Fillable Transfer-on-Death Deed Document

A Transfer-on-Death Deed form is a legal document that allows an individual to designate beneficiaries who will receive real estate assets upon their death, bypassing the probate process. This powerful tool can simplify the transfer of property and provide peace of mind to the property owner and their loved ones. Begin the process of securing your property for your beneficiaries by filling out the form below.

Start your Transfer-on-Death Deed form today by clicking the button below.

The Transfer-on-Death Deed form has emerged as a vital tool for property owners seeking to simplify the transfer of real estate upon death. This legal document allows individuals to designate beneficiaries who will automatically receive ownership of the property without the need for probate. The form streamlines the transition of property, reducing delays and costs that often accompany traditional inheritance methods. Importantly, it remains revocable, offering property owners flexibility to change beneficiaries or remove the deed altogether if circumstances shift. Understanding the nuances of this form, including its requirements and potential implications, is essential for anyone considering its use. Preparing for the future should include an examination of how a Transfer-on-Death Deed can facilitate a more efficient distribution of your assets, ensuring that your loved ones can inherit with ease and certainty.

Transfer-on-Death Deed Preview

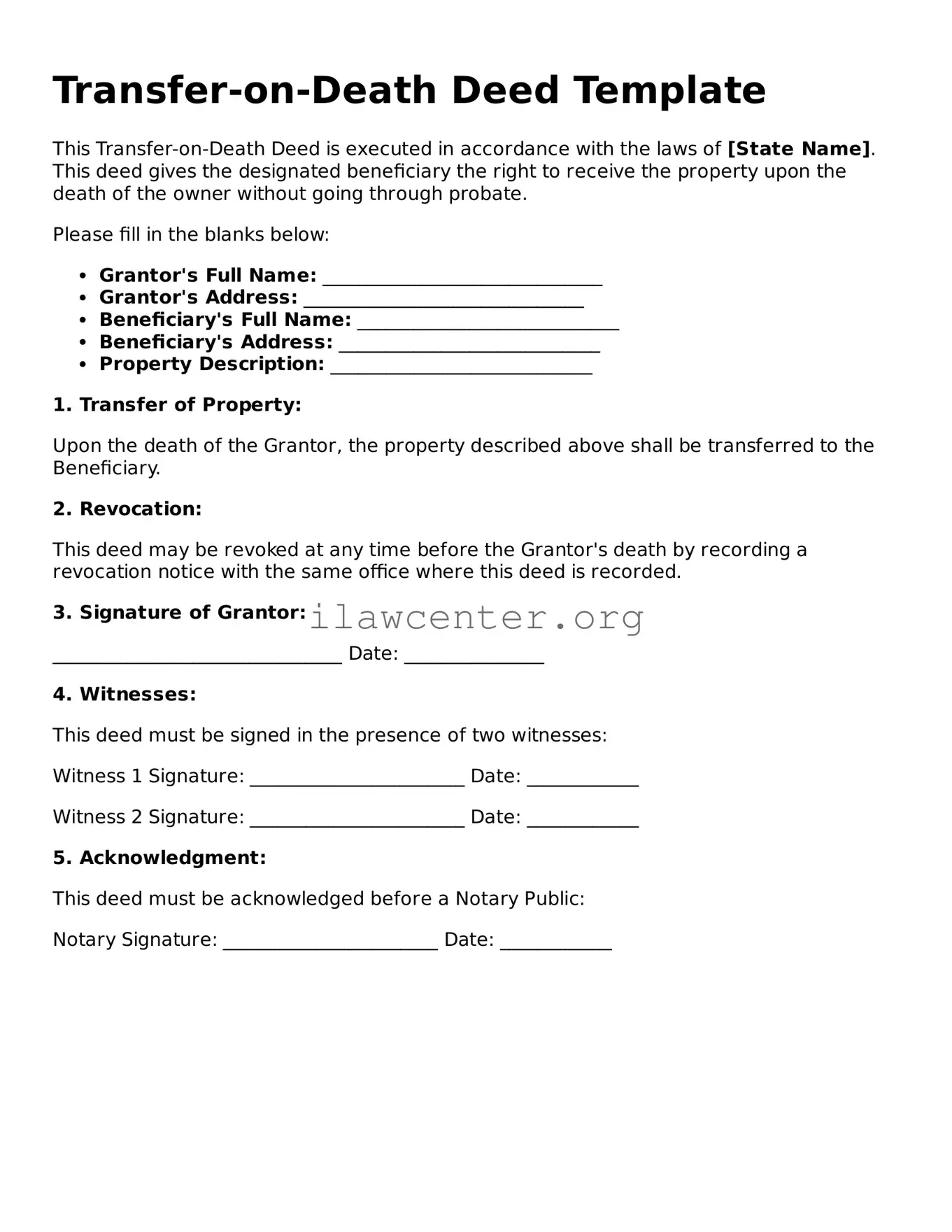

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws of [State Name]. This deed gives the designated beneficiary the right to receive the property upon the death of the owner without going through probate.

