What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a document that outlines the terms under which an individual agrees to repay a loan that was taken to purchase a vehicle. It delineates the schedule for payments, interest rates, and any penalties for missed payments. This form serves to protect both the lender and the borrower by clearly detailing the expectations and responsibilities of each party.

Who needs to complete a Vehicle Repayment Agreement form?

This form is necessary for anyone who is obtaining financing for a vehicle. Whether it involves a loan from a bank, credit union, or car dealership, both the borrower and lender need to understand and agree to the repayment terms. Completing the form ensures that all parties are on the same page regarding repayment expectations.

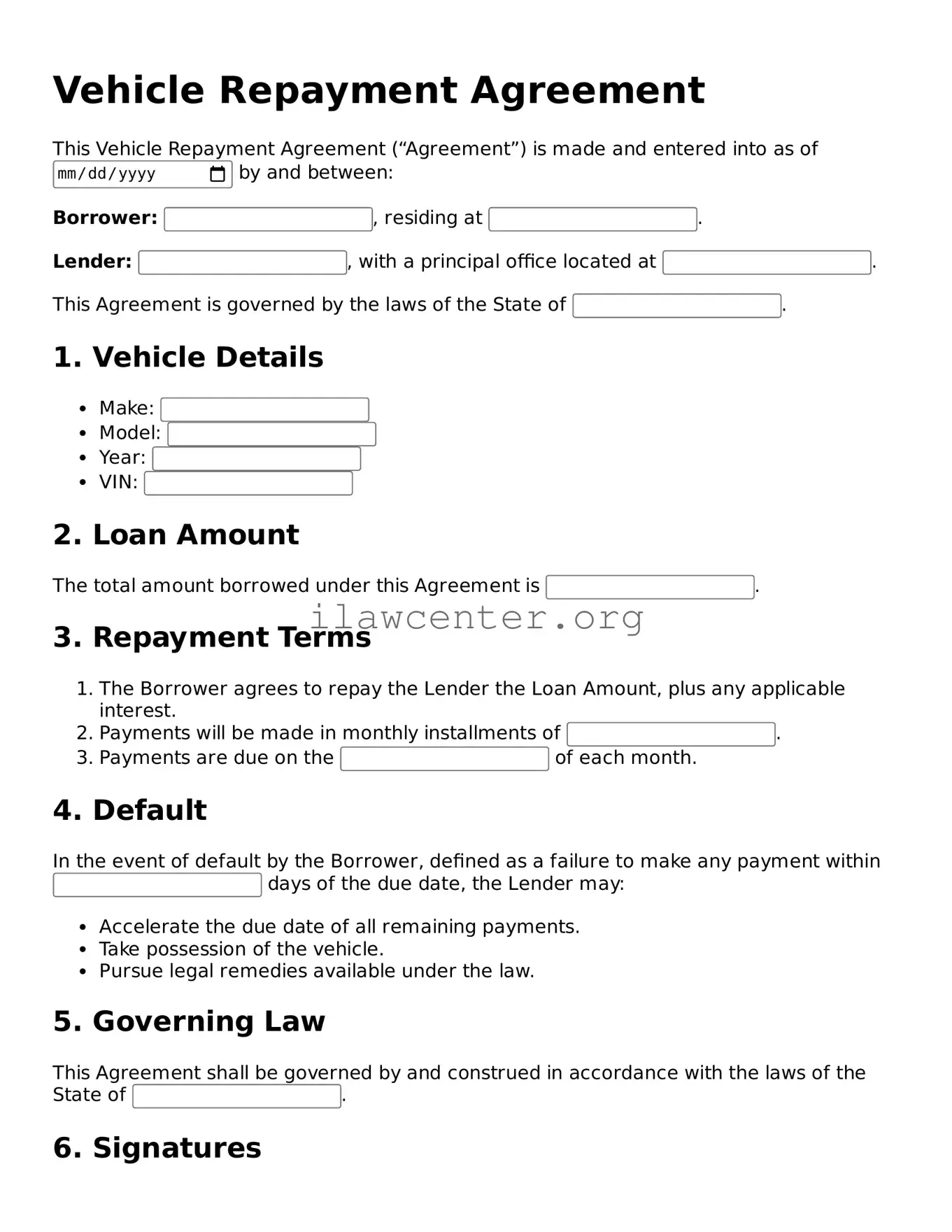

What information is commonly required on the form?

The Vehicle Repayment Agreement typically requires the borrower's personal information, such as name, address, and social security number. Additionally, it will include details about the vehicle being financed, the loan amount, interest rate, repayment schedule, and any fees associated with the loan. Both parties’ signatures may also be required to make the agreement legally binding.

Can the terms of the agreement be renegotiated?

Yes, the terms of a Vehicle Repayment Agreement can often be renegotiated if both the borrower and lender agree to it. Common reasons for renegotiation might include changes in financial circumstances, the desire for a lower interest rate, or a modification of the payment schedule. It is essential to document any changes made to the original agreement properly.

What happens if I miss a payment?

Missing a payment can result in penalties as outlined in the Vehicle Repayment Agreement. Generally, late fees may be assessed, and repeated missed payments could jeopardize the borrower's relationship with the lender. Moreover, it could potentially lead to repossession of the vehicle, depending on the terms agreed upon in the form.

Is the Vehicle Repayment Agreement form legally binding?

Yes, once signed by both parties, the Vehicle Repayment Agreement becomes a legally binding contract. This means that the terms must be adhered to by both the borrower and lender. If disagreements arise, this document can be used in legal proceedings to enforce the terms of the agreement.

Can I transfer my loan to another individual?

Transferring a loan to another person is possible, but it depends on the lender's policies. Some lenders may allow loan assumption, where another individual takes over the existing loan under the same terms. However, this typically requires approval from the lender. The details for such an arrangement must be clearly communicated and documented.

What should I do if I am unable to repay my loan?

If financial difficulties arise, it is crucial to communicate with the lender as soon as possible. Lenders often have programs in place to assist borrowers experiencing hardship. Options may include deferral of payments, restructuring the loan, or other forms of relief. Ignoring the issue can lead to more severe consequences.

Are electronic signatures acceptable on the Vehicle Repayment Agreement?

In many cases, electronic signatures are acceptable and recognized as legally binding, provided both parties consent to sign electronically. However, it is advisable to verify the lender's policy regarding electronic signatures to ensure compliance with relevant laws and regulations.

How can I ensure that my Vehicle Repayment Agreement is completed correctly?

To ensure the Vehicle Repayment Agreement is completed correctly, it is advisable to read the document thoroughly before signing. Confirm that all personal and vehicle details are accurate and that you understand the repayment terms. Seeking assistance from a financial advisor or legal professional may also be prudent if uncertain about specific clauses.