Instructions on Utilizing Washington Deed

Filling out the Washington Deed form can seem daunting, but with a clear step-by-step approach, it becomes much more manageable. Once the form is completed, it is crucial to review all information for accuracy before submitting it for recording. Below are the detailed instructions to guide you through the process.

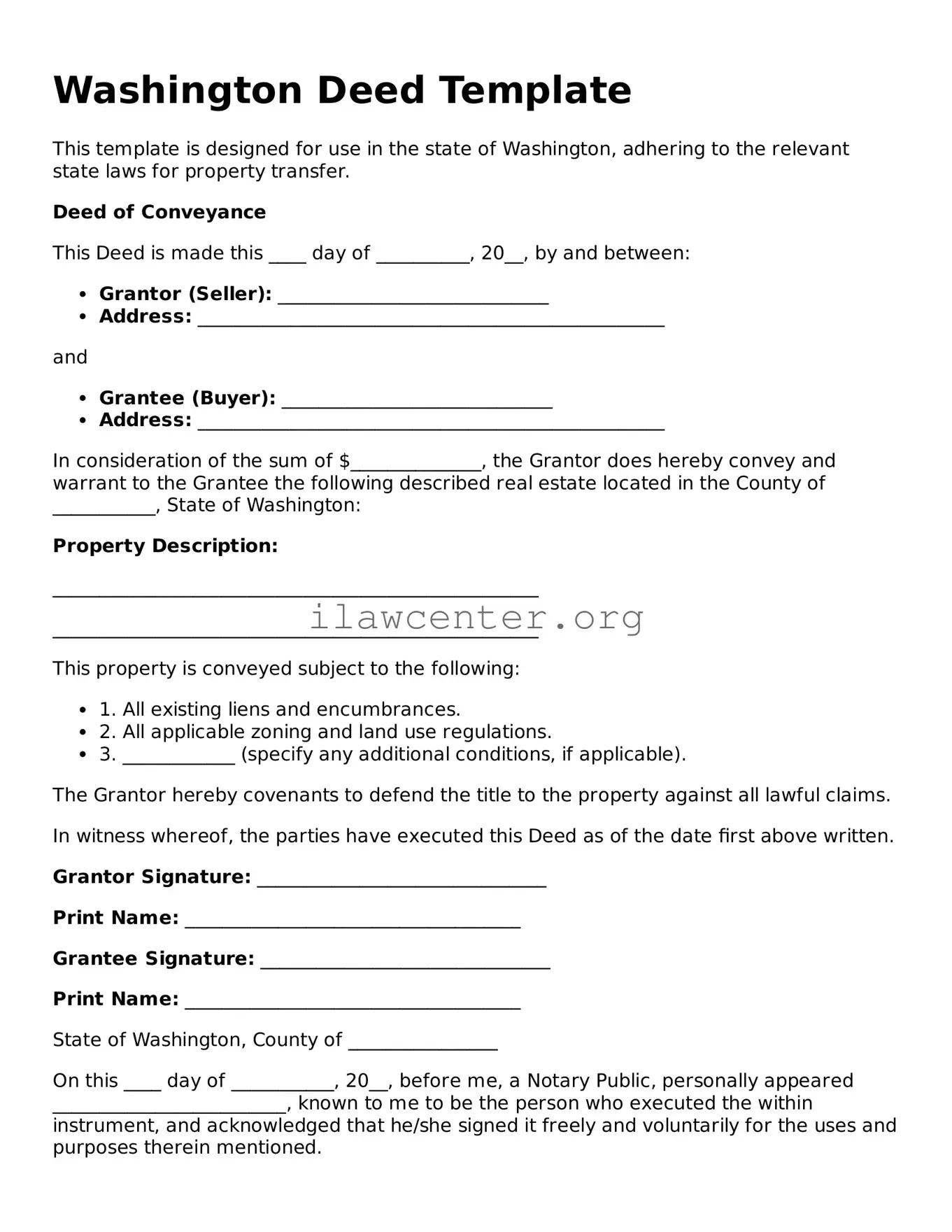

- Gather necessary information: Collect details about the property, including the address, legal description, and tax parcel number.

- Identify the grantor: Write the full name and address of the person or entity transferring the property. Make sure to include all relevant details.

- Identify the grantee: Enter the full name and address of the person or entity receiving the property. Double-check the spelling to avoid any mistakes.

- Describe the property: Fill in the legal description of the property as it appears in previous documents or county records. This may include lot numbers or other identifying details.

- Indicate consideration: State the amount paid for the property, if applicable. Use a clear and recognizable format.

- Sign and date the form: The grantor must sign and date the form in the presence of a notary public. Ensure that the signature is legible.

- Obtain notarization: Have the document notarized to verify the identity of the signers and the authenticity of their signatures.

- Submit the form: Once completed and notarized, submit the form to the County Auditor's Office for recording. Check local requirements for fees and additional documents.