Please fill in the blanks below:

- Grantor's Full Name: ______________________________

- Grantor's Address: ______________________________

- Beneficiary's Full Name: ____________________________

- Beneficiary's Address: ____________________________

- Property Description: ____________________________

1. Transfer of Property:

Upon the death of the Grantor, the property described above shall be transferred to the Beneficiary.

2. Revocation:

This deed may be revoked at any time before the Grantor's death by recording a revocation notice with the same office where this deed is recorded.

3. Signature of Grantor:

_______________________________ Date: _______________

4. Witnesses:

This deed must be signed in the presence of two witnesses:

Witness 1 Signature: _______________________ Date: ____________

Witness 2 Signature: _______________________ Date: ____________

5. Acknowledgment:

This deed must be acknowledged before a Notary Public:

Notary Signature: _______________________ Date: ____________

PDF Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TOD) allows an individual to transfer real estate to a designated beneficiary upon death without going through probate. |

| Governing Laws | In most states, TOD deeds are governed by statutes specifically outlining their creation and effectiveness. For example, California's law can be found in the California Probate Code Section 5600. |

| Revocability | The grantor retains the right to revoke or change the deed at any time during their lifetime. This means flexibility for the property owner as circumstances change. |

| Estate Planning Benefits | Using a TOD deed can simplify the transfer process, reduce costs associated with probate, and provide a clear plan for property distribution. |

Instructions on Utilizing Transfer-on-Death Deed

After obtaining the Transfer-on-Death Deed form, you need to complete it accurately to ensure the transfer of property upon death. Make sure you have all the necessary information on hand, and follow the steps below to fill it out correctly.

- Begin by filling in the name of the property owner(s) at the top of the form. Include middle initials if applicable.

- List the address of the property you wish to transfer, making sure to include the city, state, and zip code.

- Clearly describe the property. Include the legal description if applicable, or a concise description that identifies the property, like the lot number.

- Identify the beneficiaries. Enter the names of individuals or entities that will receive the property upon the owner’s death. Make sure to use full names and include any necessary identifiers, like relationship or date of birth.

- Include your signature and the date at the bottom of the form, ensuring it matches the name listed at the top.

- Obtain the necessary witness signatures as required by your state. Check local laws for the number of witnesses needed.

- Find a notary public to notarize the document. This step is crucial for authenticity and may be required for the deed to be valid.

- Finally, record the completed Transfer-on-Death Deed with your local county recorder’s office to ensure it is officially recognized. Be aware of any associated fees.

Important Facts about Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) allows an individual to transfer real estate directly to a designated beneficiary upon their death. This legal document helps avoid probate, streamlining the transfer process. The property owner retains full control of the property during their lifetime, meaning they can sell or change their deed as they see fit.

Who can use a Transfer-on-Death Deed?

Any property owner can use a TOD Deed, provided their state recognizes this type of arrangement. Generally, it is a useful tool for individuals who wish to designate beneficiaries for their real estate without generating complexities in their estate plans. However, it's advisable to check state-specific requirements as they may vary.

How does a Transfer-on-Death Deed work?

The property owner completes and signs the TOD Deed, naming one or more beneficiaries. After executing the deed, the owner must file it with the local land records office to make it effective. Upon the owner's death, the property automatically transfers to the beneficiaries without going through probate, assuming the deed was properly executed and recorded.

Can changes be made to a Transfer-on-Death Deed after it’s filed?

Yes, changes can be made. The original owner has the right to revoke or modify the deed at any time before their death. This flexibility allows property owners to adjust their estate plans as circumstances change, whether that involves adding or removing beneficiaries or altering property details.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger gift or inheritance taxes at the time of transfer; taxes typically apply at the owner’s death. However, beneficiaries should be aware that property may be subject to capital gains tax when they sell it. Consulting a tax professional can provide clarity on individual situations and potential tax liabilities.

