What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one person to another. Unlike a warranty deed, a quitclaim deed does not guarantee that the property title is clear or free of any claims. It simply conveys whatever interest the grantor has in the property, if any.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in specific circumstances, such as transferring property between family members, resolving an estate issue, or removing a former spouse’s name from the property title after a divorce. It’s important to be aware that this type of deed provides no warranty against defects in the title.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to involve an attorney, it is advisable to consult one, especially if the transaction is complex or if multiple parties are involved. An attorney can ensure that all legal requirements are met and help avoid potential disputes in the future.

What information is required in a Quitclaim Deed?

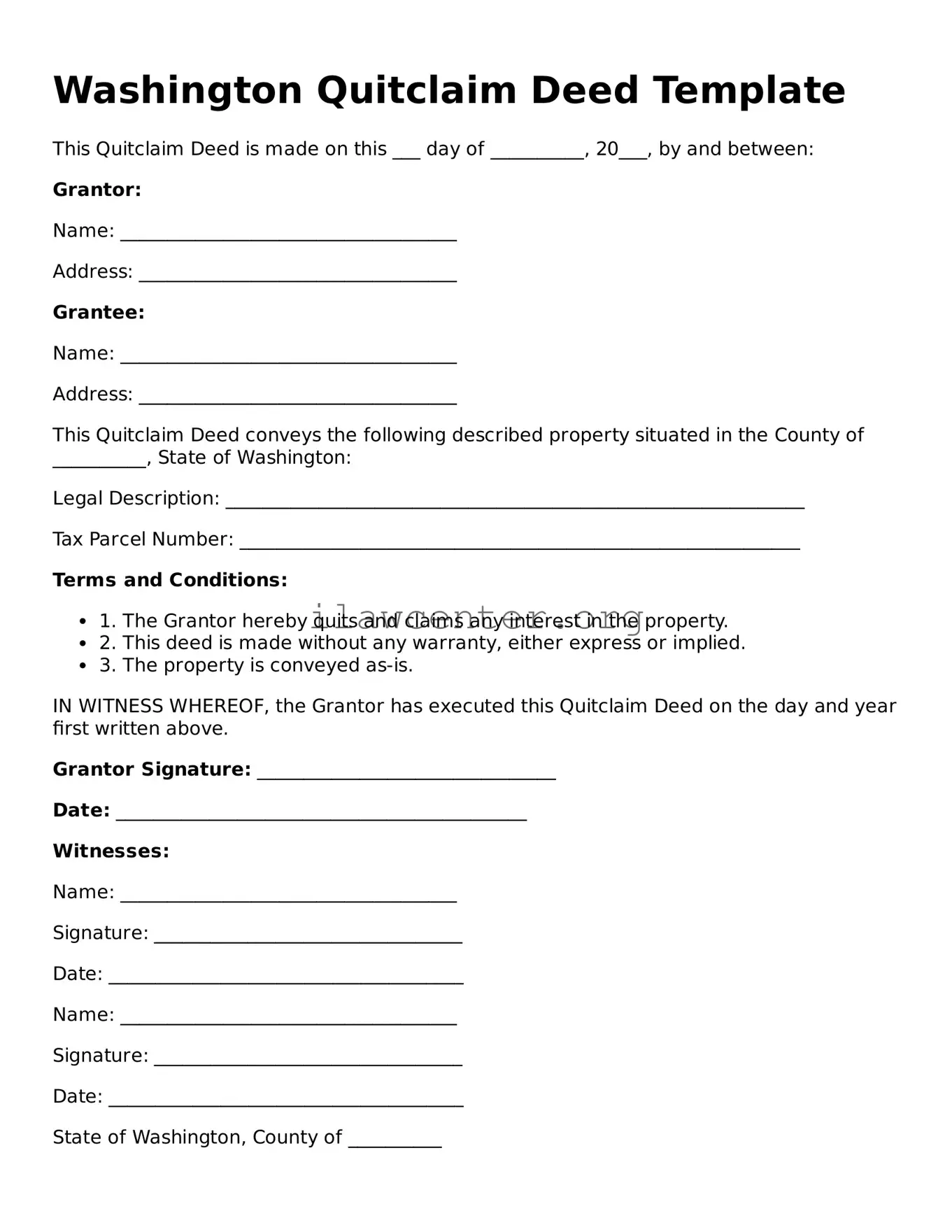

A Quitclaim Deed must include the names of the parties involved, a description of the property being transferred, and the date of the transaction. It should also be signed by the grantor (the person transferring the property) and witnessed, as required by Washington law.

How do I file a Quitclaim Deed in Washington?

To file a Quitclaim Deed in Washington, the completed document must be submitted to the county auditor in the county where the property is located. There may be a filing fee, and it is crucial to ensure that all required information is accurate and complete to avoid delays.

Are there any tax implications with a Quitclaim Deed?

In some cases, transferring property through a Quitclaim Deed may trigger tax implications. These can include potential gift taxes or property transfer taxes. It’s wise to consult a tax professional to understand the financial consequences associated with your specific situation.

Can I revoke a Quitclaim Deed once it is filed?

Generally, a Quitclaim Deed cannot be revoked once it has been executed and recorded. However, if there was fraud or undue influence involved in the signing, there may be legal grounds to contest the deed in court. Understanding the implications before executing the deed is essential.

What is the difference between a Quitclaim Deed and a Warranty Deed?

The primary difference lies in the warranties provided. A Warranty Deed offers guarantees that the grantor holds a clear title to the property and has the right to transfer it. A Quitclaim Deed, on the other hand, makes no such promises. It merely transfers the grantor's interest, if any, without assurances regarding the property's title.

Is a Quitclaim Deed the same as a Gift Deed?

While both Quitclaim Deeds and Gift Deeds can be used to transfer property without monetary exchange, they are not the same. A Gift Deed explicitly conveys property as a gift and often includes language indicating that no payment was made. A Quitclaim Deed does not specify the nature of the transfer and may or may not be a gift.