for services or repairs covered by your insurance policy. Take your time to ensure accuracy. Follow the instructions carefully to complete the process smoothly.

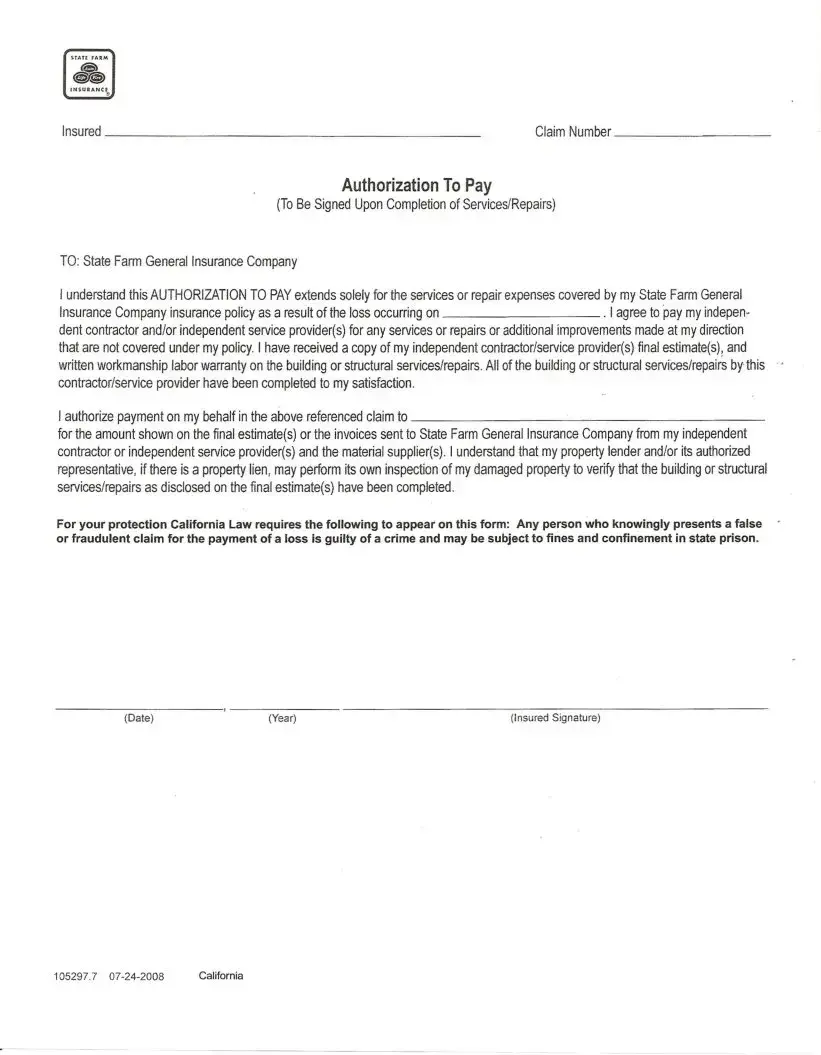

- Start by entering your name in the designated field labeled Insured.

- Next, locate the field for your Claim Number and input your specific claim number accurately.

- Find the section titled Date; enter the date of approval for services or repairs.

- Proceed to the year field and input the corresponding year for your service or repair authorization.

- In the Authorized Payee area, write the name of the contractor or service provider you are authorizing for payment.

- Carefully review the final estimate or invoice you received from the independent contractor or service provider. Ensure you record the correct amount shown.

- Sign the form in the area specified for Insured Signature. This indicates your approval to proceed with the payment.

Once the form is completely filled out, you can submit it to State Farm Insurance Company. This will initiate payment to your service provider, ensuring your repairs or services are promptly addressed. Be sure to keep a copy of the completed form for your records.