What happens if the beneficiary predeceases the property owner?

If a named beneficiary passes away before the property owner, the deed typically becomes ineffective concerning that beneficiary. The owner has the option to change the deed to replace the deceased beneficiary or designate alternate beneficiaries. Without action, the property may be transferred according to state intestacy laws or the owner's will, which highlights the importance of keeping documents current.

Common mistakes

Filling out a Transfer-on-Death (TOD) Deed form is a straightforward process, but mistakes can lead to complications later. One common mistake occurs during the naming of beneficiaries. Many individuals fail to provide the full legal names of beneficiaries. Using nicknames or initials might seem simple, but the lack of clarity can create confusion and delay the transfer of property.

Another frequent error is neglecting to check the identification of the property. When listing the property being transferred, some people mistakenly use informal descriptions, which can lead to disputes over what exactly is being transferred. It is essential to include precise details, such as the legal description of the property, to ensure that the intent is clearly understood.

Additionally, people often forget to sign the deed, which is a critical step. Without a signature, the transfer can be considered invalid. Furthermore, some individuals think that filling out the form is sufficient; however, the deed also needs to be notarized and recorded to be legally binding. Failing to complete these additional steps can render the deed worthless.

Another pitfall is the misunderstanding of state-specific requirements. Each state has its own regulations regarding Transfer-on-Death Deeds. Not recognizing these differences can lead to incorrect filings. It’s crucial to familiarize oneself with local laws to ensure compliance.

Lastly, individuals sometimes neglect to communicate their plans with the named beneficiaries. This lack of communication can result in unexpected surprises for loved ones upon the individual’s passing. Ensuring that beneficiaries are aware of their designated role can facilitate a smoother transfer and reduce the likelihood of discord among family members.

Documents used along the form

A Transfer-on-Death (TOD) deed is a powerful tool for estate planning, allowing property owners to transfer real estate to beneficiaries without going through probate. However, several other documents often complement the TOD deed to ensure a smooth transition of assets. Here’s a brief overview of some key documents that can work alongside a Transfer-on-Death deed.

- Last Will and Testament: This document outlines the wishes of an individual regarding the distribution of their assets after death. It can address any assets not included in the TOD deed.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, like life insurance policies or retirement accounts, upon the owner's death, ensuring those assets pass directly to the chosen beneficiaries.

- Power of Attorney: A power of attorney allows someone to act on another's behalf in financial and legal matters. This can be crucial for managing assets while the individual is alive but incapacitated.

- Property Titles: Proper titles for property ensure that ownership is clearly defined. Maintaining updated property titles is essential to avoid disputes and to facilitate a smooth transition when the TOD deed is activated.

Utilizing these documents in conjunction with a Transfer-on-Death deed can significantly enhance estate planning strategies. Together, they make the process of transferring assets more straightforward and effective.

Similar forms

- Last Will and Testament - A will specifies how a person’s assets will be distributed upon their death. Similar to a Transfer-on-Death Deed, it allows individuals to name beneficiaries but requires probate to enforce.

- Living Trust - A living trust helps manage assets during a person’s lifetime and distributes them upon death. Like a Transfer-on-Death Deed, it avoids probate, but it involves more management while alive.

- Beneficiary Designation Form - This form is used for financial accounts and life insurance to designate beneficiaries. Both documents bypass probate, ensuring quick transfer of assets to heirs.

- Joint Tenancy with Right of Survivorship - This arrangement allows co-owners to inherit each other’s share upon death. It holds similarities in transferring property without going through probate.

- Payable-on-Death (POD) Accounts - These are bank accounts that automatically pass to a designated beneficiary upon the account holder’s death. Both documents facilitate straightforward asset transfer without legal delays.

- Transfer-on-Death Registration for Securities - This permits individuals to transfer ownership of stocks or bonds to beneficiaries after death. Like the deed, it avoids probate, ensuring a seamless transfer.

- Health Care Directive (Advanced Directive) - While primarily addressing health care decisions, it identifies individuals who will make choices on one’s behalf. It parallels the intent of a Transfer-on-Death Deed in establishing clear wishes for after one’s death.

- Durable Power of Attorney for Finances - This document allows someone to manage financial affairs if the individual becomes incapacitated. Although it works differently, both documents focus on the management and transition of assets.

