Instructions on Utilizing Washington Last Will and Testament

Once you have obtained the Washington Last Will and Testament form, you'll need to complete it accurately. With each step, take your time to think carefully about your choices, as this document outlines your final wishes regarding your property and dependents.

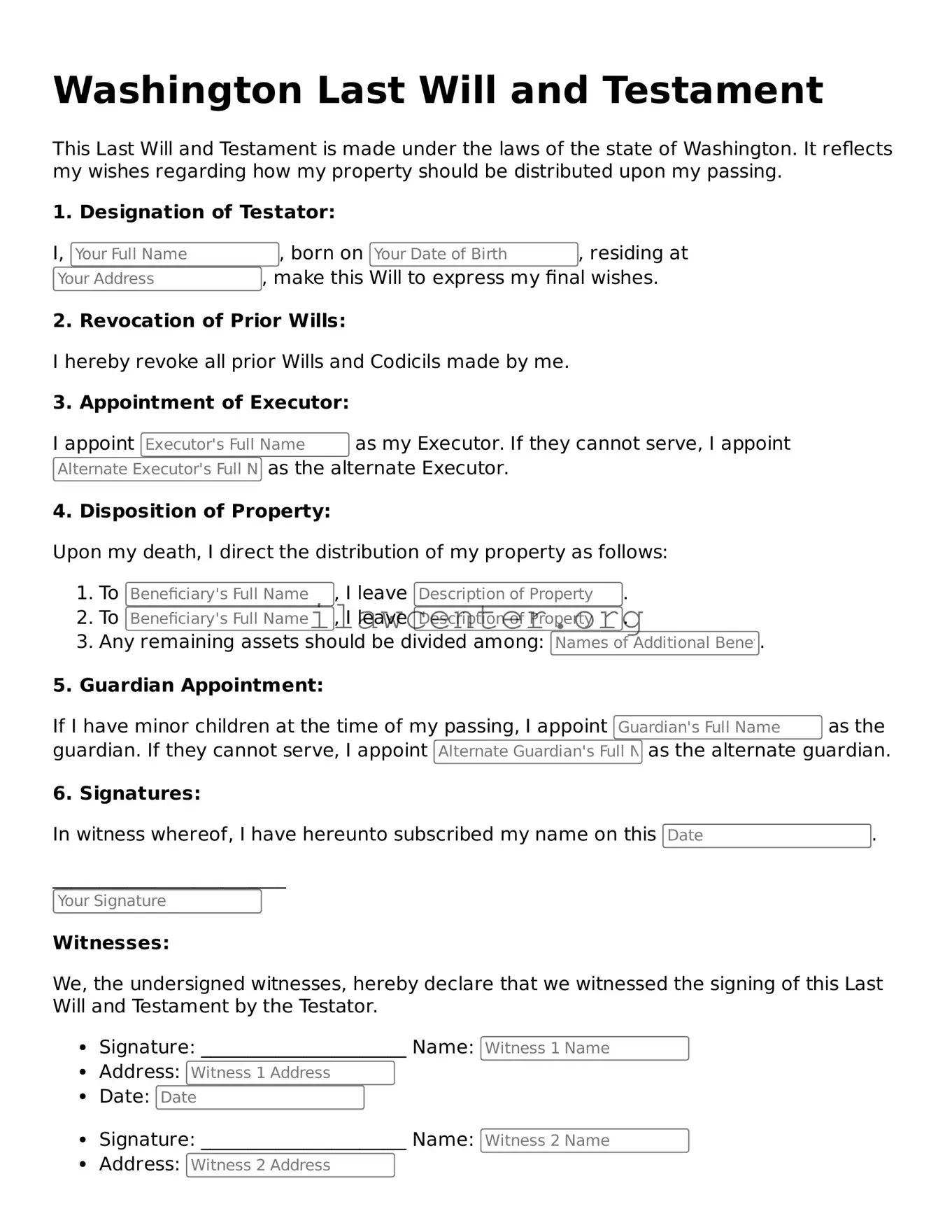

- Title the Document: Begin by writing “Last Will and Testament” at the top of the form.

- Identify Yourself: Fill in your full name, address, and date of birth. This information is essential for identifying you as the testator.

- Declare Competence: Include a statement affirming that you are of legal age and sound mind.

- Appoint an Executor: Choose an individual you trust to carry out your wishes. Write their name and contact details.

- List Beneficiaries: Identify who will receive your assets. Clearly state their names and relationships to you.

- Detail Your Assets: Provide a description of your property and specify how you wish to distribute it among your beneficiaries.

- Include Guardianship Provisions: If you have minor children, indicate who you wish to serve as their guardian and any alternate choices.

- Sign the Document: You must sign the will at the bottom of the page. This indicates your agreement with the contents.

- Witness Signature Line: Leave space for two witnesses to sign. Ensure they are present while you sign.

- Optional Notarization: Consider having the document notarized for added legal protection, though it is not required in Washington.

After completing the form, carefully review each section to ensure accuracy. Make copies for your records and securely store the original in a safe place. Consider sharing information about its location with trusted family members or friends.