Instructions on Utilizing Washington Transfer-on-Death Deed

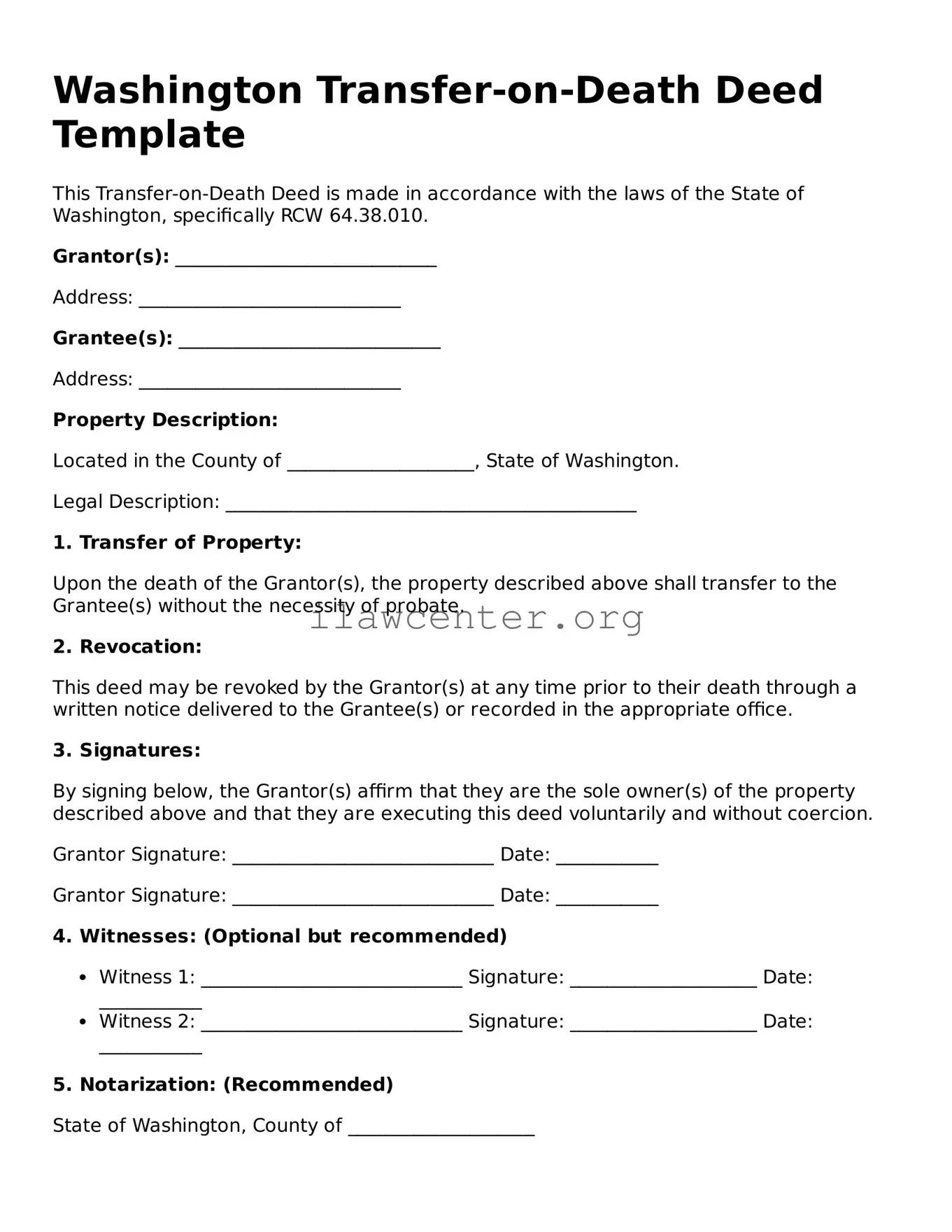

Completing the Washington Transfer-on-Death Deed form is an essential step in the estate planning process for those wanting to ensure their property is transferred directly to a named beneficiary upon their death. After you fill out the form, it must be signed and recorded with the appropriate county office to be effective.

- Obtain the Form: You can find the Washington Transfer-on-Death Deed form online through the Washington Secretary of State's website or at your local county office.

- Identify the Grantor: The grantor is the property owner. Fill in your full name and address in the designated field.

- Provide Property Details: Describe the property you wish to transfer, including its full legal description. This can typically be found on your property deed or tax documents.

- Name the Beneficiary: Write the full name and address of the person or entity you want to inherit the property upon your death. Ensure you provide correct information to avoid future complications.

- Sign the Form: To validate the deed, you must sign it in front of a notary. This adds an extra layer of authenticity and helps ensure that your intentions are clear.

- Record the Deed: After signing, take the notarized form to your county auditor's office for recording. There may be a fee for this service. The deed will be officially entered into public records, making it enforceable.

Once you have recorded the deed, it becomes an official part of your estate planning. Be sure to keep a copy for your records and inform your beneficiary of the asset transfer to help facilitate a smooth process in the future.