What is a Power of Attorney in Washington?

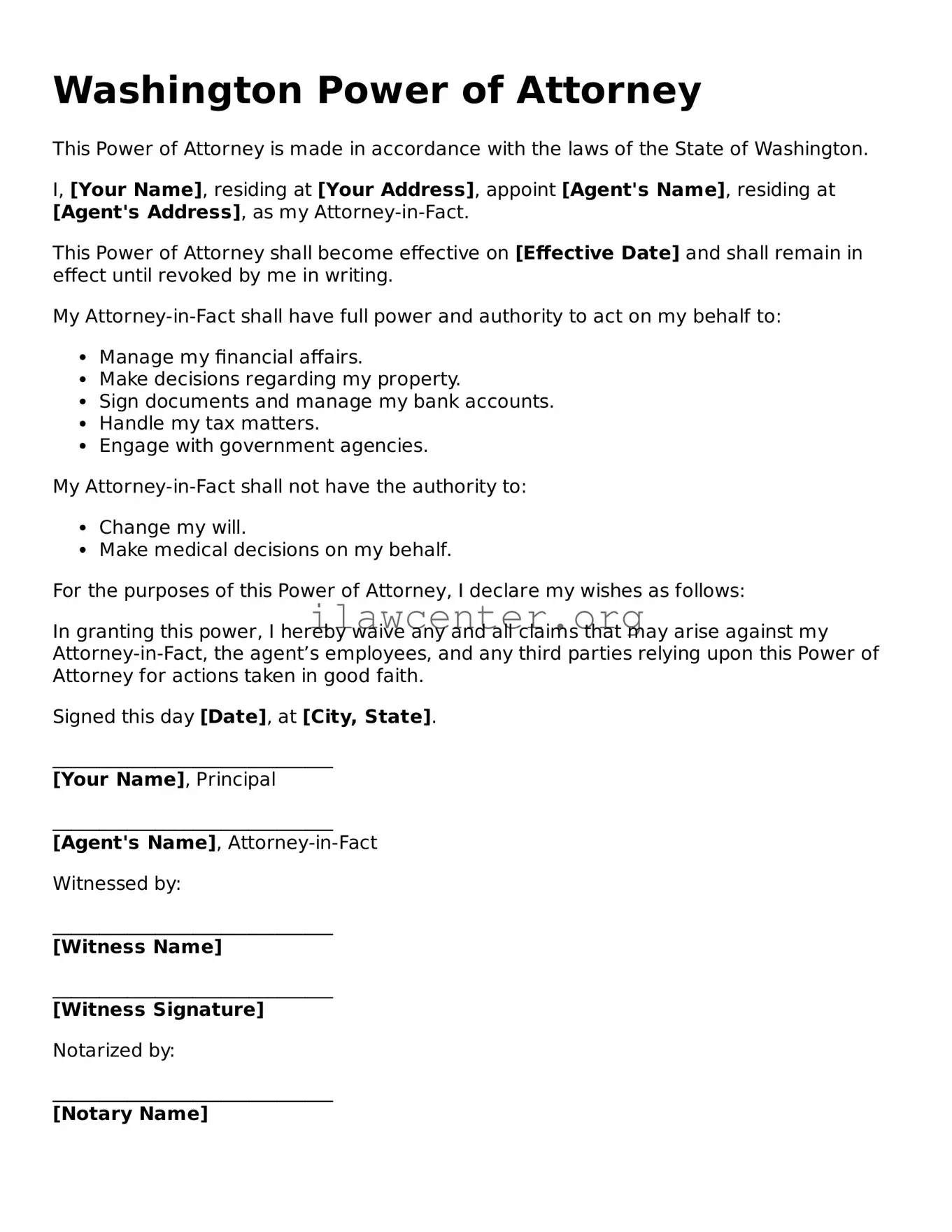

A Power of Attorney (POA) in Washington is a legal document that allows an individual, known as the principal, to grant another person, called the agent or attorney-in-fact, the authority to make decisions on their behalf. This can include financial matters, healthcare decisions, or other specified actions, depending on the type of POA created.

What types of Power of Attorney are available in Washington?

In Washington, there are generally two main types of Power of Attorney: a Financial Power of Attorney and a Healthcare Power of Attorney. The Financial POA allows your agent to handle financial matters like paying bills or managing investments. The Healthcare POA gives your agent the authority to make medical decisions when you are unable to do so.

Is a Power of Attorney valid in Washington if it is signed in another state?

Yes, a Power of Attorney signed in another state can be valid in Washington, provided it complies with the laws of that state and meets Washington's requirements. To ensure its validity, it is a good idea to consult with a legal professional who can provide guidance based on specific circumstances.

Do I need to get a Power of Attorney notarized in Washington?

Yes, in Washington, a Power of Attorney must be notarized to be valid. Notarization helps confirm that you signed the document voluntarily and that you were competent at the time of signing. This adds an extra layer of protection and legitimacy to the document.

Can I revoke a Power of Attorney in Washington?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To do so, you should create a written revocation document, notify your agent, and provide a copy to any relevant institutions, like banks or healthcare providers, that may have been relying on the original POA.

What happens if my agent under the Power of Attorney can’t serve?

If your primary agent cannot serve, it is important to have a successor agent named in the POA document. This successor can step in if the primary agent is unable to fulfill their duties. If no successor is named, you may need to create a new POA with a new agent.

Can the agent take all my money with a Power of Attorney?

While an agent does have significant authority to act on your behalf, they are legally obligated to act in your best interest. They must manage your funds responsibly and cannot use them for personal benefit. If you suspect wrongdoing, it may be necessary to consult with a legal professional or report the issue to the authorities.

How do I find a trustworthy agent for my Power of Attorney?

Choosing an agent is a significant decision. Look for someone you trust, who understands your values, and is willing to take on the responsibility. It could be a family member, a close friend, or even a professional fiduciary. Take your time and discuss your expectations openly with potential agents before making your choice.