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are five things you should and shouldn't do:

- Do: Make sure to clearly identify the property you want to transfer. This includes the address and legal description.

- Do: Provide accurate information about yourself as the owner and the beneficiary.

- Do: Sign the deed in the presence of a notary public to validate the document.

- Don't: Leave any sections of the form blank. Incomplete forms can lead to delays.

- Don't: Forget to record the deed with your local county clerk’s office. Recording is crucial for the transfer to be effective.

By adhering to these guidelines, individuals can facilitate a more efficient property transfer process upon their passing.

Misconceptions

The Transfer-on-Death (TOD) Deed is an increasingly popular estate planning tool, yet many myths surround its use and implications. Understanding these misconceptions is essential for making informed decisions about property transfer and estate planning. Here’s a breakdown of nine common myths and some clarity on each:

-

Myth 1: A Transfer-on-Death Deed allows you to avoid probate completely.

While the TOD Deed can help certain properties bypass probate, it does not eliminate the process entirely for your entire estate. Other assets not covered by the TOD will still need to go through probate.

-

Myth 2: TOD Deeds are only for married couples.

In fact, anyone can use a TOD Deed to transfer property, regardless of marital status. It can offer benefits to singles, parents, and other individuals as well.

-

Myth 3: You can change the beneficiary on a TOD Deed without any restrictions.

While you can change your mind about the beneficiary, doing so typically requires following a formal process to ensure that the changes are legally recognized.

-

Myth 4: A TOD Deed automatically transfers all your debts to the beneficiary.

Debts remain the responsibility of the deceased's estate, and beneficiaries are not personally liable for the deceased’s debts from an asset transferred through a TOD Deed.

-

Myth 5: You need a lawyer to create a TOD Deed.

While consulting a lawyer may be beneficial, individuals can often fill out a TOD Deed on their own, using templates or state-provided forms, provided they meet the local legal requirements.

-

Myth 6: A TOD Deed can create complications with Medicaid eligibility.

Generally, as long as the property is in the beneficiary’s name after death, it should not affect Medicaid eligibility or the resource determination for Medicaid benefits, although consulting an expert for various state laws is advisable.

-

Myth 7: TOD Deeds are the same as wills.

Unlike a will, which takes effect after your death and governs the distribution of all assets, a TOD Deed specifically pertains to real estate and becomes effective immediately upon your death.

-

Myth 8: All states recognize Transfer-on-Death Deeds.

Not all states have enacted laws permitting TOD Deeds. Checking the specific regulations in your state is vital to confirm the legality and effectiveness of the deed.

-

Myth 9: A transfer occurs immediately upon signing the TOD Deed.

The transfer does not occur until the property owner passes away. Until that time, the grantor retains full ownership and control over the property.

By understanding these misconceptions, individuals can make more informed decisions regarding their estate plans and the best ways to transition property to heirs.

Key takeaways

Here are some important things to consider when filling out and using a Transfer-on-Death Deed form:

- Understanding the Purpose: A Transfer-on-Death Deed allows you to transfer property to your beneficiaries outside of probate upon your death.

- Eligibility: Most states permit property owners to use a Transfer-on-Death Deed for real estate, but you should check your state’s laws for specific requirements.

- Completing the Form: Accurately fill out the form with required details, including your name, property description, and beneficiary information.

- Signatures Needed: Typically, you must sign the deed in front of a notary public. Witness requirements may vary by state.

- Recording the Deed: After completing the deed, file it with the appropriate local government office to ensure it’s legally recognized.

- No Immediate Effect: The deed takes effect only after your death. You maintain full ownership and control of the property while you are alive.

- Revocation: If you change your mind, you can revoke the deed at any time before your death. Follow your state’s process to do so.

- Tax Implications: Transferring property via this deed may have tax implications, so consult a tax professional for guidance.

- Consult an Attorney: It’s always a good idea to consult with a lawyer who can help you navigate the process and ensure your intentions are clear and legally binding.

Fill out Common Types of Transfer-on-Death Deed Templates

Deed of Gift Property - Acceptance of a Gift Deed is implied once the recipient takes possession of the property.

Lady Bird Deed Form Michigan - The Lady Bird Deed allows for the transfer of property while retaining certain rights.

Deed in Lieu Meaning - Using this deed might be a faster path to obtaining a fresh financial start for struggling homeowners.