Instructions on Utilizing Indiana Financial Declaration

The Indiana Financial Declaration form is an important document used during legal proceedings related to financial matters, such as divorce or child support cases. Filling out this form accurately ensures that all financial information is clearly presented, aiding the court in making informed decisions. The following steps will guide you through the process of completing the form.

- Gather Required Information: Before starting, collect necessary documents such as recent pay stubs, tax returns, and any records of additional income or expenses.

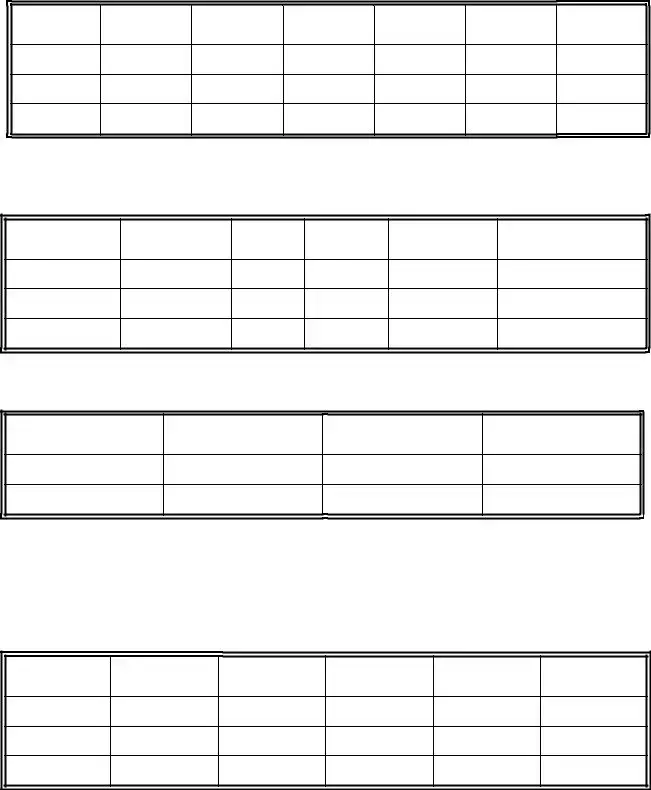

- Complete Personal Information: Fill in your name, address, occupation, employer, and date of birth in the designated fields.

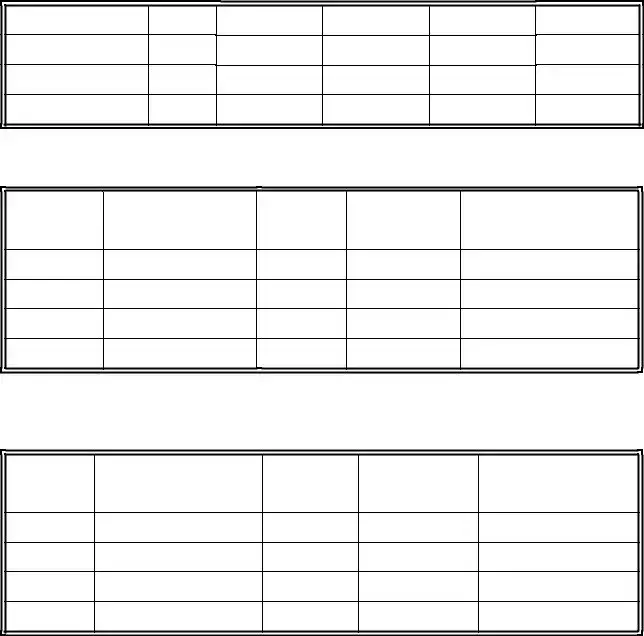

- Fill Out Income Section: Report your gross weekly income by listing amounts from various sources, including salary, pensions, child support, dividends, and any other income.

- Calculate Total Income: Add all income sources together and note the total on the appropriate line.

- Deduct Expenses: In the next section, list weekly expenses like court-ordered child support, health insurance premiums, and alimony that's being paid.

- Calculate Available Income: Subtract the deductions from your total gross weekly income to find your weekly available income.

- Report Monthly Expenses: Provide details on your monthly expenses, including taxes, mortgage or rent, utility bills, and any other relevant costs.

- Aggregate Total Monthly Expenses: Total all monthly expenses to see your overall expenditure.

- Examine Assets: List all known assets, such as real estate, vehicles, bank accounts, and other valuables, indicating their ownership and current value.

- Declare Previous Assets: If applicable, describe assets acquired before the marriage or through inheritance, along with their values.

- Certification: Complete the declaration by signing and dating the form, affirming that your statements are accurate and truthful.

- Certificate of Service: Finally, include a certificate indicating that you have provided a copy of this declaration to the relevant parties as required by law.