What is a General Power of Attorney in Washington?

A General Power of Attorney is a legal document that allows one person, known as the principal, to grant authority to another person, referred to as the agent or attorney-in-fact. This authority enables the agent to make decisions and take actions on behalf of the principal in a variety of matters. These can include financial transactions, property management, and other legal decisions. It is a helpful tool for individuals wanting to ensure their affairs are managed by someone they trust in the event they become incapacitated or unavailable.

When should I consider using a General Power of Attorney?

There are several scenarios where a General Power of Attorney can be beneficial. For example, if you are going to be out of the state or the country for an extended period and need someone to handle your finances, appointing an agent can ensure that timely decisions are made. Additionally, if you have health concerns or anticipate challenges in managing your finances in the future, this document can provide peace of mind knowing you have designated someone to act on your behalf when necessary.

How does one create a General Power of Attorney in Washington?

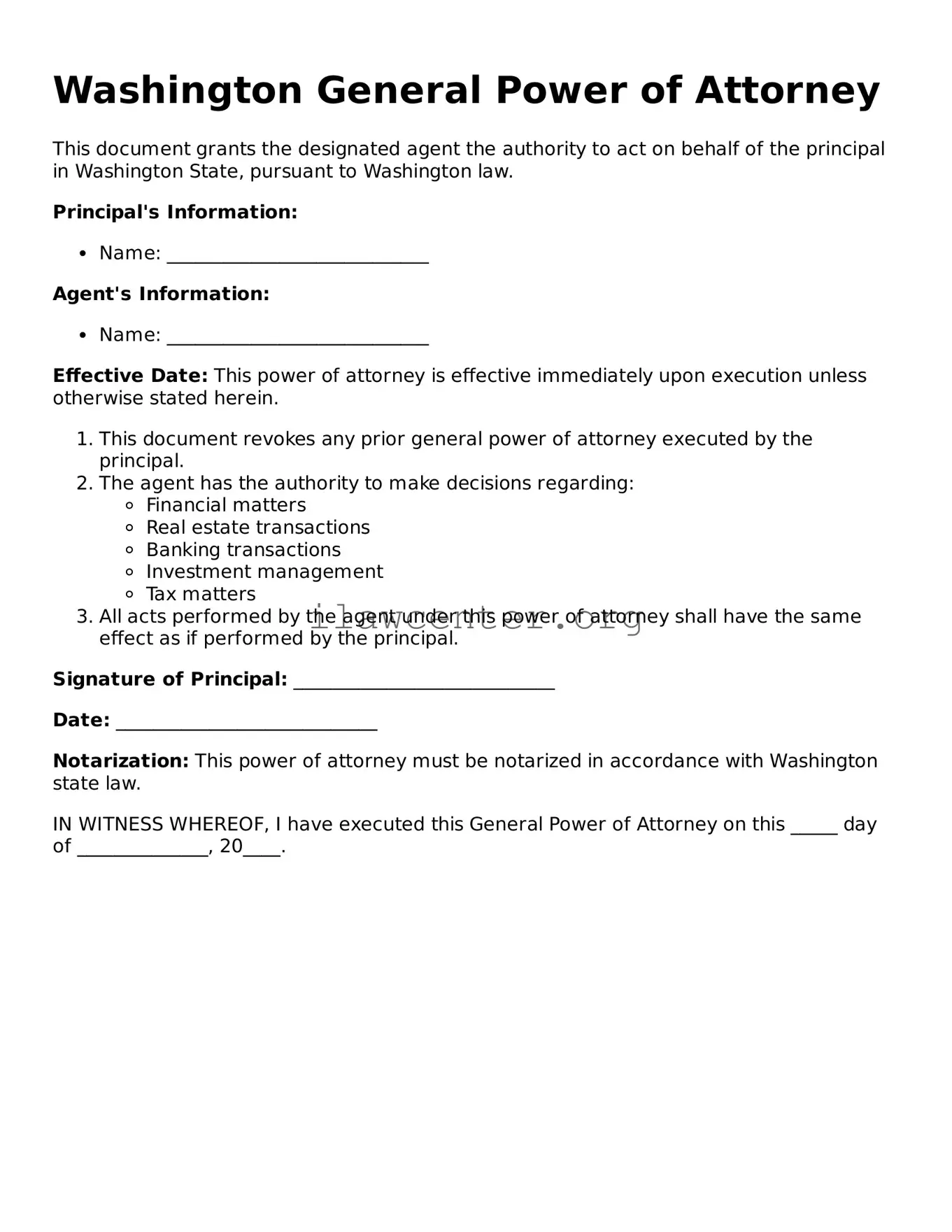

Creating a General Power of Attorney in Washington does not have to be complex. You need to formulate the document, clearly outlining the powers granted to the agent. This can be done using a standard form, which may be available through legal resources or online. Importantly, both the principal and the agent must sign the document, and while notarization is not strictly required, it is highly recommended. Notarization adds a layer of validity and helps ensure the document's acceptance by institutions.

Can I revoke a General Power of Attorney once it is established?

Yes, you can revoke a General Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation of the document and notify your agent, as well as any institutions where the power of attorney was used. It’s also wise to destroy any copies of the previous power of attorney to prevent any potential misuse. This flexibility allows you to adjust your arrangements as your circumstances or relationships change.

What happens if I become incapacitated and have a General Power of Attorney?

If you become incapacitated and have a General Power of Attorney in place, your designated agent will be able to act on your behalf. This authority remains in effect until you recover, revoke the document, or pass away. The agent can manage your financial matters, make healthcare decisions (if included), and handle other responsibilities as specified in the document. Therefore, choosing a trustworthy agent is crucial, as they will be making significant decisions while you are unable to do so.

Are there any limitations to what an agent can do under a General Power of Attorney?

Yes, while a General Power of Attorney grants broad authority, there are limitations. Agents cannot perform any actions that are illegal or unethical. They also cannot make healthcare decisions without specific healthcare power of attorney provisions in place. It’s essential to clearly outline any limits to the authority in the document itself. Doing so helps avoid misunderstandings and ensures that the agent acts in the principal’s best interests.