What is a Washington Bill of Sale?

A Washington Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. This form serves as proof that the buyer has purchased the item and that the seller has relinquished ownership, which can be important for various legal transactions and record-keeping.

When should I use a Bill of Sale in Washington?

A Bill of Sale should be used whenever property ownership is transferred. This applies to vehicles, boats, appliances, jewelry, and other personal items. A Bill of Sale is especially crucial when selling or buying high-value items, as it provides a clear record of the transaction.

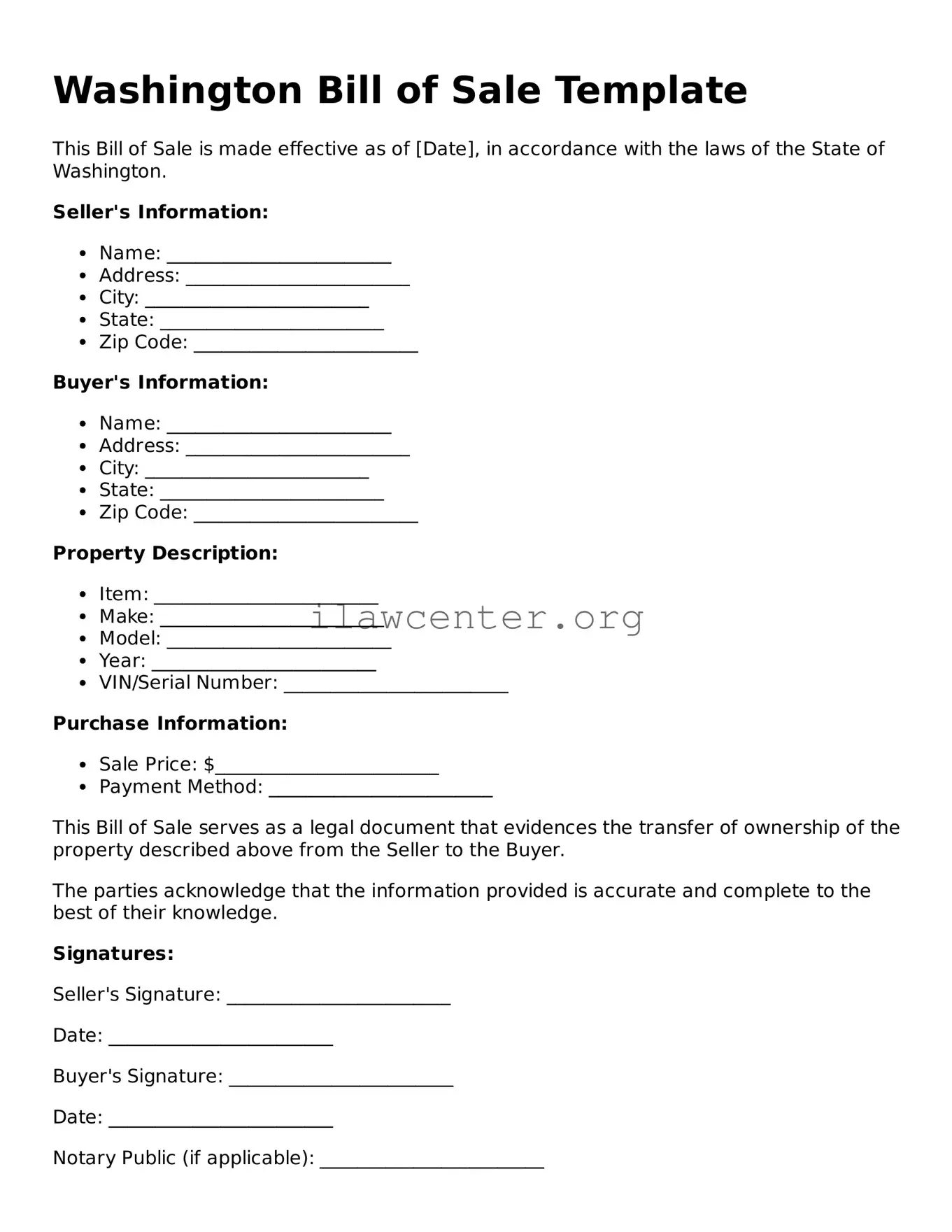

What information is required on a Washington Bill of Sale?

The Bill of Sale should include specific information such as the names and addresses of the buyer and seller, a description of the item being sold (including its condition and any identifying numbers), the purchase price, and the date of the transaction. Both parties should retain a copy of the signed document.

Is a Bill of Sale required for vehicle sales in Washington?

Yes, a Bill of Sale is required when transferring ownership of a vehicle in Washington State. The state requires this document for vehicle registration and titling purposes. Additionally, it is advisable to complete the Washington State Department of Licensing (DOL) Bill of Sale form to ensure compliance with state regulations.

Can I create my own Bill of Sale template?

Yes, you can create your own Bill of Sale template in Washington, provided it includes all the necessary information. However, many people prefer to use a standardized form to ensure compliance with state requirements. Templates can often be found online or through legal resource providers.

Does a Bill of Sale need to be notarized in Washington?

Generally, a Bill of Sale does not need to be notarized in Washington for most personal property transactions. However, notarization can provide additional legal protection and help verify the identities of the parties involved. It is wise to consider notarizing the document, especially for higher-value items.

What if I lose my Bill of Sale?

If you lose your Bill of Sale, it may be challenging to prove ownership if disputes arise. In such cases, you can create a new Bill of Sale by gathering as much information as possible regarding the transaction. It is advisable to keep copies of all important documents securely stored to avoid potential issues in the future.

Are there any tax implications associated with a Bill of Sale in Washington?

Yes, there may be tax implications when transferring ownership of certain items, particularly vehicles. Washington State has a sales tax that applies to the sale of personal property, including vehicles. Buyers should be aware of the tax requirements and ensure they comply when filing their tax returns.

How does a Bill of Sale protect both parties involved in a transaction?

A Bill of Sale protects both the buyer and seller by providing a documented agreement that outlines the terms of the sale. It helps to clarify the expectations of both parties, including the description of the item, purchase price, and any conditions of the sale. This documentation can be vital in resolving disputes and confirming ownership.