Instructions on Utilizing Washington Durable Power of Attorney

Filling out the Washington Durable Power of Attorney form requires careful attention to detail. Once completed, this form authorizes another individual to make financial decisions on your behalf. Follow these steps to complete the form accurately.

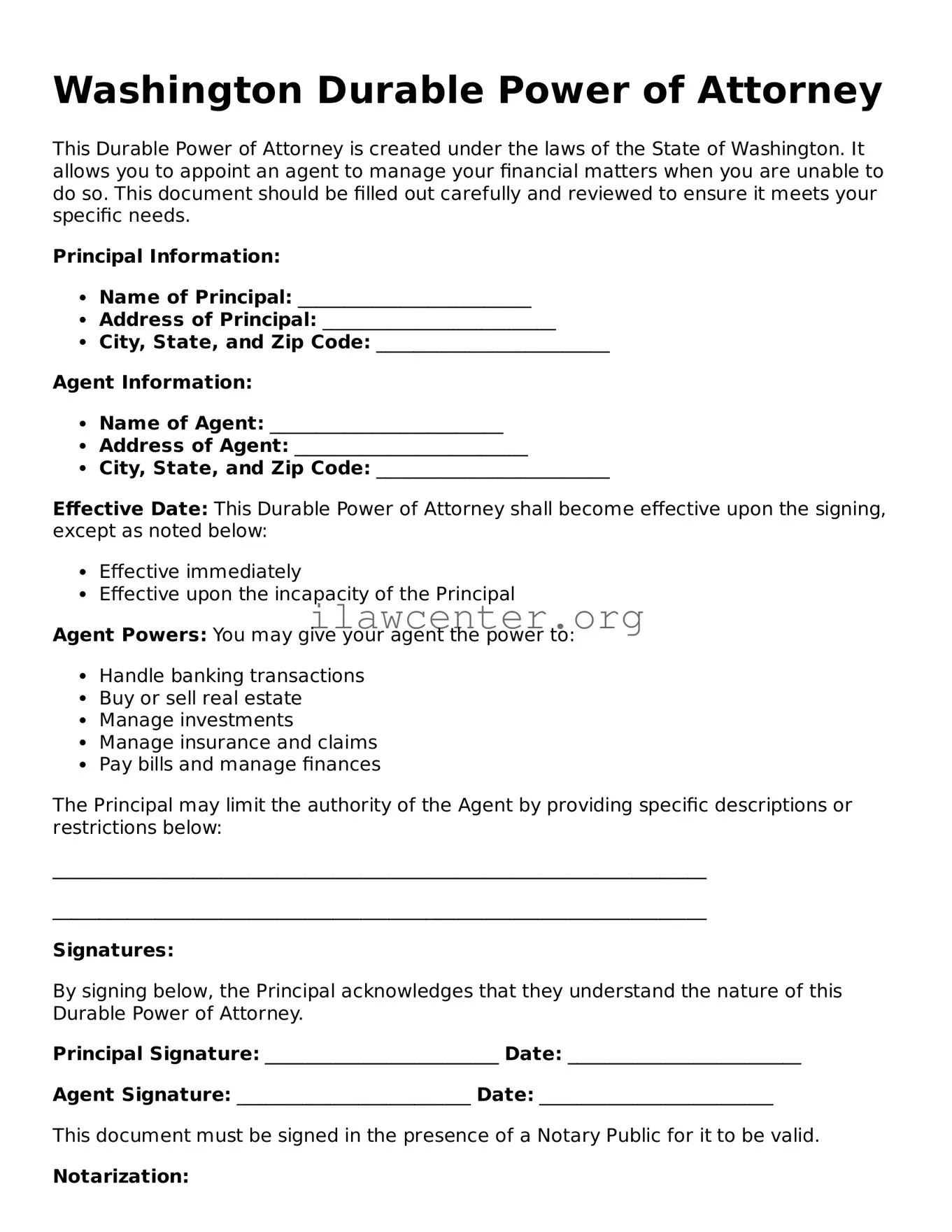

- Obtain the Form: Access the Washington Durable Power of Attorney form from a reliable source, such as a state website or legal resource center.

- Fill in Your Information: Provide your name, address, and contact details at the top of the form. Ensure all information is accurate.

- Designate an Agent: Name the person who will act on your behalf. Include their full name, address, and relationship to you.

- Specify Powers Granted: Clearly outline the areas where you want your agent to have authority. This might include managing finances, signing documents, or making investment decisions.

- Consider Alternate Agents: It's wise to name a backup agent in case your primary agent is unable or unwilling to serve.

- Include Effective Date: Indicate when you want the powers to start. This could be immediately or under certain circumstances.

- Sign the Form: You must sign and date the form in the designated space. This signature is crucial for the document’s legality.

- Witnesses or Notarization: Depending on Washington state laws, have the necessary witnesses sign the form or get it notarized. Check current requirements to ensure compliance.

After completing the form, make copies for your records and for your designated agent. It’s essential to keep the original in a safe location. Consider discussing the document with your agent to ensure they understand your wishes.